You can record cash rewards through the Credit Card Credit section whenever you receive cashback or a refund for purchases made on your credit card, Lisa.

To start with, it's not advisable to create a random project or expense unless the reward or credit directly relates to that project, as doing so can distort your financial report.

Here’s how you can record it:

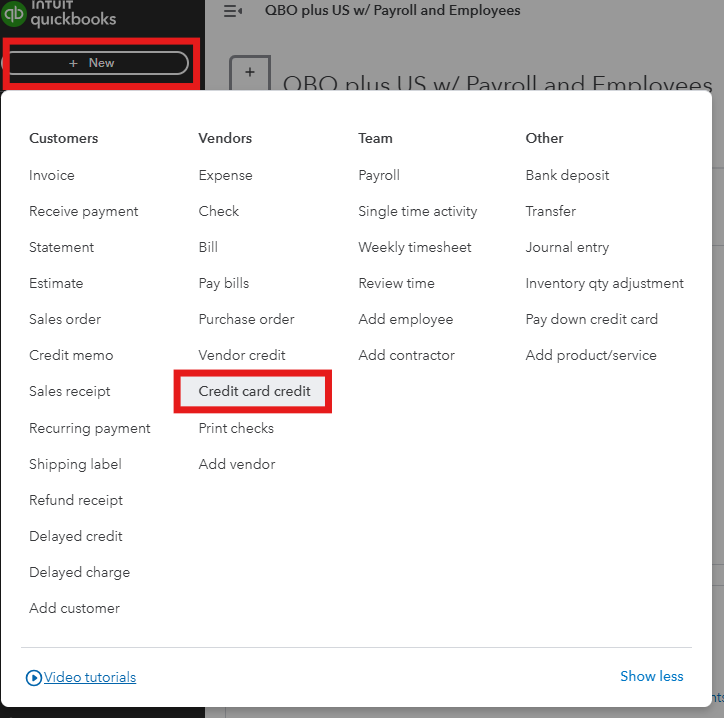

- Navigate to the + New button.

- Click on Credit card credit.

- Choose the correct account from the Bank/Credit account drop-down box.

- Under the Category details, select the account that you have for your cash back rewards.

- Fill in the other necessary information.

- Select Save and Close.

For your reference, check out this article: How can I record a cashback to my credit card account?

If you're unsure about which account to use in the category details, I recommend consulting your accountant to determine the appropriate account.

I'll add this resource so your accounts always match your bank and credit card statements: Reconcile an account in QBO.

You might want to consider checking out our QuickBooks Live Expert Assisted team. They can help you with your transactions and account reconciliation.

The Community is always available to back you up if you have further concerns.