Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI've taken over bookkeeping for a non-profit and unfortunately there was no handover from the previous bookkeeper.

We have an annual fundraiser and it looks like in the past when money was raised a bank deposit was made and using the Add Funds to this deposit any money raised was added to a fundraising account. At the end of the fundraiser money was then transferred over to the students who had been most active in the fundraiser. The students are each setup as Members (customers) and invoiced for tuition etc (we are a music org).

I am struggling on how to do the transfer from the fundraising account to each individual member. I'm assuming a Journal entry and I can see the transaction in the Members account after the JE. But I'm missing a step to allow the money to be used as a credit against current for future invoices.

Help please !!!

Robert

Hello there, fr0gpil0t.

It's indeed essential to record money movement appropriately within the system to keep your record accurate. Hence, I'll share the steps you need to transfer funds as credit for future invoices.

In QuickBooks Online, you can create a journal entry to transfer funds from a fundraising account to individual members. Since you want to show it as credit, you can use the Account Receivable. However, if you're unfamiliar with the accounts to debit or credit, I recommend reaching an accountant for further guidance.

Here's how to create a journal entry:

After that, you can now apply this to future invoices. Please note that when receiving payment, include the journal entry when selecting the invoice.

Moreover, you might want to scan these resources to generate data and gather essential information from your finances for more effective Business planning:

Keep us posted in the Community if you have additional questions when creating journal entries to transfer funds and show them as credit or other related concerns in QuickBooks Online. We're just a round to help.

I think I have the JE entry correct. It is creating the credit memo in the member's account so I can apply this amount to an invoice where I'm struggling. Assuming I'm correct I need to create the credit memo.

Robert

Yes, fr0gpil0t. You have correctly entered a Journal Entry (JE) in QuickBooks Online (QBO). Allow me to provide additional details on handling this matter.

You don't need to make a credit memo since, as long as you complete a JE correctly, the system will be able to display the available credit for your customer, which can then be credited to their open invoice. Creating a credit memo will lead to duplicates.

All you have to do is create a receive payment in QBO, select the invoice and JE, and apply the available credits to the open invoice. I'll show you how:

For detailed information and processes about credit memos, check out this article: Create and apply credit memos or delayed credits in QuickBooks Online.

You'll want to personalize and add specific info to your sales forms. Refer to this article: Customize invoices, estimates, and sales receipts in QuickBooks Online.

Kindly get back if there's anything else you need to ask about journal entries and other invoice-related tasks. Hit the Reply button below. Have a good one.

I'm in the exact situation as the OP, I just have a questions a little earlier in the process. We are just starting our QBO account now and setting up all our accounts and students. We keep our student account money in a separate checking account and track balances for individual students. How do I handle the bank account setup in QBO while also setting up the credit balances in student (customer) accounts? Do I just enter the starting cash balance in the account as opening balance equity?

Thank you for participating in this discussion, Batonking. Your active engagement in this discussion is greatly appreciated. I'll jump into this conversation to provide you with the information you need so you can effectively set up your student's checking accounts.

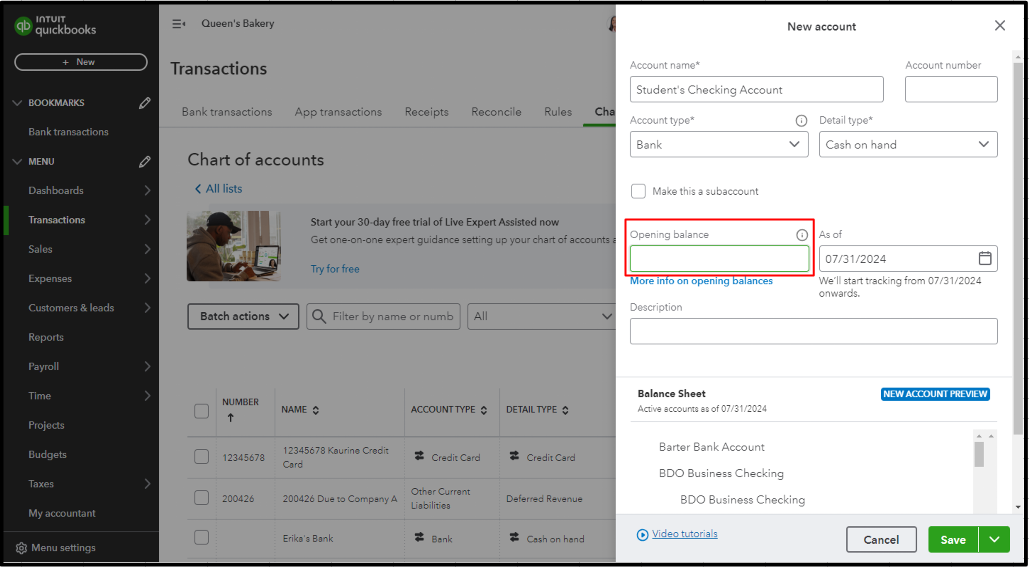

Yes, you'll need to enter the current cash balance in the Opening balance section when setting up your bank account in QBO. This step is crucial as it establishes a starting point for your financial records, ensuring that your QuickBooks data accurately reflects your real-world account balances from day one. I'll provide an image visually demonstrating this process, which should help clarify the steps involved.

Additionally, opening balances are limited to newly created accounts. If students have already been entered as customers, you'll need to use a journal entry to add the initial balance instead. You can check out this resource article to learn more: What to do if you didn't enter an opening balance in QuickBooks Online.

Finally, I recommend consulting an accountant or tax professional to provide further assistance. While this process seems straightforward, managing student funds can involve complex accounting practices. These professionals can offer you the guidance necessary to ensure you're tracking your student's funds accurately. They have the expertise to help ensure that you're not only setting up your QBO correctly but also adhering to all necessary financial and legal requirements.

As always, the QuickBooks Community forum is here to support you, Batonking. We're available 24/7 to address any questions or concerns you might have as you navigate through this process. Whether you need clarification on a specific QBO feature or troubleshooting assistance, don't hesitate to let us know in the comment section.

"How do I handle the bank account setup in QBO while also setting up the credit balances in student (customer) accounts? Do I just enter the starting cash balance in the account as opening balance equity?"

If you offset the initial checking account balance to OBE when you set up the account, you will need to move the credit balances out of OBE to A/R for each student (customer). To do that, make a journal entry that debits OBE and credits each student A/R account for their respective credit. Each student's credit will need it's own A/R line item on the journal entry. Alternatively, you can use a starting balance of $0 when you set up the bank account and then create a journal entry that debits (increases) the bank account and credits their A/R account. Either way works.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here