I'm glad you reached out, @AzzatoEnterprises! The situation you're experiencing is likely related to how these transactions are categorized. Let’s go over how to resolve this so your supplies are accurately recorded.

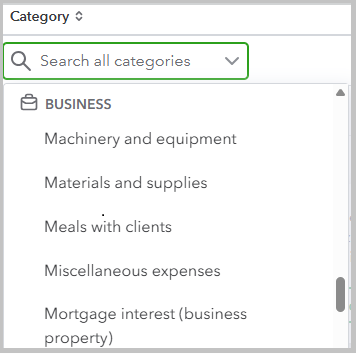

Proper categorization is essential for them to appear in your financial reports. To ensure your supplies are recognized as expenses, please verify that they are classified under the appropriate category on the Transactions page.

If you need help understanding how to categorize your expenses correctly, you can refer to the article for more information: Schedule C and expense categories in QuickBooks Solopreneur and QuickBooks Self-Employed. This will guide you in making sure all your transactions are accounted for properly.

I also encourage collaborating with an accountant to ensure the accuracy of your records. They can offer valuable insights and alternative strategies for managing your finances effectively.

I'll be around to entertain inquiries about categorizing transactions or other QuickBooks-related questions. I encourage you to utilize the comment section so we can continue conversing and address your concerns promptly. Keep safe.