Hello there, Jason. QuickBooks Desktop offers a feature that allows you to calculate late fees on unpaid invoices that have gone beyond the grace period. Since you want these charges added to the customer's next monthly invoice, we can create a service item manually. I'll outline the steps to achieve this.

The feature that calculates late fees on unpaid invoices is called "Assess Finance Charge." This functionality determines charges based on the number of days the payment is overdue, the outstanding balance, and the designated interest rate.

Although there isn't an automatic option to put late fees on the next invoice, we can create a service item for the charges and manually add it as a workaround.

Here are the steps to follow:

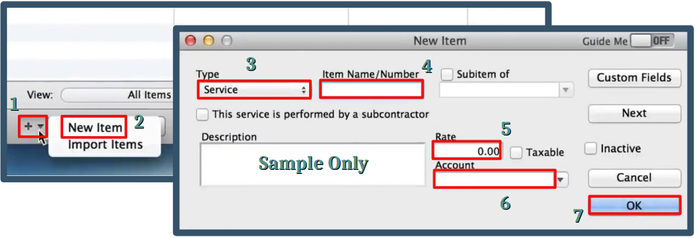

- Go to Lists, then select Items.

- Select Item, then +.

- Click New Item and choose Service on the Type dropdown.

- Enter the rate you charge to your customers. It can be a flat fee or an hourly rate.

- Complete all the necessary fields.

- Hit OK.

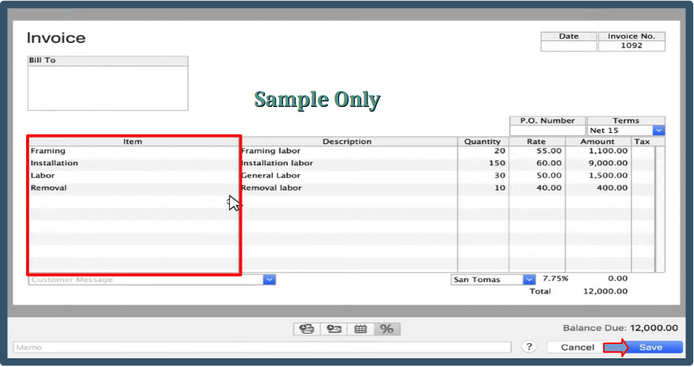

Once done, add the late fee as an additional item on your invoice:

- Head to the Customers menu, then select Create Invoices.

- From the Item dropdown, pick the fee you created.

- Complete the necessary details, then Save.

For future reference, if you have received payment from one of your customers, you can record it in QuickBooks. It will mark your invoices as paid, ensuring that your financial records are up-to-date and accurate.

Following this workaround will streamline your invoicing process, Jason. If you have any further questions or if there's anything else I can assist you with as you work toward these goals, I'm here to back you up.