Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe have a customer who mailed us a bad check for $1,806.87 on 07/10 that paid two invoices. It was deposited on 07/13. The bank debited our account on 07/16 and charged us $15. We won't charge the customer the $15. We received a second check from the customer for the same amount on 08/10.

How do we record these transactions?

Solved! Go to Solution.

Hi there, @PoolHero1. Let me share with you a simple fix that I found.

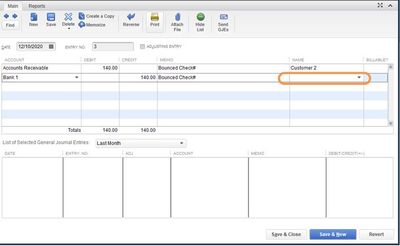

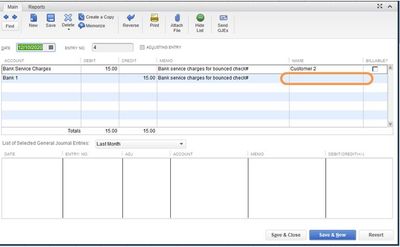

While we need to have the customer/job entered in the Journal Entry line that lists the Accounts Receivable account, you don't need to have the customer/job entered in the line that has the other account. In this case, we can remove the customer's name for the Bank asset account. This will remove the transactions from the Unbilled Cost by Job report.

You can also check out our guide on handling NSF check from customer for your convenience. It gives you two options on how to do it. You can either use the Record Bounced Check feature or do the manual process.

Please let me know if you need further assistance. I'll be around to help. Have a great day.

Let's get this taken care of for you, @PoolHero1.

We'll use the Bounced Check Feature to record these transactions. Please note, the Record Bounced Check feature can only be used in single-user mode and only applies to check payments done through the Customer Payment window.

To read more about this process in greater detail, check out this article: Handle Non-Sufficient Funds (NSF) or bounced check from customers.

Let me know if you have any other questions about this process. I'm here to help! Have a fantastic week.

Thanks @Jessica_young

When I do that the summary shows

1) the two invoices being marked unpaid

2) the two fees being deducted to from my bank acct

3) An invoice what will be created for the fee to charge to customer (it's blank).

I then go into the second payment and apply it to the two original unpaid invoices. What do I do with the journal entry that it created? In the customer payment window, the journal entry for $1,806.87 is showing like unpaid invoice. In addition, both journal entries, $1,806.87 and $15, are showing up on our unbilled accounts report. That report is a listing of anything purchased with a Customer:Job name and marked as billable.

Thanks @Jessica_young

When I do that the summary shows

1) the two invoices being marked unpaid

2) the two fees being deducted to from my bank acct

3) An invoice what will be created for the fee to charge to customer (it's blank).

I then go into the second payment and apply it to the two original unpaid invoices. What do I do with the journal entry that it created? In the customer payment window, the journal entry for $1,806.87 is showing like unpaid invoice. In addition, both journal entries, $1,806.87 and $15, are showing up on our unbilled accounts report. That report is a listing of anything purchased with a Customer:Job name and marked as billable.

Thanks for keeping us updated, PoolHero1.

I'm here to share additional information about recording bounced check from customers.

When you use the Record Bounced Check feature, QuickBooks will make sure that all related details on bounced check transactions are well-documented. As mentioned, above, the Bounced Check Summary will show you what happens behind the scenes.

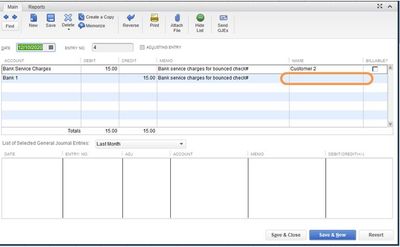

The two invoices that were paid by the bad check worth $1,806.87 will be marked as unpaid. Additionally, the amount that you entered in the Customer fee field from the Manage Bounced Check window will be deducted from your bank account.

Lastly, a particular invoice will be automatically created for the $15.00 bank fee. Since you don't want to charge your customer for it, you may just disregard this transaction. For the journal entries, I'd recommend consulting your accountant on how to handle them to avoid discrepancies on your records.

I've also included an article that will guide you on what to do when a check bounces and your bank account has non-sufficient funds.

Keep us posted if you have any other concerns or questions about checks. The Community always has your back.

Thanks @KlentB

In addition to the $1,806.87 journal entry showing up in the receive payments window for the customer, the journal entry was also creating a credit which I was then able to apply to JE in the receive payment window.

My last festering issue is with the two journal entries still showing up in the report. If you click Reports->Jobs...->Unbilled Costs by Job, the journal entries are listed. Please try to recreate the issue on your end and let me know if you're having the same issue.

Is anyone else seeing bounced check transactions in the Unbilled Costs by Job report?

Hello there, @PoolHero1.

Yes, I can see the bounced check transactions in the Unbilled Costs by Job report in QuickBooks Desktop (QBDT).

If you're unable to locate those on your end, there may be data damage. To fix this, let's run and verify rebuild your data.

Here's how:

If QuickBooks doesn't find any problems, select OK. However, if QuickBooks finds an issue with your company file, click Rebuild Now.

Check this link for more information: Verify and Rebuild Data in QuickBooks Desktop.

I've also added this article about customizing customer jobs and sales reports in QBDT.

Stay in touch with us if you have other questions. We're always here to help.

Hi @Maybelle_S

I am also able to see it which is the problem. How do I get it off of the report? Also, I happen to have rebuilt the data yesterday for another reason.

Let me share additional information. @PoolHero1.

It's possible that the original transaction that was paid by the bounced check is marked as billable. You'd want to open it and removed the checkmark from the Billable columns. I can guide you on how to do it.

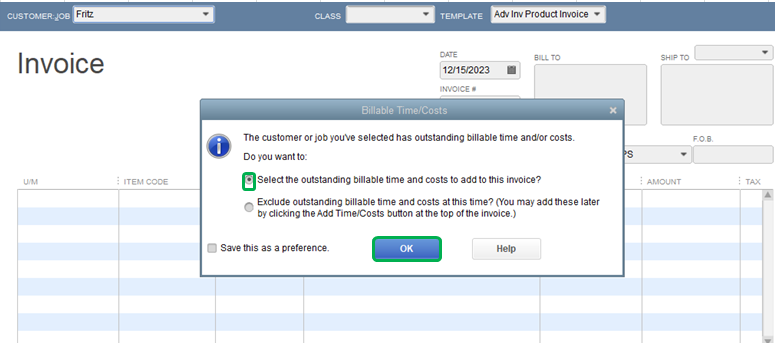

The other way is for you to remove all the billable checkmarks from the original transaction. Then, for each Customer: Job name, create an invoice. Here's how:

Keep me posted if you have other questions about managing your income and expense transactions. I'm always here to help.

Thank you @IamjuViel

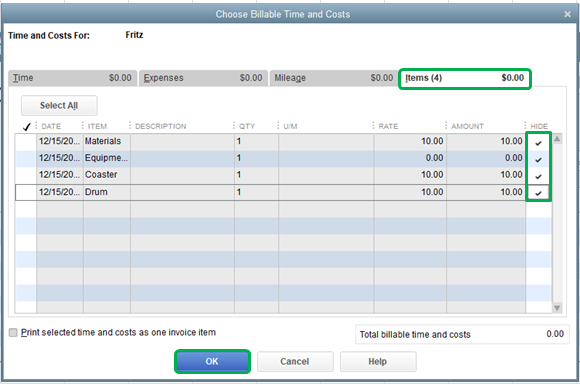

When I click the transaction in the report, it brings me to the journal entry. Neither of the two lines, my bank or AR, has a mark in the billable column. It is blank. In addition after creating a new invoice for the customer, there are no billable costs in any of the Choose Billable Time and Costs tabs.

I appreciate the update that you gave regarding this bounced check concern, @PoolHero1.

To help remove the bounced check transactions in the Unbilled Costs by Job report, I recommend consulting your accountant. This way, you'll be guided accordingly on what are the actions that need to be taken in this situation since you're routed to the journal entries when clicking the transaction.

On the other hand, you'll need to make sure that you've selected the billable job/customer upon creating the invoices so the billable costs will be visible.

Once verified and the problem continues, I recommend contacting our Customer Care Team, They have the necessary tools that can help investigate the root cause of this matter.

To reach them:

Please update me on how things go. I'll be around to help if you need anything else. Take care!

Thanks @BettyJaneB but this a QB problem, not a CPA problem. They will not be able to help.

Are you asking if I'm choosing the correct customer when creating an invoice to use the billable costs on? Yes I am. I would have thought that was obvious.

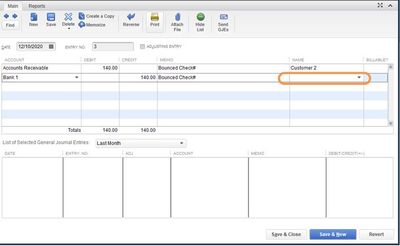

Hi there, @PoolHero1. Let me share with you a simple fix that I found.

While we need to have the customer/job entered in the Journal Entry line that lists the Accounts Receivable account, you don't need to have the customer/job entered in the line that has the other account. In this case, we can remove the customer's name for the Bank asset account. This will remove the transactions from the Unbilled Cost by Job report.

You can also check out our guide on handling NSF check from customer for your convenience. It gives you two options on how to do it. You can either use the Record Bounced Check feature or do the manual process.

Please let me know if you need further assistance. I'll be around to help. Have a great day.

@LieraMarie_A You are the bomb. Thanks so much for listening.

I have a returned check that is a donation from a church member. So she's not a customer. The check was recorded as one of many checks in a batch and the bank recorded the total amount of the deposit, then later withdrew the $300 as 'Chargeback' two days later. How can I enter the debit of $300?

Hello, Jeff Brown.

There's a way to let you enter the debit of $300 from the "chargeback" donation. I'll share it with you and ensure your transactions are accounted for.

Since there aren't any invoices involved or a customer profile entered, you'll want to record the debit of $300 using a journal entry.

To create one, go to the Company menu then select Make General Journal Entries.

For an overview, you can use the account on where the donation went and the bank account involved. However, I do recommend contacting an accountant so you'll be guided on what accounts to use for the chargeback.

After dealing with the "chargeback" donation, I'm sure you have other things to take care of. Our articles are always available for you to read if you need a guide or two in managing your books.

I'm ready to help out again if you have encounter any difficulties with your tasks in QuickBooks Desktop. Just reply here or post a new thread and I'll be right there with you.

I have a bounced check that was recorded with a general journal entry (credit to affected checking account, debit to AR), and that journal entry is now showing as an additional check/payment in my reconciliation screen. If I clear it then I'm off by that amount... how do I get it out of the unreconciled transactions?

Let me share additional information, @Ataraxis_85.

For journal entries, you’ll want to make sure you debit your account receivables for the same amount as the bounced check. Below are the easy steps.

After that, switch the payment for the invoice to the reversing journal entry. Here’s how:

Please refer to this article for more information. Scroll down to “Option 2: Manually record bounced check”: Handle Non-Sufficient Funds (NSF) or bounced check from customers.

I'd also recommend consulting your accountant to make sure your recording you’re the bounced check correctly.

You'll want to add and match bank transactions with what you've entered in QuickBooks Desktop.

Stay in touch with us if you have other questions. We're always here to help.

Hi there, thanks. That's exactly what I did, but that reversing journal entry shows up as a debit for the amount of the check in my reconciliation screen, so reconciling that would put my checking account off by that amount again. How do I clear that so it doesn't keep carrying over as an unreconciled entry?

This was perfect!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here