Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi @elitekustoms18,

Think of the new PayPal connector as a bridge between your QuickBooks Online and your PayPal account. When that bridge isn't working perfectly, the information might not flow across as smoothly as we'd like. Here are some common reasons why your invoices might not be matching correctly and what you can do to investigate:

First Things First: Let's Check the Basics

Let's Dig Deeper into Potential Causes and Solutions:

Payment Timing Differences:

Matching Issues Between PayPal Transactions and QuickBooks Invoices:

Payment Status Discrepancies:

Partial Payments:

Handling of PayPal Fees and Discounts:

Multiple PayPal Accounts:

Connector Configuration Settings:

Data Entry Errors:

Let's Get This Sorted - Your Action Plan:

Here's a tip: When contacting support for either QuickBooks or PayPal, try to have specific examples of invoices that aren't matching correctly. This will help them understand the issue more clearly and provide more targeted assistance.

It's understandable that you want your financial records to be accurate, and having your invoices match your PayPal transactions is key to that. By systematically working through these steps, we should be able to pinpoint the reason for the mismatch and get everything back in sync. Let me know if you have any specific examples or if you get stuck on any of these steps, and I'll do my best to help further!

The categorization of transactions is determined based on specific details obtained from PayPal, Elite. To provide you with a clearer understanding of this process, let's delve into more details.

Each transaction with PayPal captures various details based on its use, including the transaction type, involved items, and context—such as the information that customers provide when paying invoices.

To ensure your invoices match correctly, diligently review the mapping of categories between PayPal and QuickBooks Online (QBO). Discrepancies or errors in this mapping can result in entries being categorized incorrectly, a common cause of invoice mismatches.

Additionally, make sure all products and services listed in your QBO account precisely match those detailed in your PayPal account. During the import process, the system tries to match items from each PayPal entry to the corresponding products or services in your records.

For more information, feel free to visit this article: Match items in Connect to PayPal app.

Furthermore, to enhance your QuickBooks experience or if you require help with a specific task, feel free to contact our QuickBooks Live Expert Assisted team. These specialized professionals are readily available to assist with all your business needs.

Moreover, I recommend performing monthly account reconciliations to monitor your transactions effectively. For guidance on this process, refer to this article: Reconcile and Accounts in QuickBooks Online.

This meticulous alignment of transactions ensures consistency in record-keeping and boosts the reliability of your financial data. If you have any further questions or concerns, please don't hesitate to click the Reply button below. My team and I are always here to help you.

hi, thanks for the reply. unfortunately none of that helped. i spent over 2 hours on the phone with an expert that got me nowhere. they had absolutely no resolutions. then i got help through the chat with screen sharing and still got no where. they put in a ticket and said this is happening across MANY other QuickBooks accounts. so i know its not a user error or my importing. i did get in contact with PayPal and everything on their end looks good. importing correctly. its QuickBooks that is messing something up when everything comes in. they admitted that to me in the chat. you can search and find invoices i need, but they do not come up as potential matches, and it does not let me do a manual match, just an "add transaction" but then that puts my invoices and payments out of whack. QuickBooks is changing the invoice numbers that are coming through, and only trying to match payment amounts rather than customer and invoice number as well. meaning its pulling invoices that have already been categorized from weeks/months before for new matches, and in return messing up my actual profit/loss. QuickBooks put in an investigation case/ticket for me so now its just a waiting game. i have been dealing with this since January, and its very frustrating they still don't have a resolution. at least they finally admitted it was a problem on their end but now its just a waiting game. i just cant do anything with my accounting section until this is resolved so I'm paying for a service i technically cannot use until this is fixed. its a lose lose for now.

I am experiencing the same issue. We have deposits recorded automatically in QBO and I should just match the existing invoice. We use a specific payment type (PayPal) but the transactions shown include "Credit Card" which are not related to PayPal at all. There are only 10 suggested matches (all invoices paid by credit card) and even if I know the invoice numbers to use, there is no way to show them in the window. This is wasting our time. Please add a "find a match" button or restore the previous feature that was working well for our use case.

Same issue here, please add a "find a match" button or restore the previous feature that was working well for us.

We have deposits and invoices already recorded, by matching the transaction we want the PayPal fees correctly recorded, but the match shows only 10 invoices that have an incompatible payment type (Credit Card) and don't always show the right payment type (PayPal) so when I do not see the right invoice in the list of 10, I cannot match the right invoice.

Please know that this isn't the experience we want you to encounter, Marco. I want to assure you that we're here to help and to guarantee a prompt resolution of this issue, I highly recommend contacting our QuickBooks Live Support Team.

Our dedicated live support team has specialized tools, including the ability to conduct screen-sharing sessions, which will enable them to identify the root cause of your issue and provide tailored assistance. By contacting them, you can receive the guidance you need to resolve your concern efficiently.

You can reach them by following the steps below:

Additionally, you can read this page to learn about their availability so you can choose a time that suits your schedule: Support Hours.

Moreover, I'll share this article in case you want to categorize transactions uploaded to QBO.: Categorize online bank transactions in QuickBooks Online.

We are committed to resolving your issues thoroughly, Marco. Please feel free to return to this thread if you have further questions about matching PayPal transactions in QBO. We're always here to assist you.

I tried, but no human seems to reply on a Sunday. The best suggestion is to come here, which I did, but it doesn't work.

However, this could be a topic of general interest, please try to investigate the issue.

I understand that this is an urgent matter and that you want to match your invoices with the right payment type (PayPal), @marcorus. Please know that this issue has already been brought to our attention, and our support team is actively working on it. I recommend contacting them again to follow up on this matter.

Here are the availability hours for our Live Support, so you can reach out to them successfully:

If your subscription is one of the following: Solopreneur, Simple Start, Essentials, or Plus, you can contact Live Support from Monday to Friday between 6 AM and 6 PM PT.

If your subscription is not one of the above, I suggest checking this article for more information on the availability of other supports: Get help with QuickBooks products and services.

It's a good idea to have your account information ready before calling Live Support, as this will help ensure a smooth conversation.

Once this issue is resolved, you can refer to this resource to help you categorize transactions: Categorize online bank transactions in QBO.

If you have any additional questions or need further assistance with matching PayPal transactions in QuickBooks, don't hesitate to return to this thread. We're always here to help you.

Having the same issue. Never had this problem when I connected to Paypal Bank instead of using connector. Was told to call Paypal. Not sure why, but I called Paypal 3 times to satisfy QBO. IT IS NOT A PAYPAL ISSUE.

When will this be addressed?????

Hi there, @siocona0909.

I understand the importance of matching your transactions from PayPal to your QBO account. Rest assured, I'll guide you to our live support to ensure you receive the latest information regarding this case.

Here's how:

Once you can view your PayPal transactions in your QBO account, you can consider categorizing them according to their respective accounts.

Please don't hesitate to leave a reply if you have other concerns with QuickBooks Online. We're always ready to help.

I confirm that the problem still exists and the support online with the chat didn't help. We need a fix for this. The previous system was working much much better!!

@marcorus We understand how frustrating it is when automatic PayPal deposits aren't matching correctly in QuickBooks Online, especially when it's impacting your ability to accurately record fees.

We've brought your issue to the attention of our Next Level Help team. They will carefully review your Community comments and support history regarding this matching problem. You can expect to hear from one of our experts soon with next steps.

creator here and i can attest that the problem still exists. have spent many hours on the phone with the experts, chat and even outsourced other resources. they can get some to match but then farther back transactions do not. they tell me to reload the paypal connector but all that does is add all my issues over and over to the point where ive had duplicate after duplicate invoices and transactions that ive had to fix/delete and my books are even worse. this has been an ongoing issue since the "bank" changed to the "connector" almost 6 months ago. paypal is not the problem, have spoken to them many times as well. all of my transactions and records on there are perfect. still paying for a service that is not benefiting me in any way but i have no choice but to keep it as i have no other way to keep track of my other records/business as of right now. this has made issues for my accountant and my personal life with showing my finances. quickbooks needs to figure this out already or go back to the original paypal BANK app.

Hello -

I have spent many hours on this item. QBO insisted that I keep speaking with Paypal. I was glad I did. Paypal was able to prove that the transaction are correctly reported and exported by them. THIS IS A QBO QUESTION. SAME ISSUE WITH THE SQUARE CONNECTOR. Various clients have requested to review other accounting programs that can support items such as Big Commerce, Paypal and Square.

I will give QBO the opportunity tomorrow to provide a solution as it appears they are not addressing the matter. I have received direct emails form various other accountants with the same issue.

I appreciate your communication.

Oliver Noah-

All of your guidance and suggestion have been done by my staff and personally by me. IT DOES NOT WORK.

When will this be addressed?

That has been done. Two cases open 1513982089 and 1513928030. Still no communication.

After several years of using QuickBooks effectively, the customer support's handling of the PayPal App feature is incredibly poor. After hours of phone calls and emails, the result is that it is not their fault and the fact that we are unable to use the connector in an effective way is wholly ignored. We were happy with the previous PayPal connector, but the new one requires us to reconcile every transaction manually, and it is a huge step back.

I want to make the last email of the support public because I hope that other customers will raise the same concern and increase the priority of changes to the feature that addresses the need for a working system.

The following is the response received by the customer support. Only bad news.

Before diving into your questions, I want to acknowledge that the outcome of this case may not meet your expectations. While no changes will currently be made to how the PayPal Connector functions, we’ve taken the time to submit your product improvement suggestions for consideration. If you’d like to submit additional suggestions directly, you can do so within your account by navigating to the gear icon and selecting Feedback.

when will I be able to match paypal payments to exisiting invoices?

Hi there, Camgrinder. You can match your PayPal payments to existing invoices as soon as the payments appear in your bank feed or after your PayPal account is connected to QuickBooks Online.

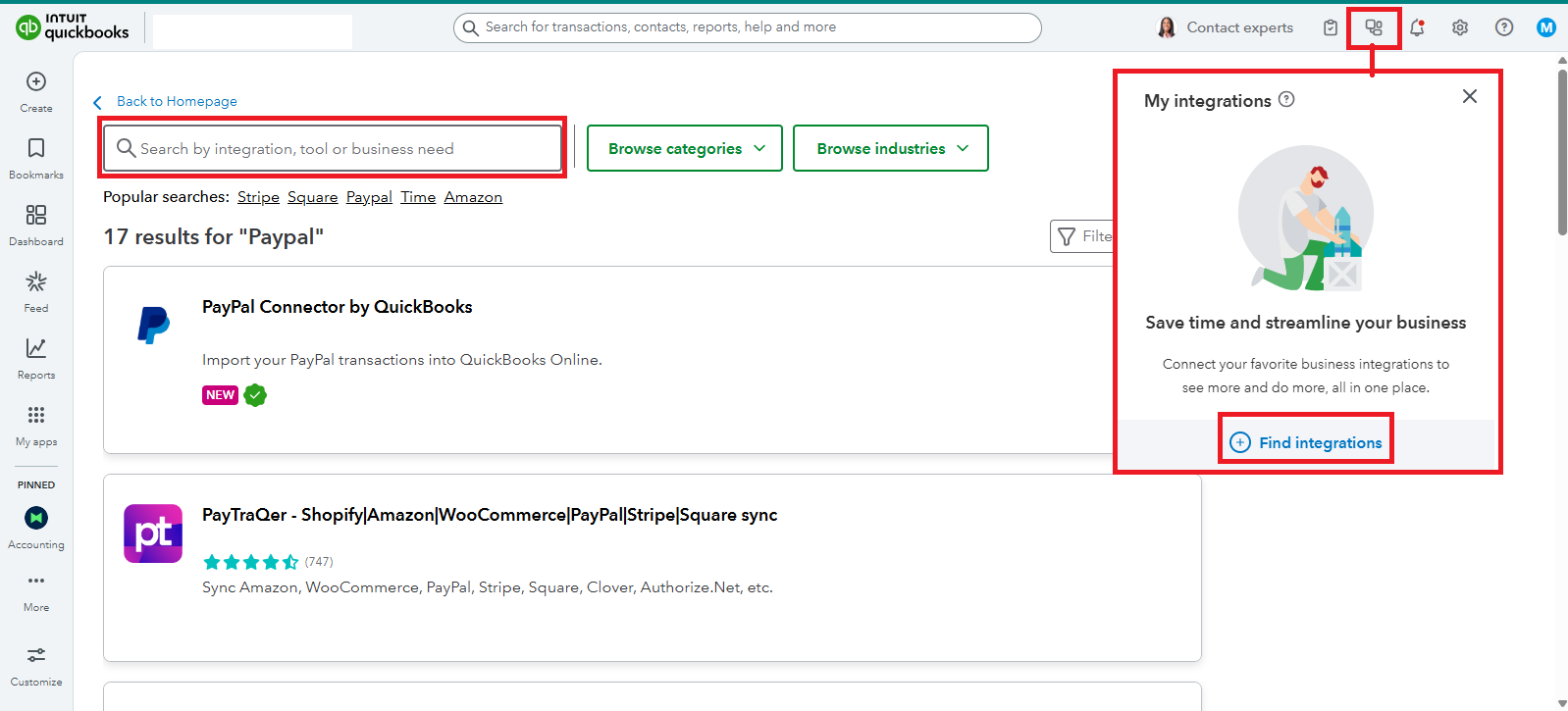

If your PayPal account isn’t connected yet, go to the My Integrations section, search for the PayPal connector, and integrate it with QuickBooks. Once connected, transactions will automatically sync to your bank feed.

If you’ve already imported the transactions into QuickBooks, you can match them through the Bank Transactions section.

Here's how:

Let me know if you need further assistance. We're always here to help.

quick books team! yet again this does not work. its been months, customers are still issuing the same complaints and problems. we are sick and tired of the "help" we do not actually receive. none of it works. im still trying to get things to match from 6 months ago.

I understand that having unexpected issues with a program can be inconvenient. Let me direct you to our support team for assistance with the error you’re encountering, Elitekustoms18.

Since you’ve already tried troubleshooting, I recommend contacting our Live Support team. They have the tools to investigate further and resolve the error, allowing you to correct and match your invoices. Here’s how:

You can check our support hours to ensure timely assistance.

Don’t hesitate to hit the Reply button below if you have further concerns about tax payments.

The "bank transactions" option is not available for the Paypal app. There is no "match" button in the app. There are no rules being applied. This is the worst integration I ever seen

Same here, I have already moved clients to Xero because of this issue and hope to move more. Every "update" to QBO makes it less usable but the PayPal Connector is the worst I've seen yet. It's completely unusable. After hours on the phone and in live chat with support they insist the issue is resolved, but there is no change to the functionality. On top of that the app created more than a dozen accounts in the Chart of Accounts and several Product/Services on the list, which add to usage limits and are completely useless. I'm not sure what use case they were envisioning when developing this system but I am sure they couldn't have consulted with a single accountant or bookkeeper about it. The old Bank Feed worked just fine and now I must disconnect PayPal entirely and reconcile manually until I can get everyone to move away from QBO.

"Match" is not an option in the PayPal Connector.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here