Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have a customer that I wrote off their invoice as bad debt, because they never paid. They now want more work done, and I would like to get them to pay the old invoice first. When I pull up the old invoice, it shows as paid because I wrote it off. Is there any way to not have it show as paid? I would prefer not to go through the process of undoing the bad debt (that's a whole separate question for a different day!) until I know they will pay it. For now, I would like to just send it to them without the invoice saying it's paid. Is that possible? I also don't want to mess up my books from years ago when I originally wrote it off in the process of getting this done. Thanks!

Solved! Go to Solution.

Thank you for the detailed information you shared about the situation with your previous sale transaction, as well as for specifying your goal regarding what you want to do with the invoice that was written off as bad debt, @SarahCO. This assures us that we are on the same page.

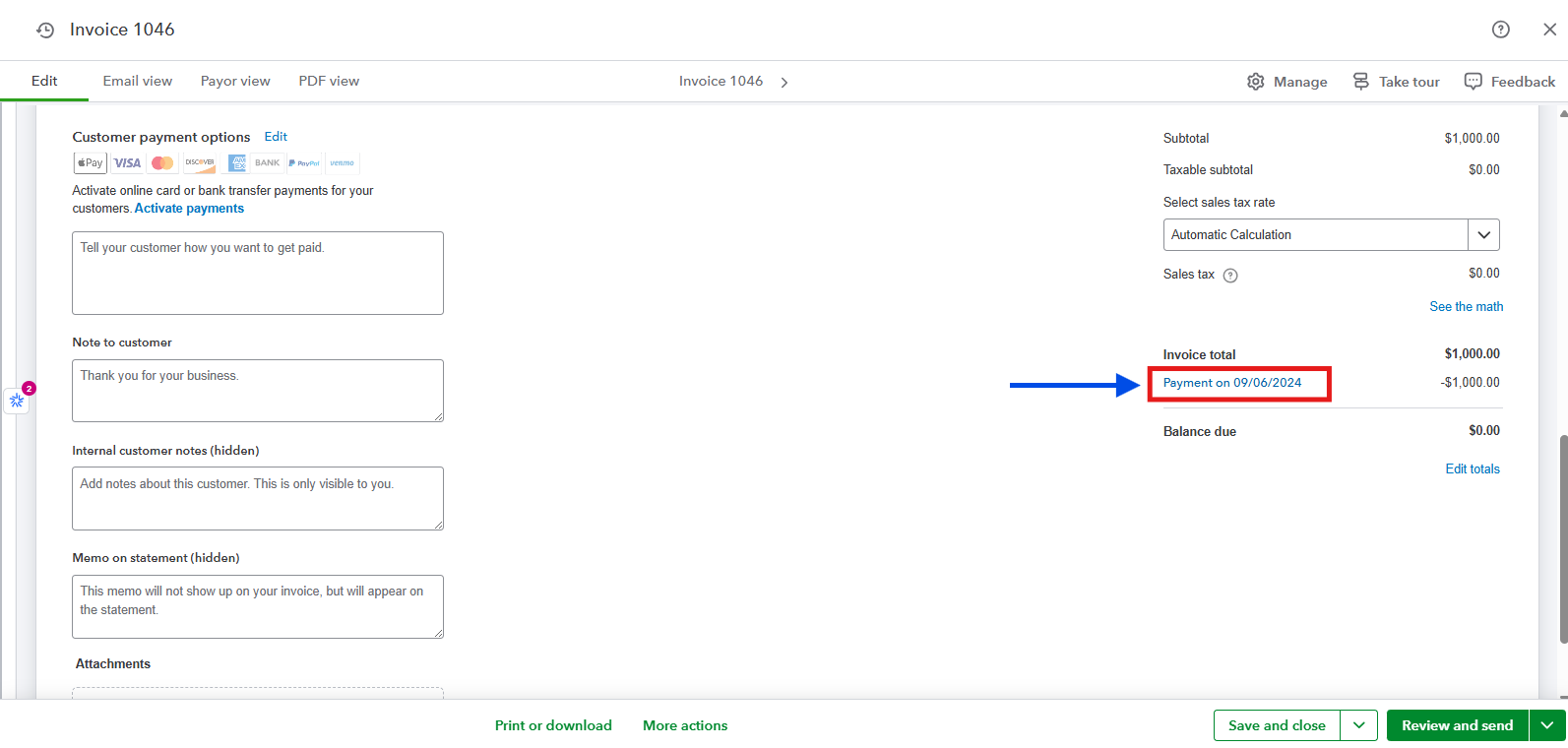

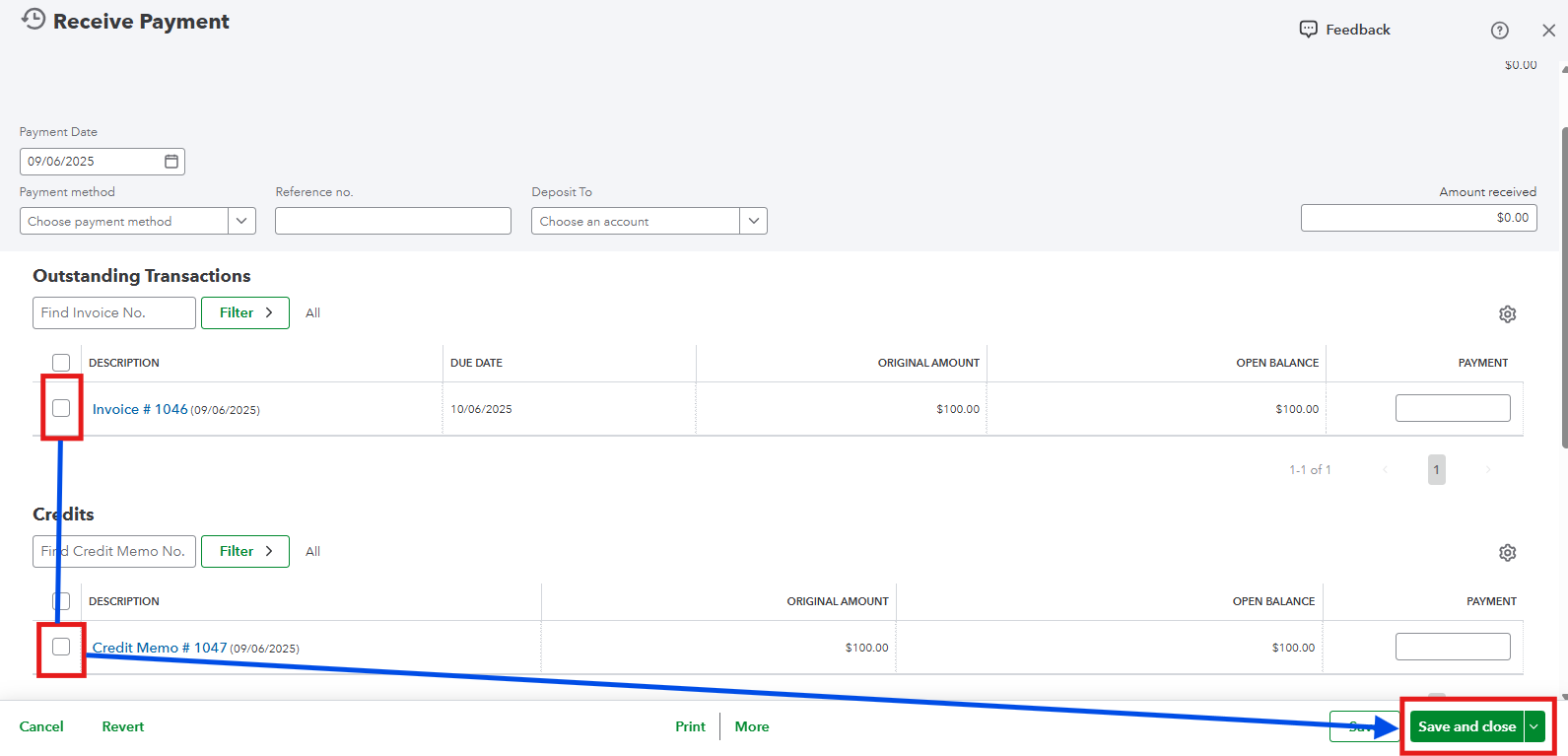

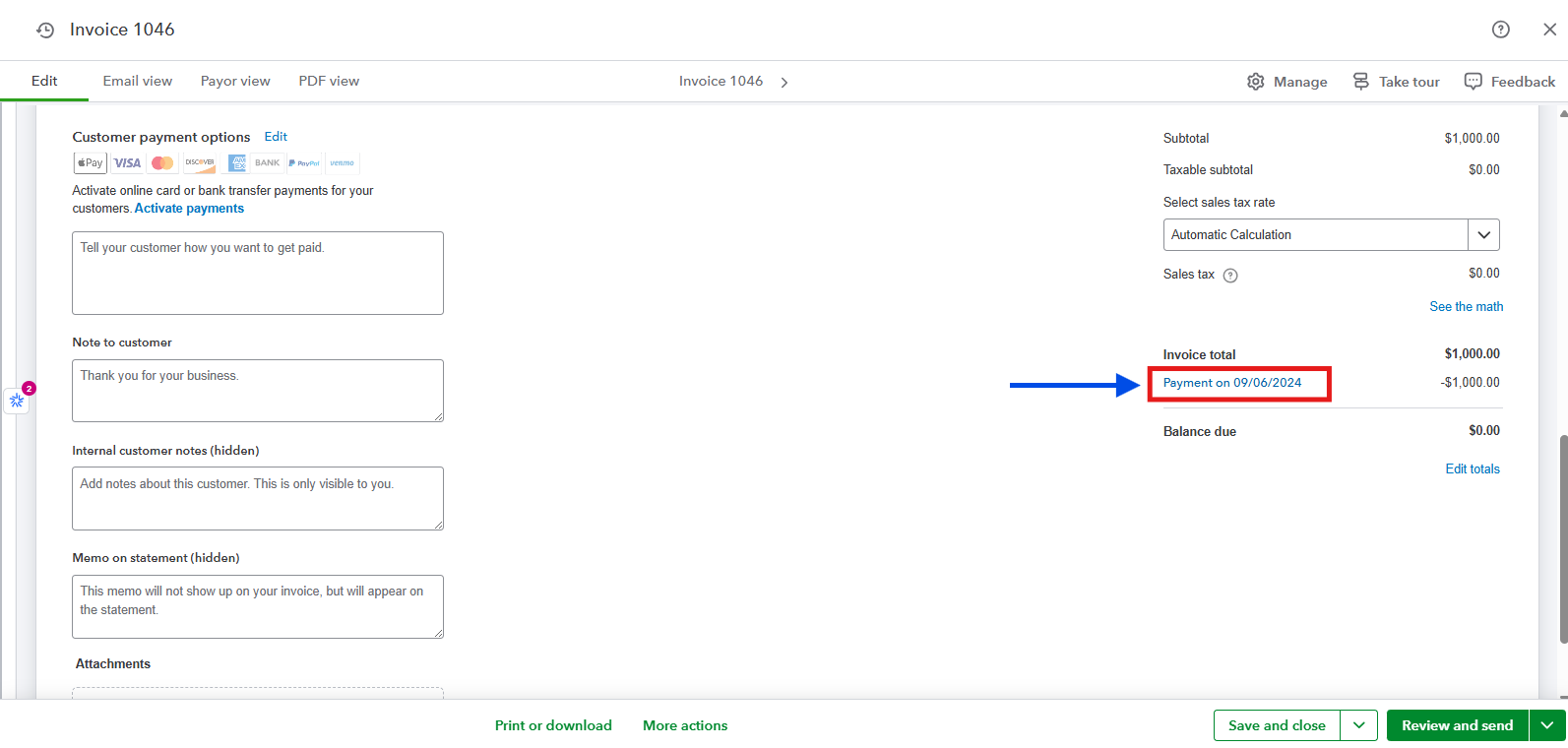

Sending the invoice that you write off as bad debt to your customer as unpaid is possible. However, you will need to unlink the credit that allows it to appear as paid before delivering it to your customer.

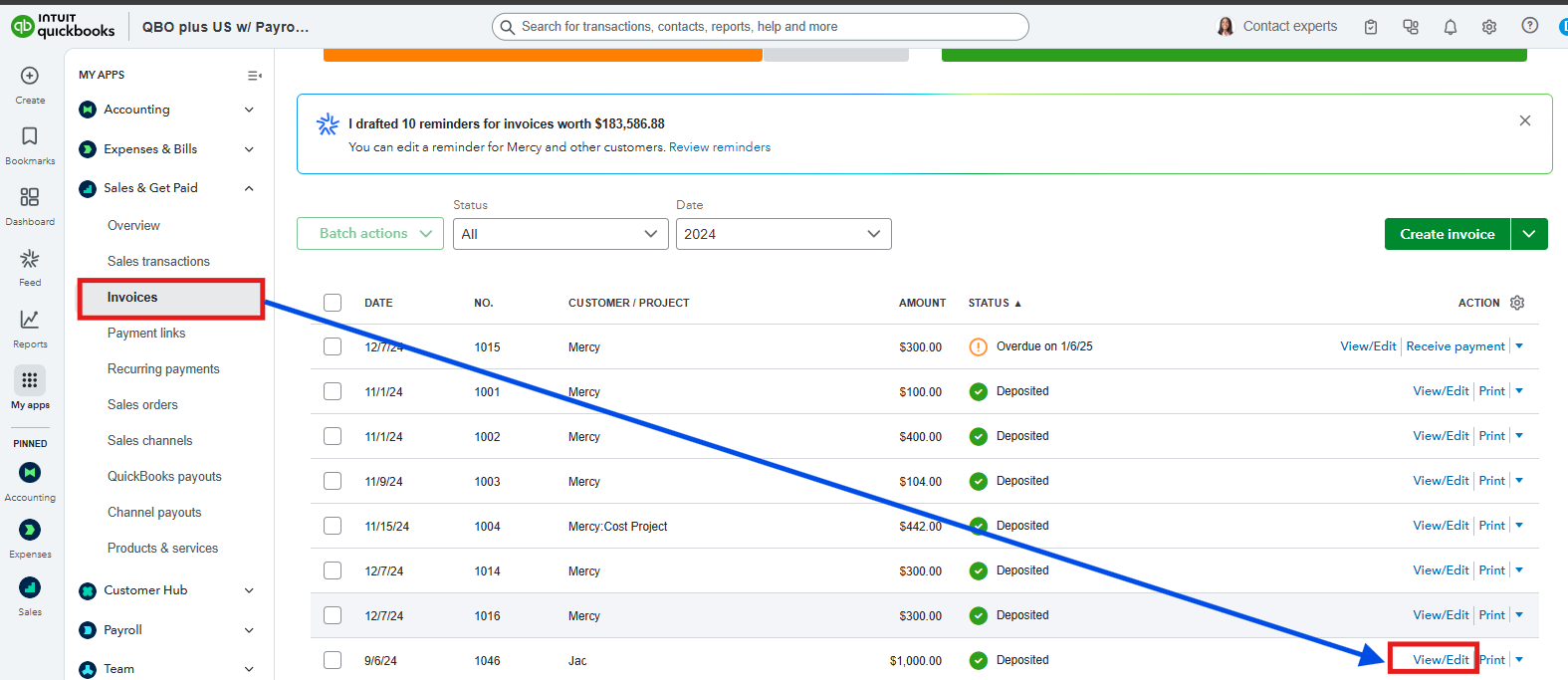

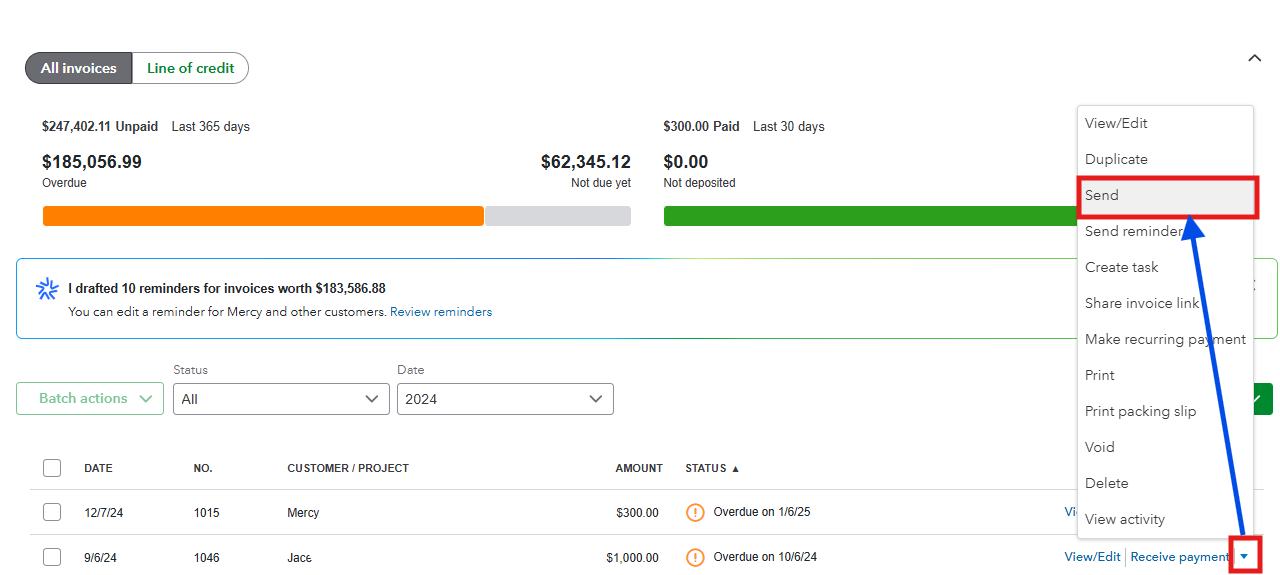

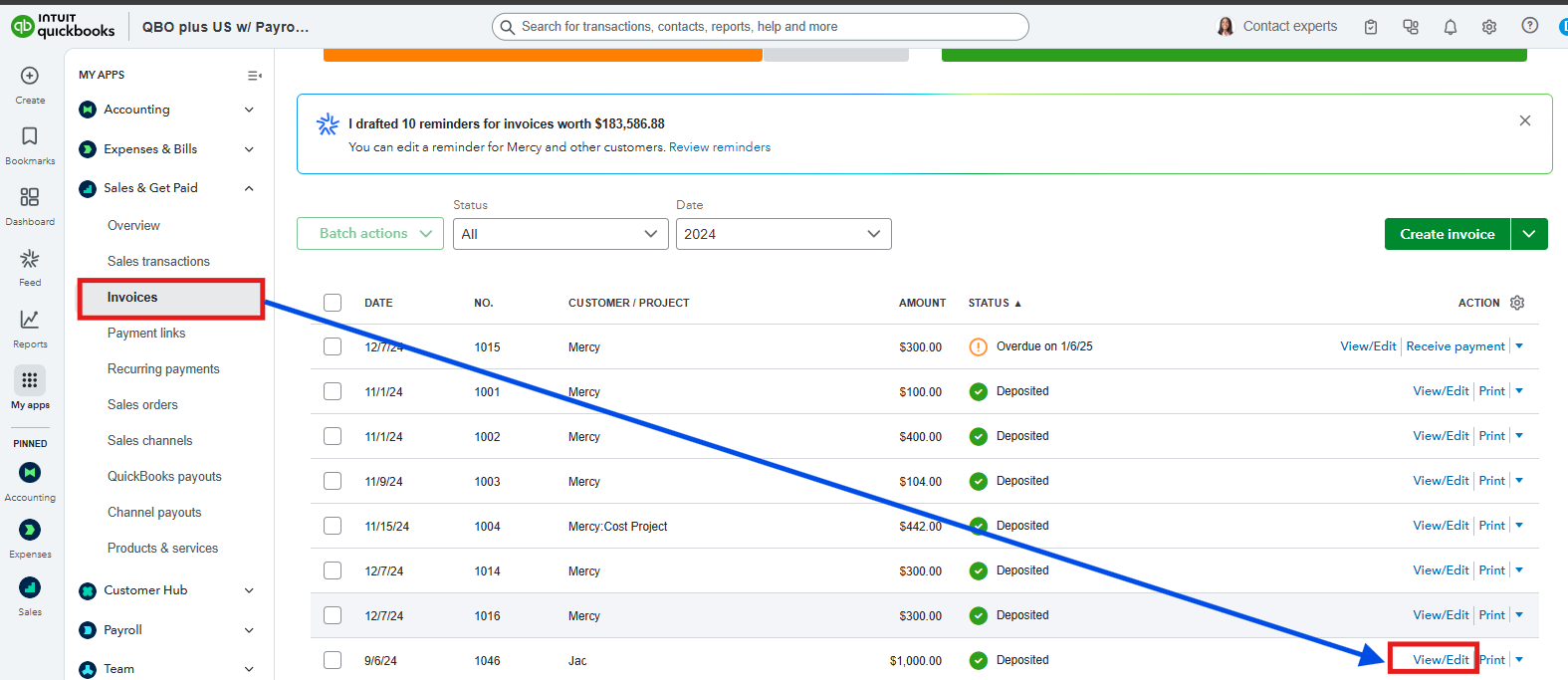

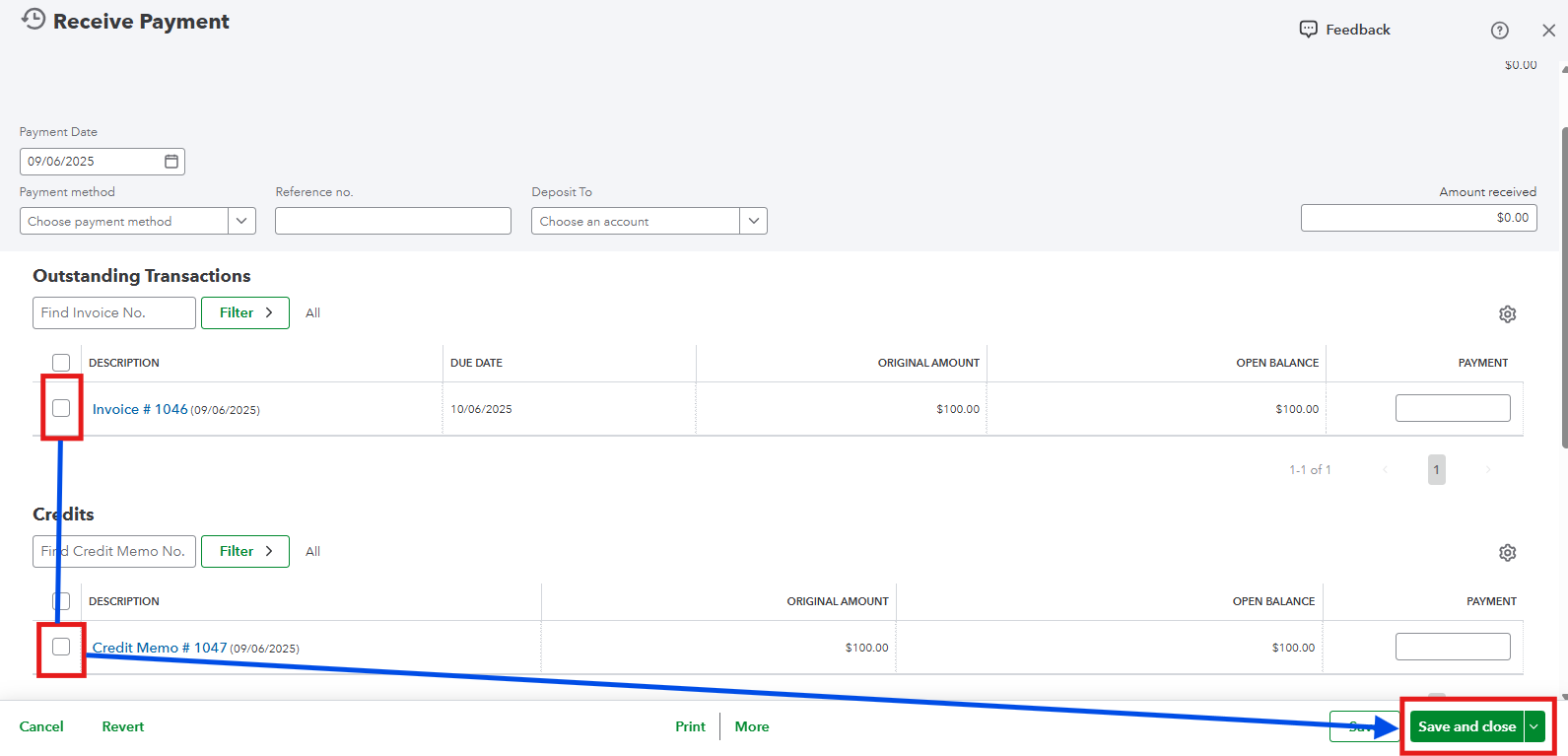

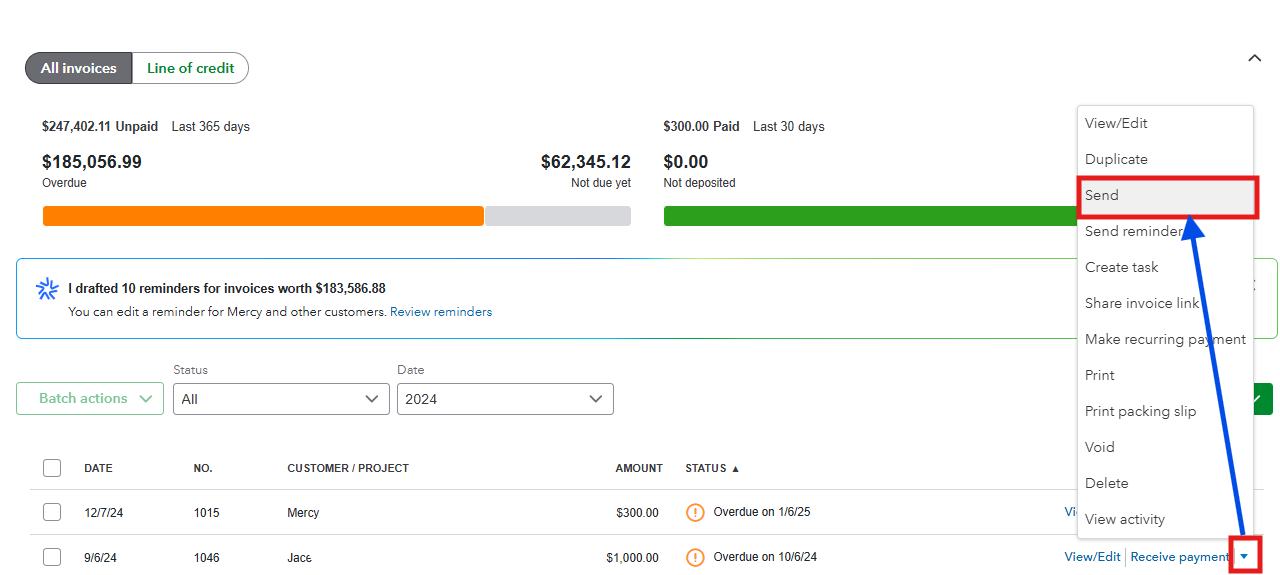

Here's how:

Once the invoice is delivered to your client as unpaid, you can relink the bad debt credit to maintain the record balance of your book.

Take note that you are dealing with a transaction from the previous year that supposedly locked and closed. Accessing this entry will also open your A/R account. Considering this, I recommend reaching out to your accountant before performing the process to avoid messing up your books from years ago.

Reopening old entries can be crucial, but sometimes our business needs it for proper reporting and documentation of the previous year's transactions. If you need additional assistance in managing your invoice transactions, either from the past or in the present, you can drop a comment below.

Thank you for the detailed information you shared about the situation with your previous sale transaction, as well as for specifying your goal regarding what you want to do with the invoice that was written off as bad debt, @SarahCO. This assures us that we are on the same page.

Sending the invoice that you write off as bad debt to your customer as unpaid is possible. However, you will need to unlink the credit that allows it to appear as paid before delivering it to your customer.

Here's how:

Once the invoice is delivered to your client as unpaid, you can relink the bad debt credit to maintain the record balance of your book.

Take note that you are dealing with a transaction from the previous year that supposedly locked and closed. Accessing this entry will also open your A/R account. Considering this, I recommend reaching out to your accountant before performing the process to avoid messing up your books from years ago.

Reopening old entries can be crucial, but sometimes our business needs it for proper reporting and documentation of the previous year's transactions. If you need additional assistance in managing your invoice transactions, either from the past or in the present, you can drop a comment below.

Thanks for your response. So, from what you're saying, it sounds like it WILL mess up my books from the prior year, that's why you tell me to reach out to my accountant? Or will it only mess it up if I don't re-link the bad debt credit correctly?

Good afternoon, @SarahCO.

We appreciate you reaching back out and asking additional questions.

Anytime you try to change or edit any transactions from prior years, it can mess with your books.

That's why we recommend speaking with your accountant to ensure this would be the best route to take, and if they have any advice for you moving forward with these steps and what it may do to your books.

If you have any further questions, don't hesitate to come back. We're always here to help in any way we can. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here