Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe just started using direct pay for materials purchases.

I'm glad to have you here, @mistyglsolar. To assign the vendor bills to a customer's dues, link an open or a new bill to your client's invoice, and make it billable. This way, the payment obligation will be on their end.

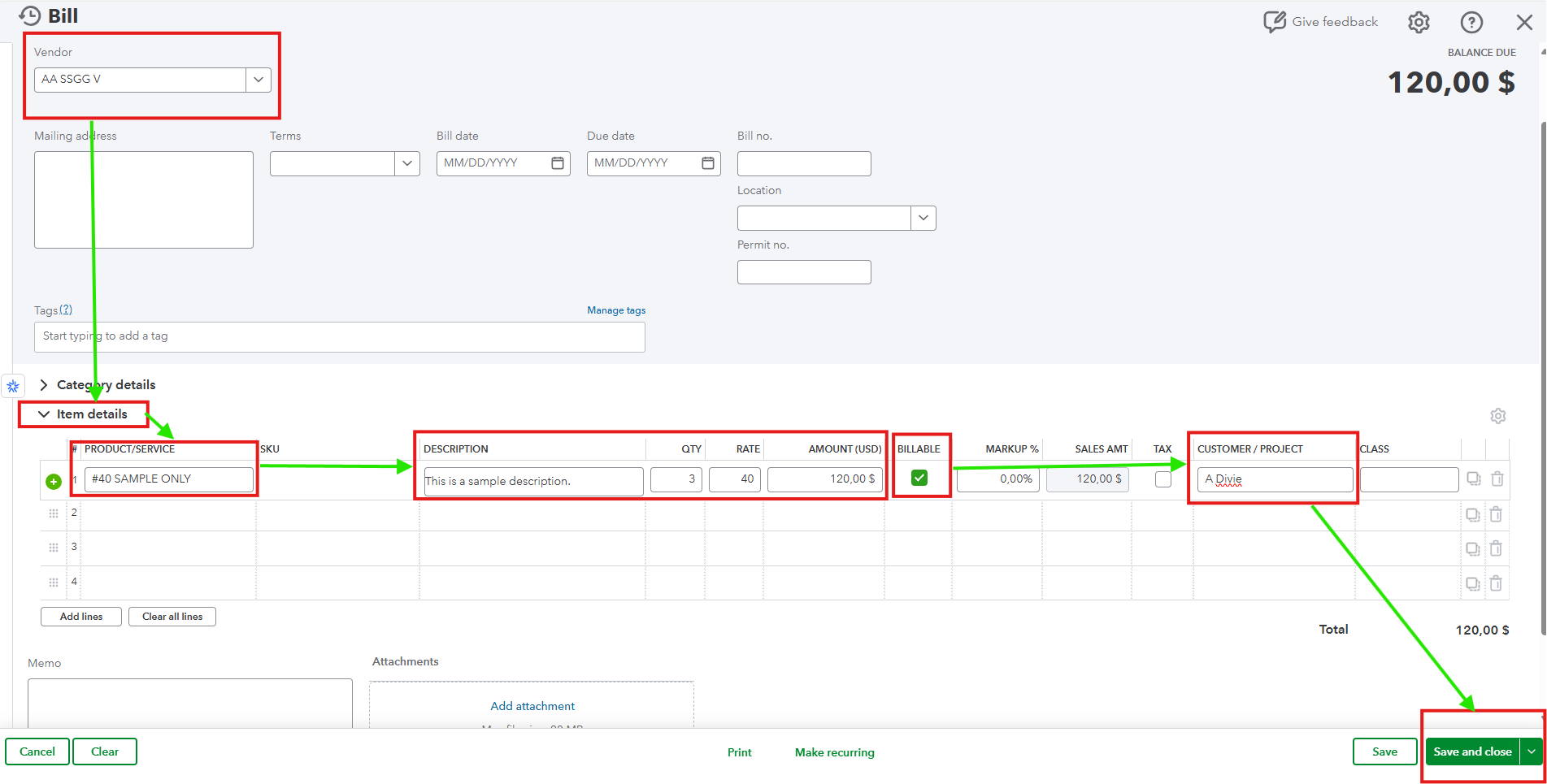

Start it by creating a bill transaction to your vendor that you will be linking to a customer. Here's how:

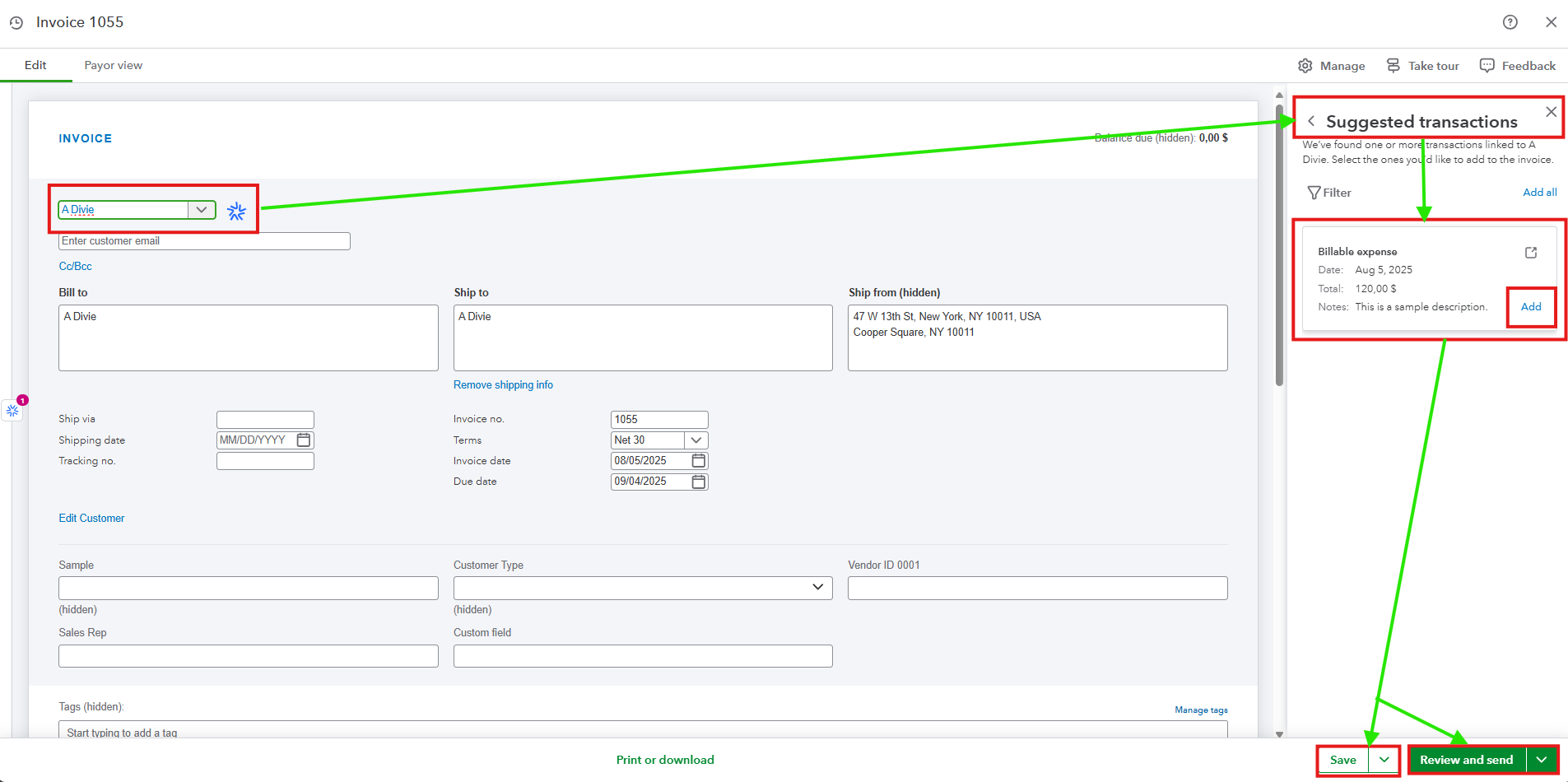

To finish this, create an invoice and add this as a billable expense. Feel free to follow these steps:

Once the customer has paid, receive the payment from the invoices tab, and pay the bill you create to balance the transaction.

Please keep us updated on the result of linking the bill to your customer, so we can assist you further and guide you in achieving your goal.

@Bryan_M - Yikes. Did you read and understand your customer's question? The customer paid a vendor bill. Your suggestion of entering a bill and marking it as billable makes no sense, since the customer has already paid the bill. The OP owes the customer; the customer doesn't owe the OP.

Create a journal entry for the amount of the vendor bill: debit A/P for the vendor and credit A/R for the customer that paid the bill. Then, go to Pay bills and apply the credit created by the journal entry to the vendor bill. At this point, the customer has an A/R credit equal to the vendor bill they paid. You can either: 1) apply the credit to one of their invoices, or 2) issue a check to the customer. If you issue a check, assign A/R to the check. To tie the check to the journal entry, go to Receive payment and apply the credit created by the journal entry to the "invoice" created by the check.

We tried that but no suggested transaction appear on our invoice when receiving the invoice payment so still trying to figure this out

Thank you the journal entry method worked

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here