Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello everyone,

I am having trouble locating and deleting a customer credit that should not exist in QB. Basically, every time I create a new invoice for this customer, a pop up shows up saying that the customer has a credit and asking whether it should be applied. However, no credit memo exists for this customer. So, it appears that QB thinks the customer has a credit, even though there is no credit memo.

The amount of the credits are very specific (i.e., $413.24 and $216.00), and I am able to locate the invoices and payments that have those amounts (i.e., the invoice was issued and the payments were received). They appear to be correctly recorded in QB as having been received and "paid," so I have no idea from where these duplicate payment credits are stored in QB. Furthermore, the bank account balance reconciles with QB, so I know there is no "double deposit" that would account for these credits.

So, questions:

(1) Any suggestions on how to isolate where these errant credits originate from, and

(2) Any suggestions on how I can just plain delete them so they don't keep existing in QB?

Thanks!

Solved! Go to Solution.

Hi there, @itsjoebwan. I'll help you locate the unwanted customer credits so you can delete them from your records.

As of now, you can run the Transaction List by Customer report to check all the customer credits recorded in your account. From there, you can see the transactions that need to be deleted. You can also see the invoices and payment transactions associated with your customers.

Here's how:

For more tips about handling your QBDT reports, open this article: Customize reports in QuickBooks Desktop.

Additionally, here's how you can get more resources about handling your accounts receivable workflows in QuickBooks: Get started with customer transaction workflows in QuickBooks Desktop.

If you have any other questions about your customer's existing credits, let me know by adding a comment below. It's my pleasure to help. Have a good one!

Hi there, @itsjoebwan. I'll help you locate the unwanted customer credits so you can delete them from your records.

As of now, you can run the Transaction List by Customer report to check all the customer credits recorded in your account. From there, you can see the transactions that need to be deleted. You can also see the invoices and payment transactions associated with your customers.

Here's how:

For more tips about handling your QBDT reports, open this article: Customize reports in QuickBooks Desktop.

Additionally, here's how you can get more resources about handling your accounts receivable workflows in QuickBooks: Get started with customer transaction workflows in QuickBooks Desktop.

If you have any other questions about your customer's existing credits, let me know by adding a comment below. It's my pleasure to help. Have a good one!

That did the trick! I was able to locate the payments that were not attributed to any specific invoice, thereby resulting in the "floating" credit that did not appear as a credit memo. Thank you!

Hello, mine are not duplicates, it is showing that some of my customer's have a credit, but I never put it in there. Can you tell me how to delete the credits. I tried to follow the instructions above, but that is not working for my situation.

Thank you.

Flower shop

Hello, that did not work for me. I have credits showing in some accounts that I never put there. When I go to put in their payment, it shows available credit. How can I just delete those credits?

Thanks

Hello, @elginsflowershop123! I'm pleased to guide you on how to clear customers' available credits.

You may have accidentally entered payments in excess of what are due. Not to worry, we can fix them in no time. You'll want to pull up the Customer Balance Detail report to locate these overpayments.

Here's how:

If your customers overpaid you in reality, you can use the credit toward an invoice, refund the customer, or enter the overpayment as a tip.

Keep in touch with me here should you need any further help with handling customer credits. I'm always available to help.

This does not work

I've got some steps to remove customers credits from an invoice or bill in QBDT, @Orsefski Painting.

If you're trying to remove a credit from an invoice, here's how:

However, if it's a credit from a bill, here's how:

For more insights, check out this article to guide you with removing credit from an invoice or bill.

Come again if you have another concern. We're always around to help you.

hi.. need to delete unused credits when there is no credit memo and there are no unused credits for the customer.

Also for overpayment too... also not real for the customer

Have looked at previous replys but did not work for me.

Hello there, @eawarner1.

First off, I'd like to appreciate you for taking the time to read and follow the steps provided in the thread. No worries, I'm here to chime into this conversation to assist you further in deleting or correcting unused credits and overpayments.

Before I start, would you mind if I ask what product are you currently using? This is for me to provide you with an accurate solution appropriate to your product since the steps are both from QuickBooks Online (QBO) and QuickBooks Desktop (QBDT).

However, I don't want you to go empty-handed so I'm going to provide you on how we can rectify this issue. Since you mentioned that there were no credit memos and unused credits for the customer, let's run the Invoices and Receive Payments report in QBO to check for any incorrect payments and we can then correct the payment there, instead of deleting it.

Here's how:

In QBDT, you can consider running the Payments and the Invoices and Deposits they are linked to. Here's how:

For more tips about handling your QBDT reports specifically in personalizing their appearance, open this article: Customize reports in QuickBooks Desktop.

If you need additional assistance with regard to managing payments and customer credits, please feel free to notify me by adding a comment below. I'm more than happy to help. Take care.

did not work for me. No credit memos

Hello, eawarner1.

I appreciate for following the steps provided by my colleague. Since it didn't work for you. I suggest reaching out to our customer support team.

This way, one of our agents will be able to pull up your account and help determine why you are unable to view the credit memos.

Here's how to reach them:

Please know that the availability of support depends on which type of subscription you're using. You can check out this article for our contact information. Click on the QuickBooks Online drop-down to see the most updated support schedule: Support hours and types.

I appreciate your patience on this matter. I'm only a few clicks away if you need assistance with your other QuickBooks tasks. It's always my pleasure to help you out again.

I did this and it shows the correct credit amount for this customer credit that was later used. However in the box below that says credit balance it shows a huge amount that should not be there and doesnt show anywhere that i can find. what now?

Thanks for getting involved with this thread, plaubacker.

I'd initially recommend running your Transaction List by Customer report and checking each of your customer credits recorded in their accounts. From here, you can review which transactions. This can help you to look over your records and identify what may need to be deleted.

Here's how:

If you aren't able to see any records that need to be deleted after reviewing your Transaction List by Customer report, you'll want to get in touch with our Customer Care team. Detailed steps for reaching them can be found in AileneA's post.

Please feel welcome to send a reply if there's any additional questions. Have a lovely Thursday!

I'm on QuickBooks online and this does not help me! One specific customer applies a $252 credit every month. Where is this located and how to I remove?? I don't know how it got there to begin with.

You can open a customer statement to find and remove the credit, @CCMT. I'd be delighted to walk you through the steps.

You'll want to create an Open item and Balance Forward the customer statement to find the $252 your customer credits monthly. Here's how:

Once done, you can navigate to the Statements tab. View the statement you've created to identify the transaction causing the credit. Take note of it, then Void or Delete if it was mistakenly created.

Additionally, you may to turn off the automatically apply credits feature, giving you the option to decide when to apply the credits for your customers moving forward.

Furthermore, there are several financial reports you can run to track your sales income in QuickBooks. These reports provide helpful insights on the items you buy and sell, as well as the status of your inventory.

Please let us know if you have any other questions about handling your customer's credits or other QBO-related tasks. Keep safe always.

I'm on quickbooks desktop and I could not do the balance forward on the statement; I've run the balance detail report; the transaction report; The credit is not found; When I go to receive a payment for the customer it shows there on their account that they have this credit;

An invoice was deleted AFTER payment was received and then re-created and then re received the payment; The first payment was NEVER deleted and a second one was received; now the customer shows a credit.

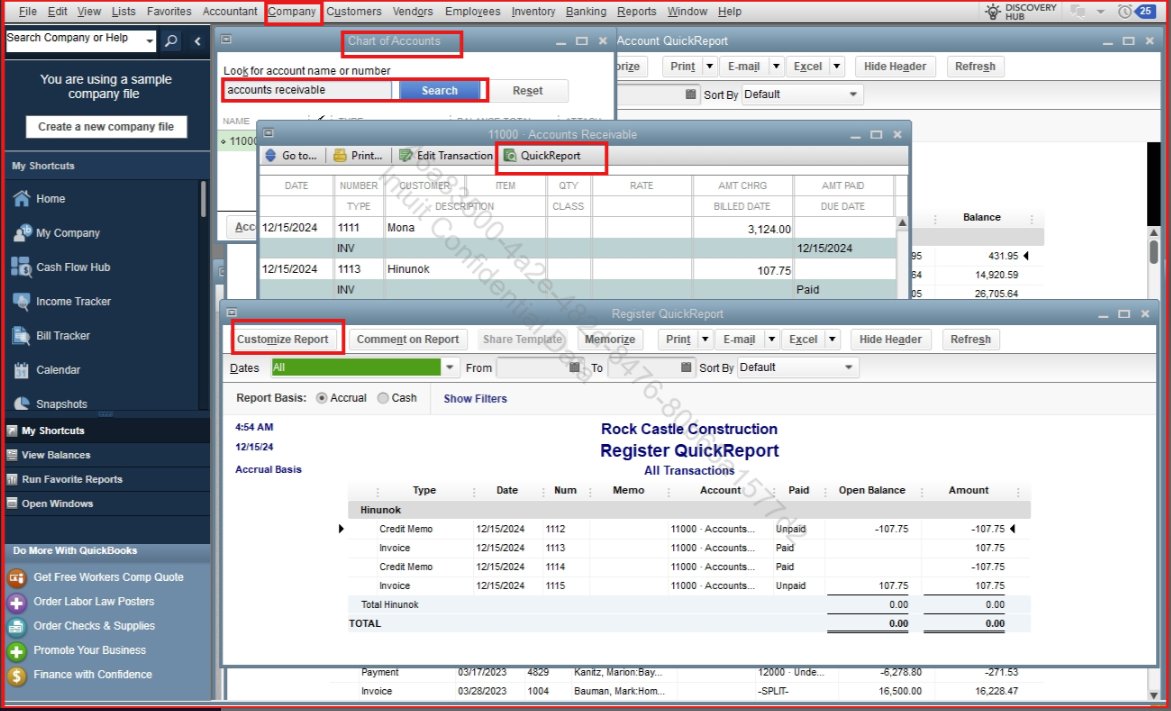

To find the credit, open the Account QuickReport in the Chart of Accounts and filter by Accounts Receivable, Dianem1.

Here's how:

Note that invoices will appear in the report due to the open paid status filter, but you can see unapplied credits listed as negative amounts.

On the other hand, a quick way to locate the credits of your customer. Here's how:

Please feel free to reach out if you have any further questions regarding how to locate credits or any other concerns by leaving a reply. We'll be sure to get back to you.

I really appreciate the reply; I did see it in the customer information unapplied payments and credits; It is showing as a payment; How would I get rid of it? Delete was not an option;

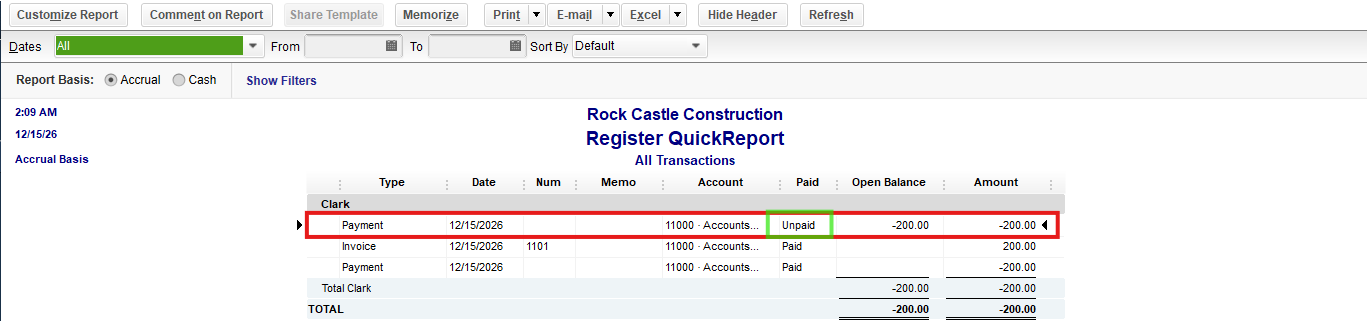

It’s great to see that my peer’s recommendation helped you view the payments recorded for a customer, @dianem1. To resolve the unapplied credit showing as a payment, identify the transaction marked as Unpaid in the Accounts Receivable QuickReport. Then, double-click the payment transaction to delete it as it was recorded incorrectly.

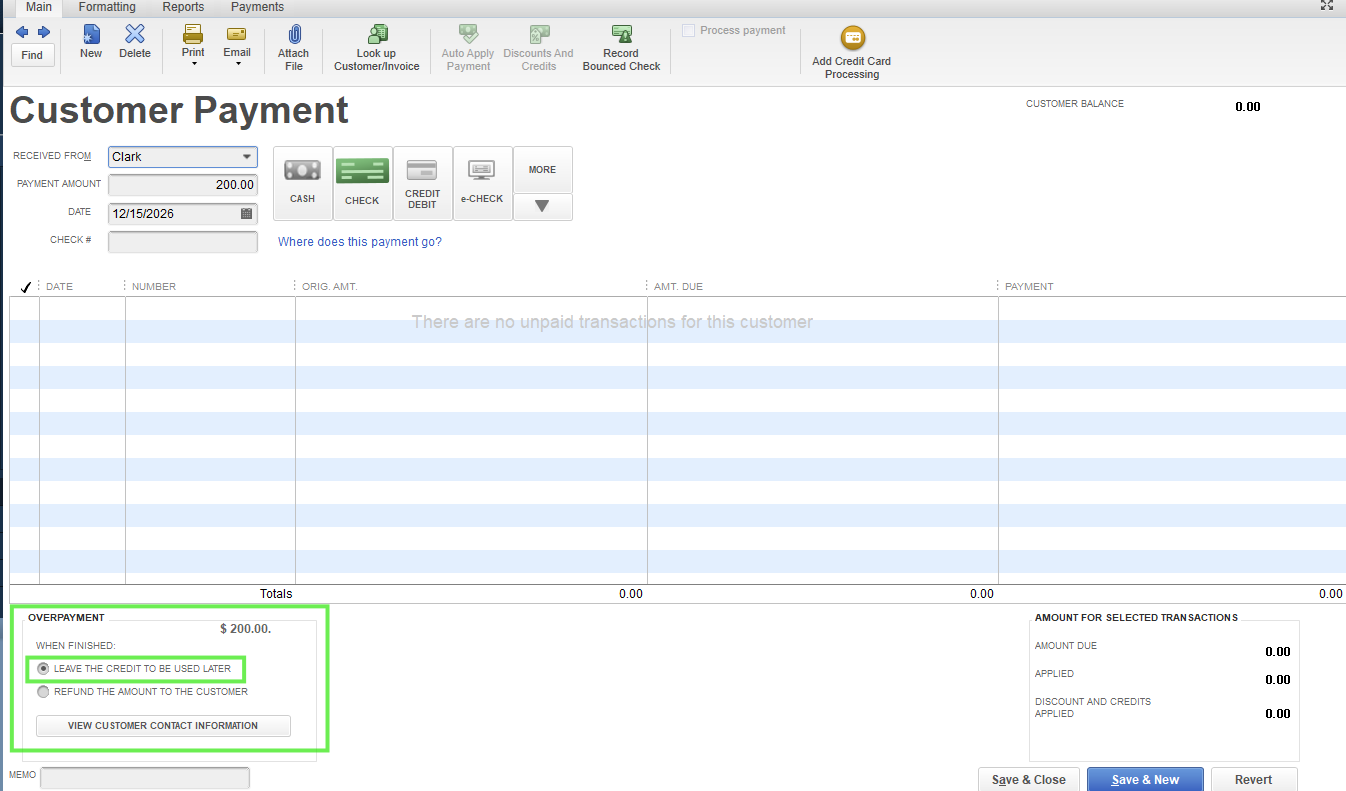

When reviewing the transaction in the Customer Payment window, it will appear as an overpayment left to be used later. You can refer to the screenshot below for guidance, along with the video I’ve added as a visual reference to help you delete the payment.

Keep in mind that deleting unapplied payment transactions can involve multiple steps, especially if you’re using Accounts Receivable to track invoices and payments. To simplify this process in the future, you can use the Customer Balance Detail Report to pull up all customer transactions within a specific period. This report displays relevant entries, making it easier to identify and delete payment transactions that show as customer credits or overpayments.

From the report, click on a payment transaction to verify whether the payment has been applied to an invoice or left as a credit to be used later. Payments recorded incorrectly and left as credits—sometimes appearing as phantom credits when creating invoices—will show up as overpayments. These transactions can be deleted to ensure your records are accurate, as illustrated in the video above.

Feel free to leave a comment if you need additional assistance or tips for navigating QuickBooks tasks.

Hello

So again; thanks for the response and the video; In your video on your quick report it showed 2 payments and you could delete one On my report I still show only one payment and it says unpaid; but when I go to the invoice it is marked paid. I don't want to delete a 'paid' invoice; please advise

It's great that you followed my colleague's suggestion. However, there is a simpler way to delete the unapplied payment, Dianem1.

To delete the overpayment, first locate the unapplied transaction in the Customer Information window by checking if the OPEN BALANCE shows an amount. Then, double-click the transaction to open it. To confirm it isn’t linked to an invoice payment, use the SHOW dropdown menu to select Payments and Credits, and filter the date to match the invoice or payment date.

When you're in the Customer Payment window, you'll see the transaction listed as an overpayment available for future use. Look for the Delete option at the top of the screen to remove the credit.

This will ensure no unapplied credits remain. Please refer to the screenshot below for a visual guide.

Feel free to reply to this thread if you have any more questions.

In your response you said:

Then, double-click the transaction to open it. To confirm it isn’t linked to an invoice payment,

That's the problem. It IS linked to and invoice and that invoice is marked paid.

Thanks for confirming that the transactions aren't linked together,

dianem1.

As you mentioned in your original post, an invoice was deleted after a payment was received. It was then recreated, and a separate payment was recorded for the new invoice without deleting the original one.

This is why the invoice shows as paid even though the original payment isn't linked to it. To delete the original payment, open it and click the Delete button. If you don't see the button, press Ctrl + D on your keyboard, and then choose OK.

Please continue to reply to us if you need more help from us.

I appreciate the communication; I want to make sure I am clear in explaining my situation

I feel I should see two payments for the amount of that invoice; The invoice amount is 1093.58 and the payment is same 1093.58; That is the only payment for that amount in our system; There is not a second payment.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here