Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThis seems like it should be easy to do, but, alas, it's not. I also cannot find any straight forward, step by step instructions on how to do this.

We had a customer who had multiple past due invoices (15+), by arrangement with us. Normally, we can give them the total of all and they can make a payment to one of the invoices, and by editing the amount of payment, get a credit on their account due to the overpayment. Then we can pay the other open invoices form the credit. For some reason, the client was prohibited from entering a payment larger than $200 per invoice payment. The client didn't want to pay 15+ invoices that way, so we sent a payment link equal to the balance due. This automatically becomes a sales receipt on their account for that amount. Client paid with a card at their business location.

Now the issue becomes how to apply the sales receipt money to the open invoices, as the sales receipt does not create a credit on the account, which one would think it should. The sales receipt payment has been deposited but can be reversed, if needed, as it hasn't bene reconciled.

Anything that seems like would be the correct option, doesn't exist or can't be found. HELP!

Solved! Go to Solution.

Hi there, @CyberSpyder. I got here some clarifications so you can manage your client's payments in QuickBooks Online (QBO).

For your first question, yes, you can cancel/void the deposit in order to cancel/void the created sales receipt if this is deposited under the Undeposited Funds account. No, if the sales receipt is directly deposited to the bank account.

Regarding your second concern, no, the canceled/voided sales receipt will not become a credit to the client's account (since the whole transaction with the amount is already deleted). You can manually create a credit memo to add the amount as a credit to your client's account instead. Here's how:

For additional reference in managing your customer payments, check out this article: Take and process payments in QuickBooks Online with QuickBooks Payments.

It's also easy to locate those customers who have outstanding balances in QBO. To do so, you can run an Accounts Receivable Aging Summary report.

I'm just around the corner to provide additional help if you have other concerns processing your customer's payments. Have a good one, and stay safe.

I recognize your desire to convert Sales Receipts into invoice payments, Cyber. Let me provide more details on sending a payment link in QuickBooks Online and offer guidance on the most appropriate steps.

The feature for customers to make payments using the link and get credit on their account is only available in QuickBooks Desktop. In QBO, when you send a payment link to your customer, QuickBooks automatically generates a sales receipt if it's not the one from the invoice. The proper way to keep track of invoice payments in QBO is by using the Receive Payment functionality.

I recommend deleting the sales receipt and manually making payments to the invoice. Let me show you how:

To erase the sales receipt:

To receive payment:

Here's an article you can browse to learn more about how to record partial and/or multiple payments in QBO: Record invoice payments in QuickBooks Online. Kindly review the third and the last section for the detailed steps.

Furthermore, check this out in case you want to personalize your sales forms: Customize invoices, estimates, and sales receipts in QuickBooks Online.

Get back to this thread if you have additional questions about the process of how sales receipts and invoices work. I'll be around to back you up also about any QuickBooks-related concerns. Have a good one!

We appreciate your rrply. We've been QBO users for many years and understand the processes. We hope you understand why the Payment Link was used in this scenario, as it was explained. If the Payment Link is not a useable option in QBO, it shouldn't be available.

Anyways, will deleting the Payment Receipt automatically add the payment, made by the client with their card, to the client's account which can then be used for paying the invoices?

Since the Payment Receipt payment has been deposited, will that deposit need to be edited to remove the payment first since it will show up again for deposit as the invoices are paid from the Payment Receipt funds

?

I value your time posting here again to clarify some things, @CyberSpyder.

Though invoices and sales receipts are similar, their difference lies in issuance and utilization in your accounting. Not to worry, I'm willing to help you record the payment and link them to the invoices in QuickBooks Online.

An invoice payment link is a simple way to request a settlement from customers paying for goods and services. It automatically creates a Sales receipt as a record of a completed sale. That's why linking this to an invoice is unavailable.

Please know that deleting or voiding the sales receipt to avoid double posting will not automatically add the payment. Therefore, we need to receive payments manually on the invoices to mark them as paid.

Here's how:

Once done, open the invoice and click the Receive payment button. From there, tick the invoice and deposits. You can follow these screenshots as your reference:

For more ways of receiving customer payments, refer to this article: Record invoice payments in QuickBooks Online. It will walk you through documenting partial payments and grouping them into a single deposit.

I'm adding this guide to learn how to personalize invoices and other sales forms: Customize invoices, estimates, and sales receipts in QuickBooks Online.

If I can be of help while working with invoice payments, feel free to let me know by adding a comment below. I'd love to hear how it goes on your end. Have a great rest of your day.

Why can't anyone answer a question directly? That's why we really don't like QB support. As much as we need and request a simple answer, we have to ask multiple times for simple information.

Please try your best to answer these two questions with yes or no:

1) Do I need to cancel/void the deposit in order to cancel/void the created Sales Receipt? Yes or no.

2) If we cancel/void the automatically created Sales Receipt created from thefrom the Payment Link, will the paid funds be applied to the client's account as a credit? Yes or no.

Hi there, @CyberSpyder. I got here some clarifications so you can manage your client's payments in QuickBooks Online (QBO).

For your first question, yes, you can cancel/void the deposit in order to cancel/void the created sales receipt if this is deposited under the Undeposited Funds account. No, if the sales receipt is directly deposited to the bank account.

Regarding your second concern, no, the canceled/voided sales receipt will not become a credit to the client's account (since the whole transaction with the amount is already deleted). You can manually create a credit memo to add the amount as a credit to your client's account instead. Here's how:

For additional reference in managing your customer payments, check out this article: Take and process payments in QuickBooks Online with QuickBooks Payments.

It's also easy to locate those customers who have outstanding balances in QBO. To do so, you can run an Accounts Receivable Aging Summary report.

I'm just around the corner to provide additional help if you have other concerns processing your customer's payments. Have a good one, and stay safe.

Thanks @DivinaMercy_N for actually reading and understanding the question(s)/issue(s). It still amazes us that support has went so far downhill from what it used to be several years ago that we have to repeat a question/issue in multiples ways for anyone to understand.

As referenced above, if Payment Links are a bad idea and cause issues like this, they shouldn't be available in QBO. Or, at the very least, have warning with them about their usage and the results and problems that can be caused by them.

Hi,

What can I do if the sales receipt is deposited directly to the bank account? Would I be able to create a credit memo to apply payment the customers open invoices ?

Let me guide you in the right direction on how to handle your sales receipt and open invoices, kk74.

In QuickBooks Online (QBO, you can create an invoice to be paid later. While a sales receipt is used for real-time or immediate payments. Keeping both will double your income because they're the same sales transactions.

If you're trying to apply the sales receipt to open invoices, the option is currently unavailable. You'll have to delete the sales entry and create a credit memo so you can apply it to your open invoices.

To remove the transaction:

Next, let's proceed and add the credit memo. Here's how:

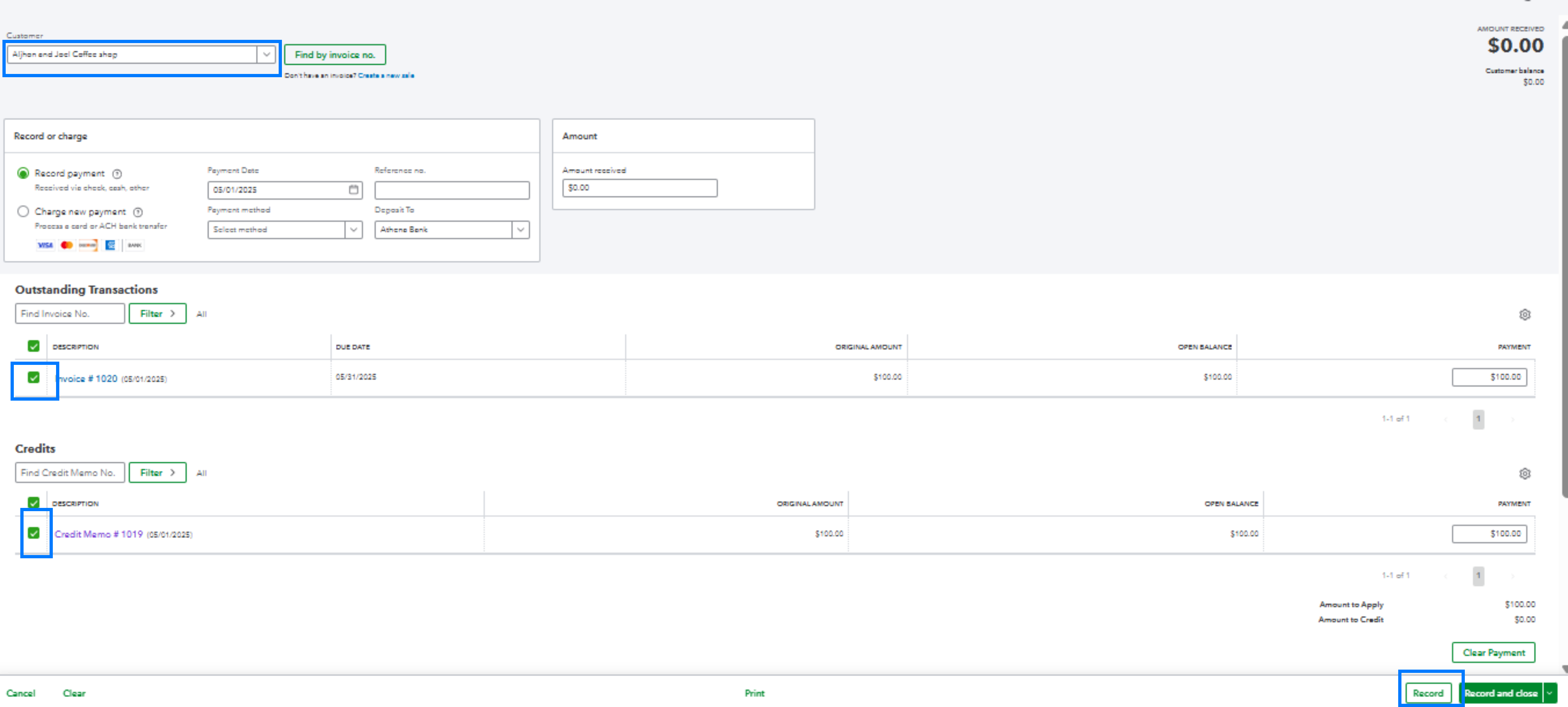

Now that we've added the transactions, let's proceed and apply it to your open invoices. Here's how:

You can go over these links for tips on when to provide credit to customers as well as use sales receipts:

We've also collated resources to guide users handle any customers and sales-related transactions or tasks:

Drop a comment below if you have additional questions about managing open invoices, applying credit memos, and sales receipts. The Community is always available to provide the assistance you need.

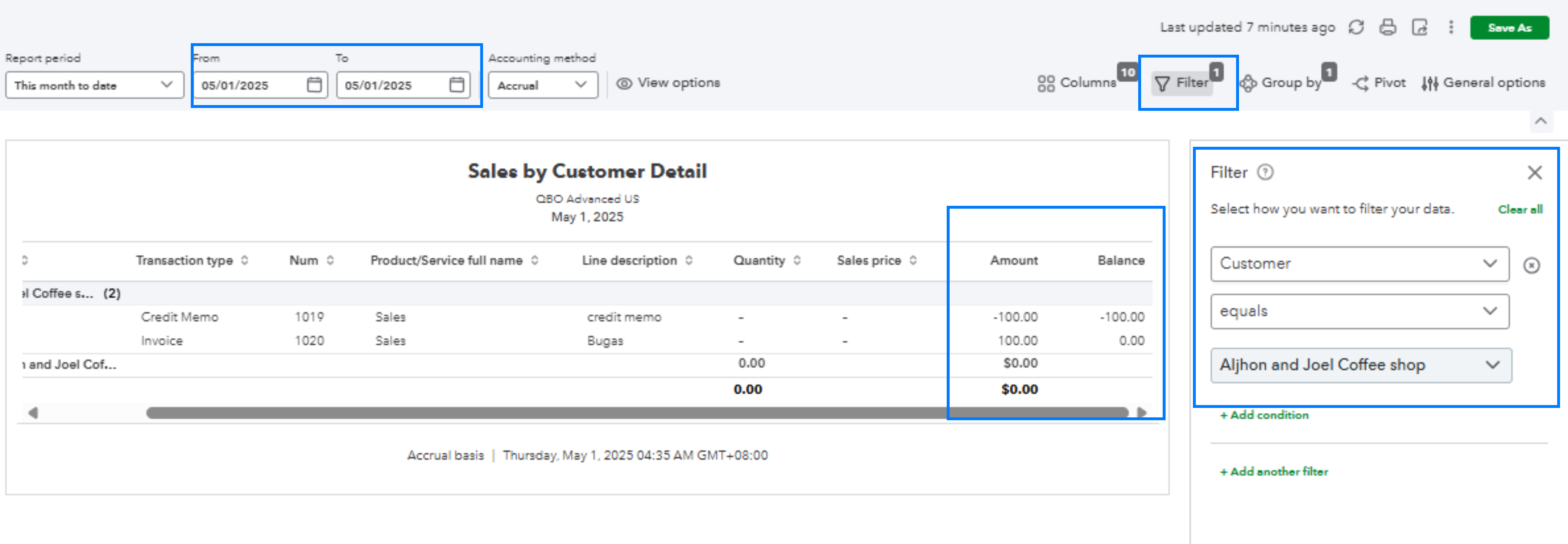

I followed the steps provided by Rasa-LilaM, and they seemed to work. However, I encountered a problem when creating a credit memo. While it does "release" the funds to allow them to be applied to the outstanding invoice, creating a credit memo also "subtracts" that amount from the overall monthly sales figure.

To illustrate with a real example: A customer invoice was issued for $100, but the original payment link was faulty. Therefore, I created a new payment link and sent it to the customer. The customer successfully made the payment using the second link. However, this resulted in duplicate income: an outstanding invoice for $100 and an autogenerated sales receipt for $100.

I followed Rasa-LilaM's solution: I deleted the sales receipt entry from the register, raised a credit memo to release the funds for application to the invoice, and then applied the credit to the invoice. Everything seemed fine, but now I have a credit of -$100 showing up on my sales report. I can use filters to exclude certain entries, but that isn't effective in all cases, as we sometimes have legitimate credits to report (for example, when a customer returns an item or we need to issue a refund). However, none of these scenarios apply to my customer. What do you suggest I do about this?

I followed Rasa-LilaM's steps, which initially worked, but I faced an issue creating a credit memo. While it releases funds for an outstanding invoice, it also subtracts that amount from the monthly sales figure.

For example, I issued a $100 customer invoice but had to create a new payment link after the first was faulty. The customer paid via the new link, resulting in duplicate income: an outstanding invoice and a generated sales receipt. Following Rasa-LilaM's solution, I deleted the sales receipt, created a credit memo to release the funds, and applied it to the invoice. However, now I see a -$100 credit on my sales report. I can use filters to exclude certain entries, but that isn't effective in all cases, as we sometimes have legitimate credits to report (for example, when a customer returns an item or we need to issue a refund). However, none of these scenarios apply to my customer. What do you suggest I do about this?

I appreciate you following the steps suggested by my colleague, amplate73. I'll explain why this happens so you can apply the credit memo to an invoice effectively without compromising the accuracy of your financial records.

Before we begin, may I know what specific sales report did you run? Any additional information is greatly appreciated as it will help provide the best solution.

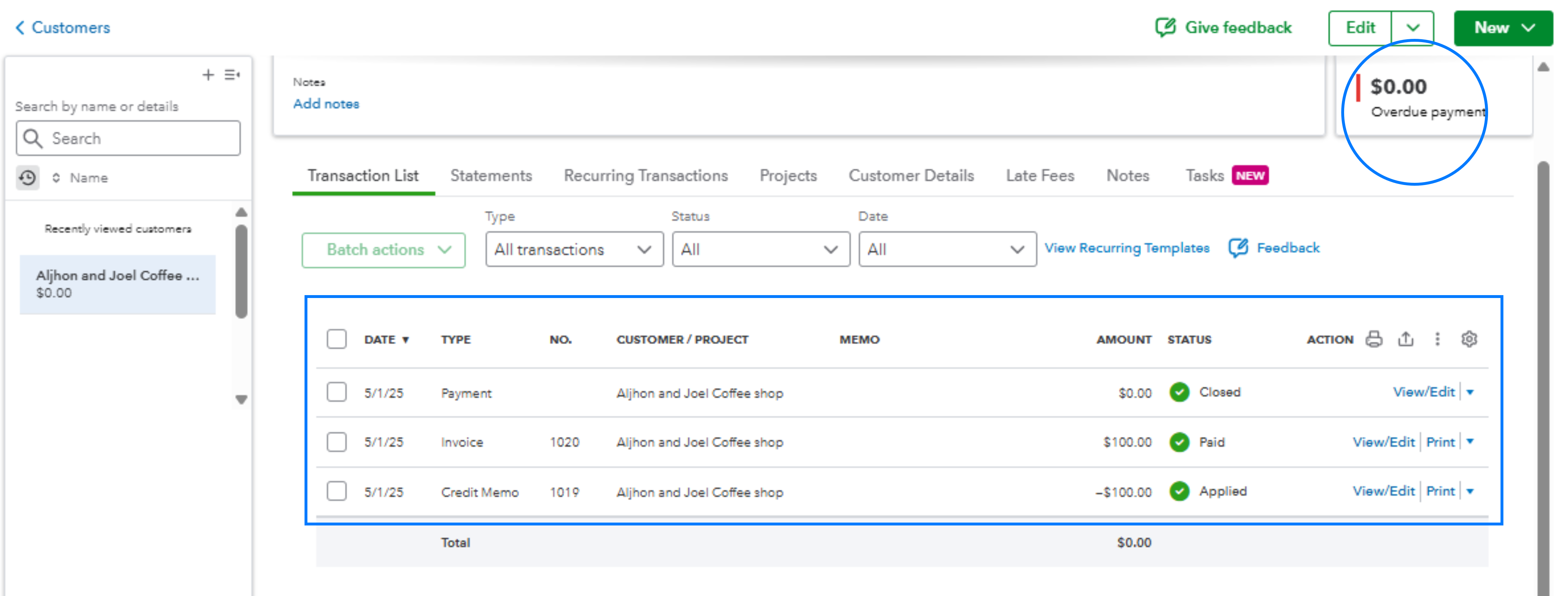

When we apply the credit memo to an open invoice, it will show a 0 balance when you go to the customer profile. However, it will still show as a negative figure (For example -$100) from your sales report since it is intended this way as a credit memo means to offset the invoice payment.

First , apply the credit memo to an invoice:

Then, go to the Customer profile:

Lastly, Run the specific sales report ( For example Sales by Customer Detail

Moreover, you can check this linked article on how to Create and apply credit memos or delayed credits in QuickBooks Online.

Additionally, consider saving this report customization for future use.

Furthermore, If you need assistance managing your books, consider scheduling a free consultation with our expert from QuickBooks Live Expert Assisted.

Should you need more detailed guidance managing your reports. Don't hesitate to reach out our support team. We're here to ensure you make the most out of your accounting software. Have a great day.

I follow all of that. Using the Customer Detail report, the issue is that the invoice date and the payment date are not in the same month. So for example, the March report shows that we sold $100 to customer ABC. But April shows that we credited customer ABC -$100 thus taking away from the overall April sales figure. So the payment is acting like a credit against the entire sales month. How do I fix this without having to use filters? Is there a journal entry I can apply?

Hey there, @amplate73.

Thanks for reaching back out on this thread and asking additional questions.

With all the details gave and other questions arising, I recommend contacting our Customer Support Team so they can review your account with you to see which direction would be best for your business to take to get this to report in QBO properly. Here's how:

Please keep us updated on how the call goes. We want to ensure that you get this taken care of as soon as possible.

Hey there, @amplate73.

Thanks for reaching back out on this thread and asking additional questions.

With all the details gave and other questions arising, I recommend contacting our Customer Support Team so they can review your account with you to see which direction would be best for your business to take to get this to report in QBO properly. Here's how:

Please keep us updated on how the call goes. We want to ensure that you get this taken care of as soon as possible.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here