Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhat is the best practice to record customer deposit on an invoice under the cash method?

Thanks for getting in touch with the Community, Salessio0564.

If you require a deposit from your customer, you can add a deposit field to their invoices. After you've entered a deposits on an invoice, it will reduce the total amount and calculate your customer's balance due. You'll want to be sure to enter everything correctly so you can see it in the Deposit Detail report.

Initially, you'll need to turn on deposits if you haven't yet.

Here's how:

After turning deposits on, you can add a deposit to an invoice:

Next, you can record your deposit and run the Deposit Detail report.

If there's any additional questions, I'm just a post away. Have a great Monday!

The response provided by @ZackE is incorrect. That method will not show the deposit as income on cash basis.

There are several ways this can be handled, depending on whether you issue an invoice for the deposit or not.

You can receive payment from the customer (New > Receive payment) and not apply it to an invoice. When you run a P&L on cash basis, the deposit will show as 'Unapplied Cash Payment Income' as of the date the deposit is received.

If you issue an invoice for the deposit, create a 'Customer Deposit' service product assigned to an income account and receive payment on that invoice. Then, when you issue the final invoice, add the Customer Deposit service product as a line item as a negative amount, thereby reducing the amount due. That will book the deposit as income as of the date payment is received on the invoice for the deposit and the remaining income on the final invoice.

Hello,

thanks for your help, but I’m looking to not include the deposit into income until the full payment is made.

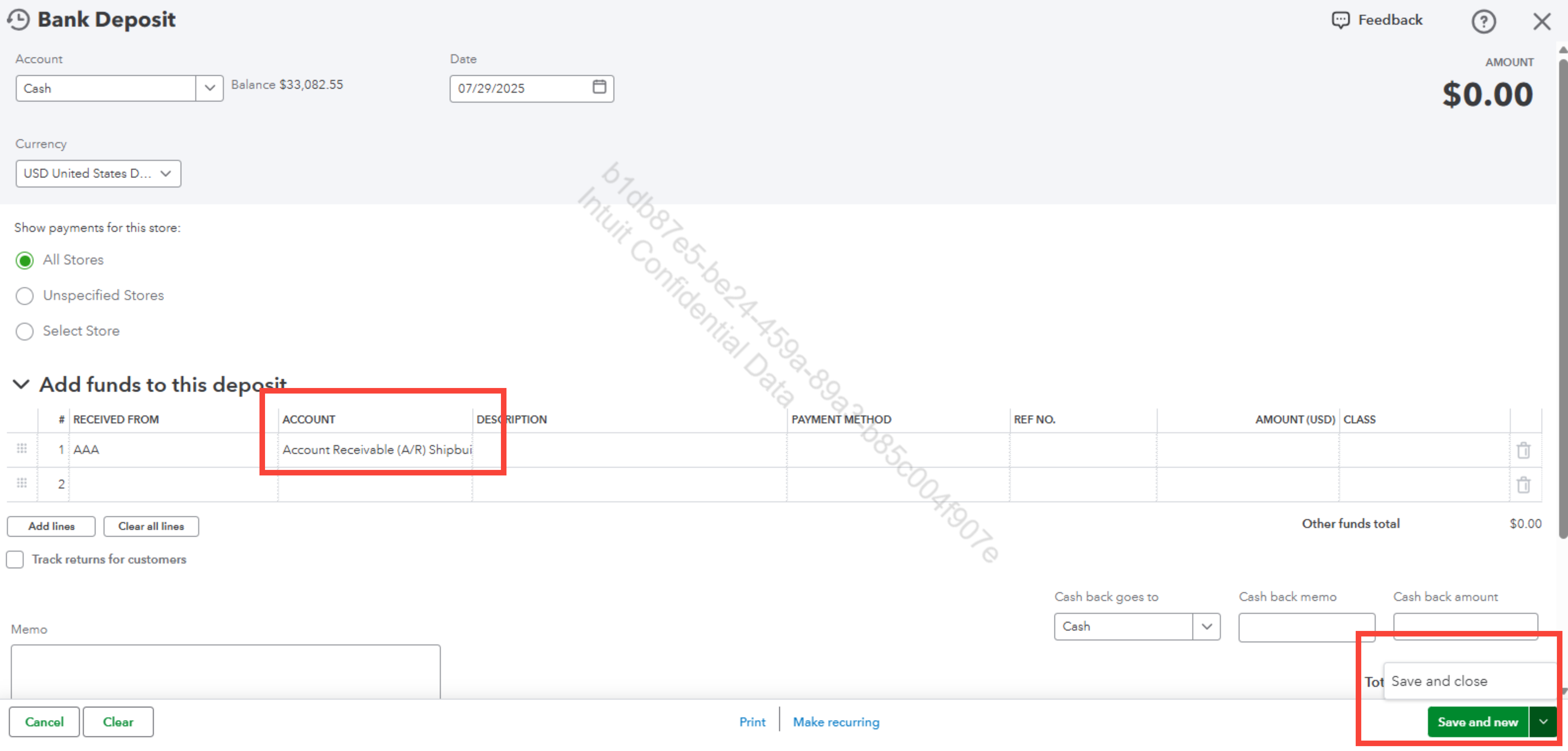

If the deposit isn't considered income, record it as an Account Receivable prepayment from the customer, Salessio0564.

Here's how to record it:

Once the full payment is received, you can link to your invoice and apply the payment by following these steps:

To apply prepayments to the invoice, follow these instructions:

If you need any further clarification or guidance, feel free to reach out. We are fully committed to providing you with the assistance you need.

"but I’m looking to not include the deposit into income until the full payment is made."

Then you're not on cash basis. If you're on cash basis, customer deposits are income when received. The IRS would not approve of deposits not being reported as income. Accrual basis doesn't recognize the deposit as income until the work/product has been delivered.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here