Thanks for checking out the Community, benwerner. I'm here to clear things out for you.

According to the Internal Revenue Service, a single-member LLC is a disregarded entity, meaning there is no separation between the business and its owner. By default, the IRS taxes it the same as a sole proprietorship. To ensure that you're entering the correct company type, I'd recommend consulting your accountant.

Regarding your second question, it would depend on what you're filing for and how you operate. There are different QuickBooks products that can help you manage your business processes efficiently. Each of them is designed to address specific needs.

QuickBooks Self-Employed is built for individuals filing Schedule C. On the other hand, QuickBooks Online is meant for businesses with complex needs, like payroll and double-entry accounting.

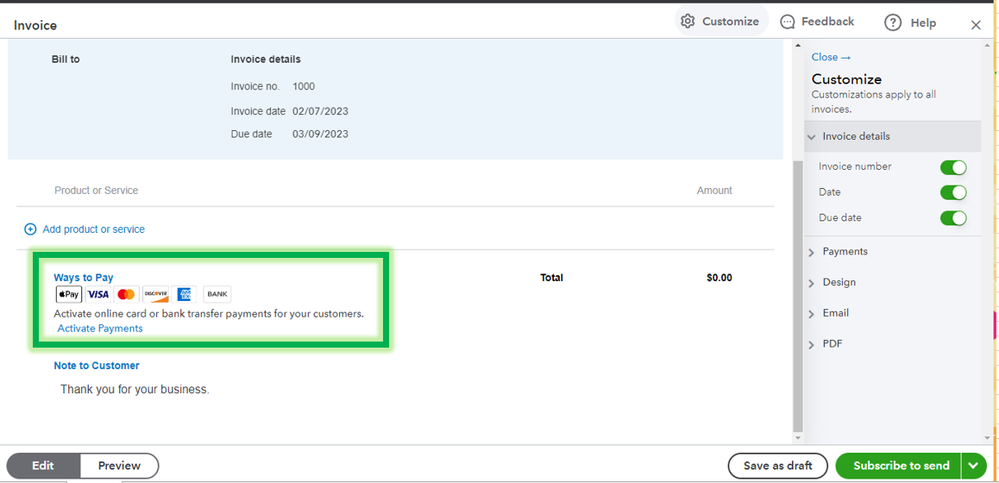

Since you need to file 1040, QBSE may become your top choice since QBO doesn't support it. Once you subscribed, you won't need to change any tax form in the settings. You can directly set up online payments so customers can pay their invoices electronically. Here's how:

- Go to the Invoices menu.

- Select Create invoice.

- Click Set up payments to begin setup.

- Tap Activate payments and follow the on-screen instructions.

Feel free to visit these pages for an overview of each program:

If you have future questions about using our software, please let me know by adding a reply to this thread. I'll be more than happy to help you out.