Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen I write off small amount of customer invoice, do I need to choose discount/credit or I need to choose Minor ar /ap charge off under discount/credit

Solved! Go to Solution.

Greetings, @TERESA Guardian.]

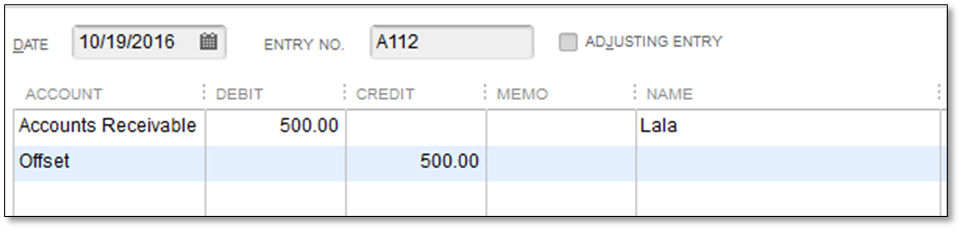

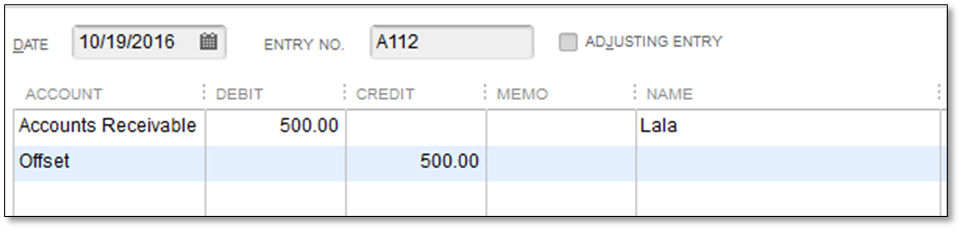

Deciding how to write off a small amount of customer invoice relies on your usual business process. You either create a Journal entry to write off the amount or apply discounts to remove small amounts.

Meanwhile, you can use discounts to write off small amounts. You'd want to make sure to create a Charge off Account and Charge-off item. You can follow these steps:

Create a Charge-off item:

Now, you can apply the discount. Here's how:

You can read through this article for more detailed steps: Write off customer and vendor balances

Additionally, you can run the Customer Balance Summary report in QuickBooks Desktop. This displays your customer's current balance.

Lastly, I'd recommend consulting an accountant so you'd be guided in accurately tracking your transactions.

I'm only a post away if you have any other questions. Wishing you continued business success now and in the future.

Greetings, @TERESA Guardian.]

Deciding how to write off a small amount of customer invoice relies on your usual business process. You either create a Journal entry to write off the amount or apply discounts to remove small amounts.

Meanwhile, you can use discounts to write off small amounts. You'd want to make sure to create a Charge off Account and Charge-off item. You can follow these steps:

Create a Charge-off item:

Now, you can apply the discount. Here's how:

You can read through this article for more detailed steps: Write off customer and vendor balances

Additionally, you can run the Customer Balance Summary report in QuickBooks Desktop. This displays your customer's current balance.

Lastly, I'd recommend consulting an accountant so you'd be guided in accurately tracking your transactions.

I'm only a post away if you have any other questions. Wishing you continued business success now and in the future.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here