Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

How do I fix a negative amount in a payables account?

I have a client paying sales taxes a couple times a year. They DO NOT track the 'payables' as they go. They just pay whatever taxes are due when the time comes, but they've been putting it to the 'sales tax payable' account, which results in a negative balance.

What do I need to do to fix this?

Thanks!

Hello there, @Ralphthefluffycat.

I can guide you on how to fix the negative amount on your payable account.

The negative amount will show on the sales tax liability once you make an overpayment in QuickBooks. As you make sales, the sales tax collected reduces that negative amount until it gets to zero. Then, it will start showing a positive amount.

If you want to clear the negative amount in the sales tax payable, you can enter a positive adjustment. You can check this article for detailed steps on how to adjust Sales Tax Liability in QuickBooks Online.

Also, I'd suggest consulting an accountant for specific suggestions on how to adjust the sales tax liability in QuickBooks.

For additional tips, while managing your transactions and sales taxes, you can as well open this article: Sales tax in QuickBooks Online.

I'm always here to help if you have any other questions. Just add a comment below. Wishing you a good one!

Hi, thanks for your reply. :)

They're not using the 'sales tax center' in QBO at all. Just assigning transactions to categories when they come through the bank feeds. How would I correct this without going through the 'taxes' application in QBO?

Thanks for getting back to this thread, @Ralphthefluffycat.

Let share with you some insights on why your sales tax payable' account shows a negative amount.

The reason behind this is that your clients categorize your downloaded tax payments in a liability account type. Doing this will show a negative balance on it since they are no bills created to offset these payments. It's like creating a bill payment checks without having a bill.

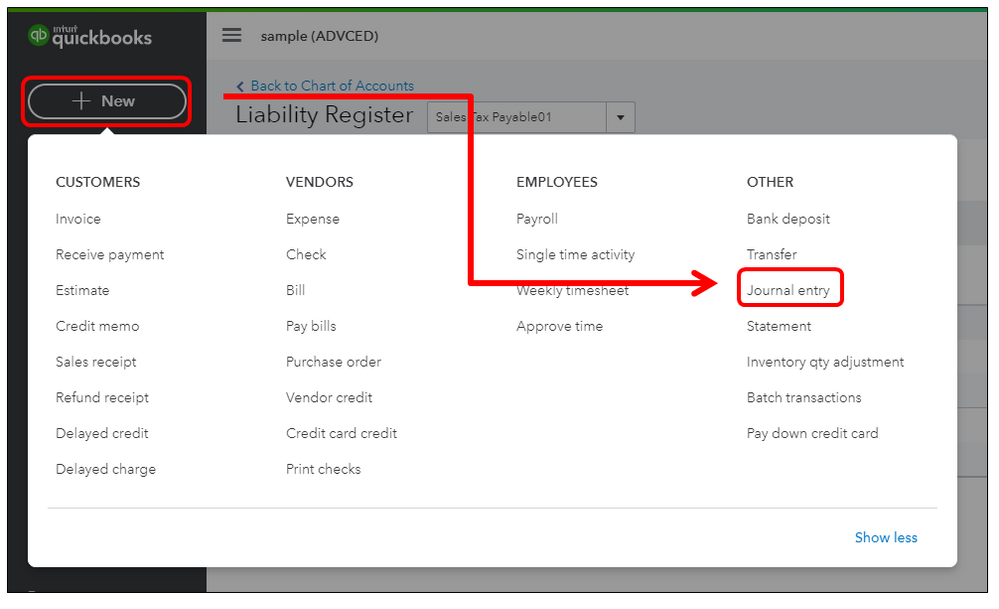

To correct this, you have to create a journal entry to zero out the balance in the Sales Tax Payable account. Let me show you how:

You can also reach out to your accountant for further advice on what account you'll need to use in the second line.

In addition, you can run the Quick Report of your accounts in QuickBooks. This way, you can check transactions that affecting its balance. Just go to the Accounting menu and select Chart of Accounts. Look for the account and click the drop-down arrow beside the View register, then choose Run report.

Please let me know if there's anything else I can do to be of assistance. I'll be more than happy to help. Have a wonderful day, and stay safe.

Thanks so much for your reply. :) I thought perhaps something like this, but I wasn't sure.

Any advice on what the offsetting account should be? I'm not sure what the best option is.

Whoops, sorry for the double post. Didn't look like it went through the first time but I was mistaken. :)

Thanks for getting back to us, Ralphthefluffycat.

I highly suggest consulting your accountant for guidance on which account should be for offsetting the amount. This is to ensure the accuracy of your books. You can visit this site: https://quickbooks.intuit.com/find-an-accountant/ to help you find certified professionals in your area.

Check out these sales taxes related articles for additional guide and reference:

You can post anytime here if you have other questions about sales tax in QBO. I’m always here to help.

The admin won't answer for liability reasons. What I'm going to do is create an "Other Current Assets - Sales Tax Adjustments" account on the balance sheet and use it offset the adjustment in the "Other Current Liabilities - Sale Tax Payable" account.

Hello,

Did you ever get an answer as to which account to use to offset the tax liability? I am having the same problem.

Did you ever figure this out? I'm new to QB and having the same issue: negatives on my Sales Tax Payable accounts because we don't use QB to track tax, we just pay the bill.

When I attempt a journal entry, nothing changes.

Hi there, courtneymae99.

I appreciate you following the steps provided above by my colleagues. I suggest seeking help from your accountant to ensure you use the correct affecting account when creating J.E. to ensure it offsets the negative balance on your sales tax payable.

If you don't have an accountant yet, you can visit the website Find a Pro Advisor Accountant to locate one near your location who can help you with your business.

You can check out this article about adjusting sales tax in QuickBooks: How to Adjust Sales Tax Liability in QuickBooks Online. This article contains some insights about how to adjust or zero out the sales tax balance.

You can post a comment if you have additional questions about the negative in sales tax payable. I'll make sure to help you out. Enjoy the rest of the day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here