Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi, I would like to know how to write off accounts receivable (old unpaid invoices)? Is it need to use the write off or credit memo will do? Thia is for a small business owner. LLC. Thank you in advance.

Solved! Go to Solution.

You can zero out the invoices if you have access to make changes to prior, closed periods. Since you're on cash basis, those entries were never on your balance sheet or P&L so zeroing them out will not impact any cash basis closed period. It will affect any prior period accrual basis reports.

If you don't have access to make changes, then, IMO, you should create credit memos that offset the revenue on the invoices, not create an offsetting expense. On cash basis, when you apply a credit memo to an invoice, QB increases your revenue based on the invoice amounts and then offsets that with whatever accounts are assigned to the Product/Services on the credit memo. If you assign an expense account to the credit memo, your revenue and expense will both increase, thereby offsetting. That's correct for accrual basis but not cash. On cash basis, you don't increase revenue, so the Product/Service on the credit memo should match the income accounts associated with the invoices. That why it's easier to just zero out the invoices IMO. Forgive me if you know all of this already.

Writing off old unpaid invoices is easy, Charm25. We'll use the Credit memo feature. I'd be glad to show you how.

If the invoices you send through QuickBooks are no longer collectible, you can classify them as bad debts and remove them from your records. This process helps keep your accounts receivable and net income accurate. Here are the steps to write off invoice balances.

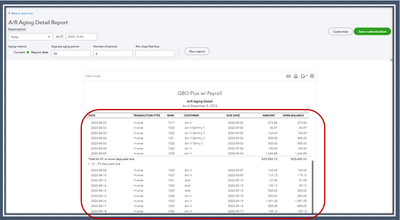

To start, let's run the Accounts Receivable Aging Detail report. Doing so helps us review all your invoices that should be considered bad debt. I'll show you how:

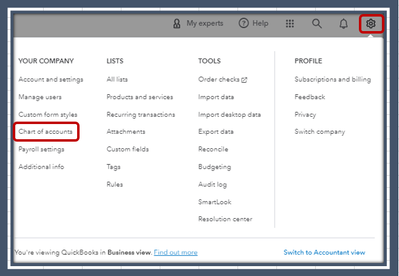

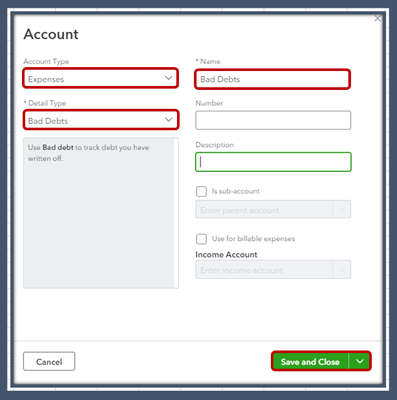

Then, create a Bad debts expense account:

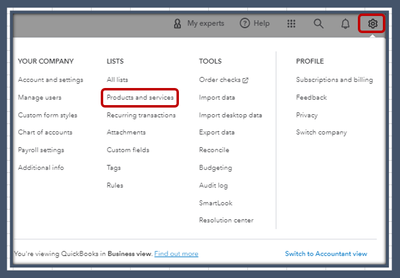

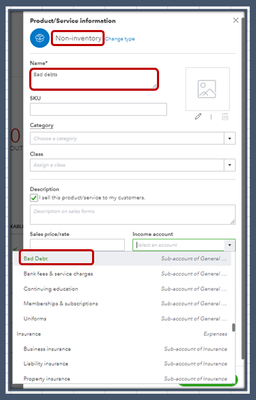

Next, if you haven't already, create a non-inventory item as a placeholder for the bad debt. It isn't a real item, it's just to balance the accounting:

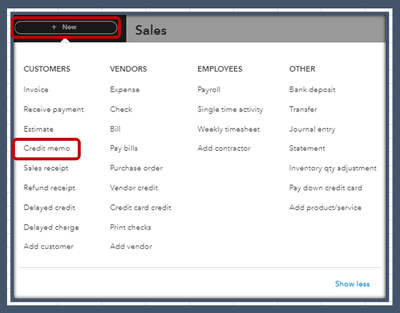

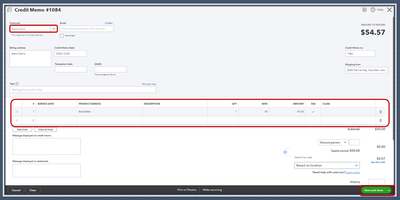

After that, create a credit memo for the bad debt:

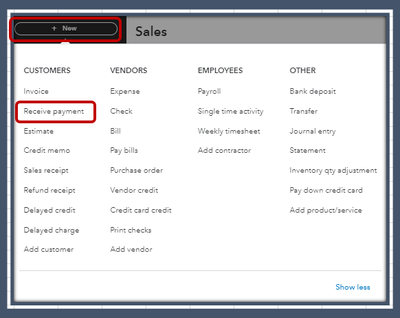

Once done, apply the credit memo to the invoice:

For more details about the process, please see this article: Write off Bad Debt in QuickBooks Online.

If you have any further concerns about tracking the transactions, please don't hesitate to post them here. I'm always ready to assist you. Have a great day!

@CharleneMaeF 's response only applies if you're on accrual basis. If you're on cash basis, zero out the old, unpaid invoices since they were never recorded as income.

Thank you.. Yes, it's a cash basis.. How can I zero out if the books were already closed. Should I create a credit memo instead to offset the unpaid invoice?

Thank you. This is a cash basis accounting method.

You can zero out the invoices if you have access to make changes to prior, closed periods. Since you're on cash basis, those entries were never on your balance sheet or P&L so zeroing them out will not impact any cash basis closed period. It will affect any prior period accrual basis reports.

If you don't have access to make changes, then, IMO, you should create credit memos that offset the revenue on the invoices, not create an offsetting expense. On cash basis, when you apply a credit memo to an invoice, QB increases your revenue based on the invoice amounts and then offsets that with whatever accounts are assigned to the Product/Services on the credit memo. If you assign an expense account to the credit memo, your revenue and expense will both increase, thereby offsetting. That's correct for accrual basis but not cash. On cash basis, you don't increase revenue, so the Product/Service on the credit memo should match the income accounts associated with the invoices. That why it's easier to just zero out the invoices IMO. Forgive me if you know all of this already.

Thank you. It really makes sense..

Hi.. Last question..

Write off feature in qbo is use for accrual basis only?

Then, for cash basis it is better to zero out invoices and if dont have access to change the invoice, better to use credit memo with income classification to zero out?

Hi.. Last question..

Write off feature in qbo is use for accrual basis only?

Then, for cash basis it is better to zero out invoices and if dont have access to change the invoice, better to use credit memo with income classification to zero out?

What if it is cash basis and partial write off. For example the customer never payed off balance? The example I am seeing zero it out for full write off. What should we date should be used current date or same date as the write off. Also, if it is a credit is used should we back date. Please explain in detail. Thanks

Hello Rainflurry,

Thank you for sharing your input to help address the issue. We love to see members supporting one another! Have a great day.

What if they are older and partially paid invoices? In our world there are often unpaid balances (small dollar), We are on a cash basis and want to clean these old invoices up.

Should I zero the out the whole invoice? Seems like we were partially paid I should zero the balance of what's outstanding not the whole invoice

I appreciate you joining this thread, kkbmar. Let me share information to help you write off old and partially paid invoices in your online account.

With QuickBooks, you may consider creating credit memos for the remaining unpaid balances from the invoice. The steps shared by my colleague, CharleneMaeF above, have similar processes when writing off customer invoices that were paid partially. Thus, it's best to run an Accounts Receivable Aging Detail report to help you review all bills that are considered bad debts. To do this:

Once reviewed, you may follow Steps 2 & 3 outlined in this article when creating a bad debt expense account and item: Write off bad debt in QuickBooks Online.

Once done, enter the remaining amount balances from an invoice when creating credit memos for the bad debt. You may refer to the steps below:

Moreover, you can run specific reports to help review your business finances and other accounting data.

I'll keep this thread available if there's anything else you need further assistance with when managing sales transactions in your account. Just let me know, so I can provide additional help. Keep safe!

RE: Write off (A/R), old unpaid invoices

For the Cash Basis wouldn't you still complete most of the steps in @CharleneMaeF 's response except for the last step to select Receive payment?

If not could you please list the steps for the Cash Basis. Thank you.

Thanks for joining the thread, @angelacct.

Instead of receiving payments from your customers, you can issue a credit memo. By this, we can apply the credit amount to their invoice, which will show up as a return in their account. By doing this, you can clear the amount from your accounts receivable and reduce your net profit.

Here's how:

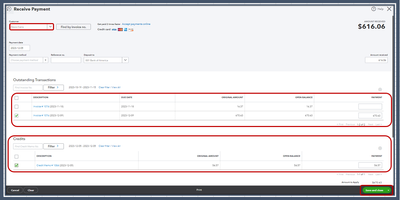

After creating the credit memo, it can be applied automatically to your invoices depending on if you've turned the settings on. Otherwise, here's how we can manually apply them to your invoice:

Furthermore, you'll want to check this article and learn how and when to give a credit memo or delayed credit to customers: Create and apply credit memos or delayed credits in QuickBooks Online.

Additionally, you can refer to this article for future reference if you want to learn how to personalize and add specific info to your sales forms: Customize invoices, estimates, and sales receipts in QuickBooks Online.

I'll leave this thread open for your comment if you need additional assistance managing your invoices in QuickBooks Online. Stay safe.

Thank you so much for the information, I really appreciate it.

Hi there, @angelacct.

I'm glad to see that my colleague was able to help you resolve your issue. Rest assured, we'll continue to provide you with quality customer service.

If you have further QuickBooks concerns, feel free to come back here. I'll be willing to lend a hand. Keep safe and have a great day!

QB Employees don't understand proper accounting and it's clear by their responses that they really shouldn't be giving advice on how to handle this. On cash basis, you have two options for uncollectible invoices:

1) Zero out the invoice.

2) Create a Credit Memo with an item linked to an income account, not an expense account.

You don't want to use an expense account like Bad Debt Expense on cash basis because that will increase your revenue with an offsetting expense. Although the bottom line is the same, you don't want to show revenue from uncollectible invoices on cash basis.

I just realized that you had already answered that "zeroing out the invoice" is the best practice for cash basis.

Thanks so much for taking the time to answer the same question again. I really appreciate it.

Hello and good evening!

I have some invoices that are old with overdue balances. I want to write off the remaining balance so that it is off from the aging report. At the same time, I have some invoices that are partially paid. If I clear out the invoice to a zero, that is going to increase the revenue.

How do I clear the outstanding balance without increasing the revenue?

I want these off the books since they are really old.

Please help!

Thank you in advance,

Bless.

To zero out the open invoices, it's important to mark them as bad debt and write them off. Allow me to walk you through the process of writing off bad debt in QuickBooks Online (QBO), @customer.

First, you'll need to Create a bad debts expense account.

Then create a bad debt item, here's how:

After that, you'll need to create a credit memo for the bad debt.

Then you'll need to apply the credit memo to the invoice. Here's how:

For more detailed steps on writing off bad debt in QBO, you can refer to this article: Write off bad debt in QuickBooks Online.

Moreover, regarding to concern about clearing the outstanding balance without increasing the revenue, please be reminded that you'll need to consult an accountant to ensure that everything is properly recorded and that the revenue remains unaffected.

Additionally, you can get more hints while running your financial reports in our system, from these links:

If you have further questions about clearing old invoices, you can comment below, and we'll respond to you as soon as possible.

How to write off unpaid old account on my credit profile

I appreciate you following this thread.

I'm here to share additional insights on writing off unpaid old accounts.

If you're referring to the need to write off unpaid old invoices, you can record them as a bad debt, allowing you to update your accounts receivable and net income. You can follow the steps outlined by my colleague in the previous reply.

If you're referring to clear unpaid bills from your Accounts Payable account, you can delete them if you operate on a cash basis. However, if you have unpaid bills and use accrual accounting, you'll need to create a credit memo to clear those bills.

When making the credit memo, use the same expense account that was used for the original bills. Then, you can apply the credit memo to the unpaid bills to remove them from your Accounts Payable account. This approach allows you to properly account for the transactions on an accrual basis.

Additionally, you can generate reports to gain a deeper understanding of your business's financial health, improve financial management, better planning, and ultimately, more sustainable growth for your company.

Should you have any other questions regarding the write-off of unpaid old accounts or any other concerns, visit the Community. We are always here to help. Stay safe.

Can you do this "bad debt " for multiple invoices at a time, or you have to go one by one ? Thanks for this very useful information

Hi there, @Cbohn25.

Yes, we can write off multiple invoices in QuickBooks Online if they are from the same customer so it's easier to manage outstanding balances. If the invoices are from different customers, you will need to handle each one separately, focusing on one customer at a time. I’ll guide you through each step of the process, giving you a clear understanding of each stage.

Here's how:

If you haven't already, create a Bad debts expense account.

Next, Create a Bad debt item.

If you haven't already, create a non-inventory item as a place holder for the bad debt. This isn't a real item, it's just to balance the accounting.

Then, Create a Credit memo for the bad debt.

Lastly, Apply the Credit memo to the invoice.

The uncollectible receivable now appears on your Profit and Loss report under the Bad Debts expense account.

For your complete reference, refer to this article: Write off bad debt in QuickBooks Online.

For your future reference on how to run your uncollectible invoices, refer to this article: Run a bad debts report.

Clearing multiple invoices in QBO is streamlined when dealing with a single customer, helping you manage outstanding balances efficiently. If you have any additional questions, don't hesitate to reach out to us directly. I'm here to provide any assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here