Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowCan i enter multiple payment methods (partial cash and credit) under one "Sales Receipt"?

Welcome to the Community space, @dilly120.

Currently, the option to record a single sales receipt with multiple payment methods is not available in QuickBooks Online.

As a workaround, you can create separate receipts for each payment method and include a description to clarify the transactions.

One sales Receipt for Cash and another one for Credit, deposit them both to Undeposited Funds then create a bank deposit and select the two sales receipts.

Furthermore, you can check this article for detailed information:

If you wish to learn about customizing invoices, estimates, and sales receipts in QuickBooks Online to help you personalize and add specific info to your sales forms, refer to this article.

I hope this helps! Feel free to stop by if you have more questions.

It's surprising that QB employees don't know how to do this. Creating multiple sales receipts is not a viable option

Create a service product(s) called Cash Payment or Check Payment, etc., and select your bank account or undeposited funds under 'Income account' depending on where you want the payment to post. Then, just add that product to your sales receipt as a negative amount based on the first payment method made by the customer. Then select the appropriate 'Payment method' and 'Deposit to' on the sales receipt for the second payment method and save it. You're all set.

Thanks for the reply. I couldn't have said it better!

To me it's such a basic option that it's hard to believe

it can't be done.....multiple receipts????

My subscription fee has more than doubled over the last

10 years but not the service. They are obviously focused

on large companies not sole proprietors like myself.

Time to move on!

To me it's such a basic option that it's hard to believe

it can't be done.....multiple receipts for one sale because

you can't enter two payment methods????

My subscription fee has more than doubled over the last

10 years but not the service. They are obviously focused

on large companies not sole proprietors like myself.

Time to move on!

Thank you!!! I have been doing entries to work around this but knew there had to be an easier way. We sell serialized units so creating a second sales receipt was not an option. I'm putting your solution into our process today!

Can you please help me? I have purchased materials and tools from a local big box store and I used I store credit for some of the payment and my credit card for the rest of the purchase. I know how to split the receipt but I can’t figure out how to record that I paid for some of it with instore credit and the rest with my credit card. Can this be done or is there a work around? Thank you.

Hello there, Frauendorfer. I'll guide you on how you can record your payments.

You can create a bill for the total amount of your purchased materials. Here's how:

Once done, create a vendor refund, this is the store credit you received. I've provided the steps below:

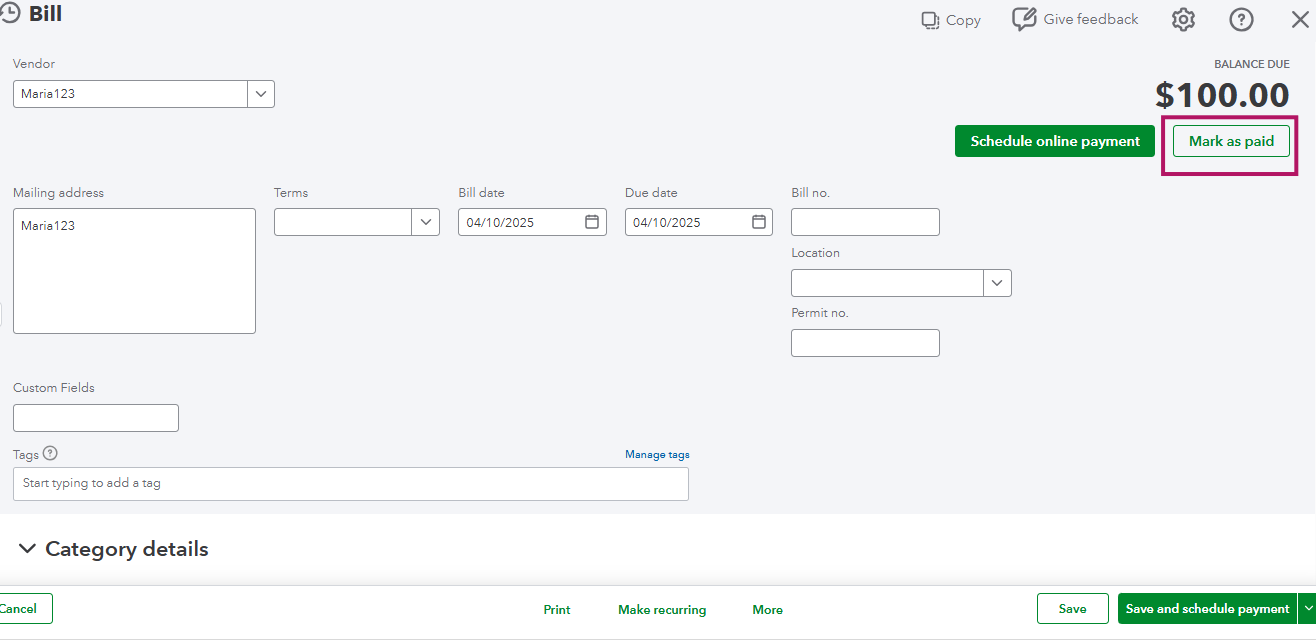

Then, open the bill, and click the Mark as paid option on the upper right.

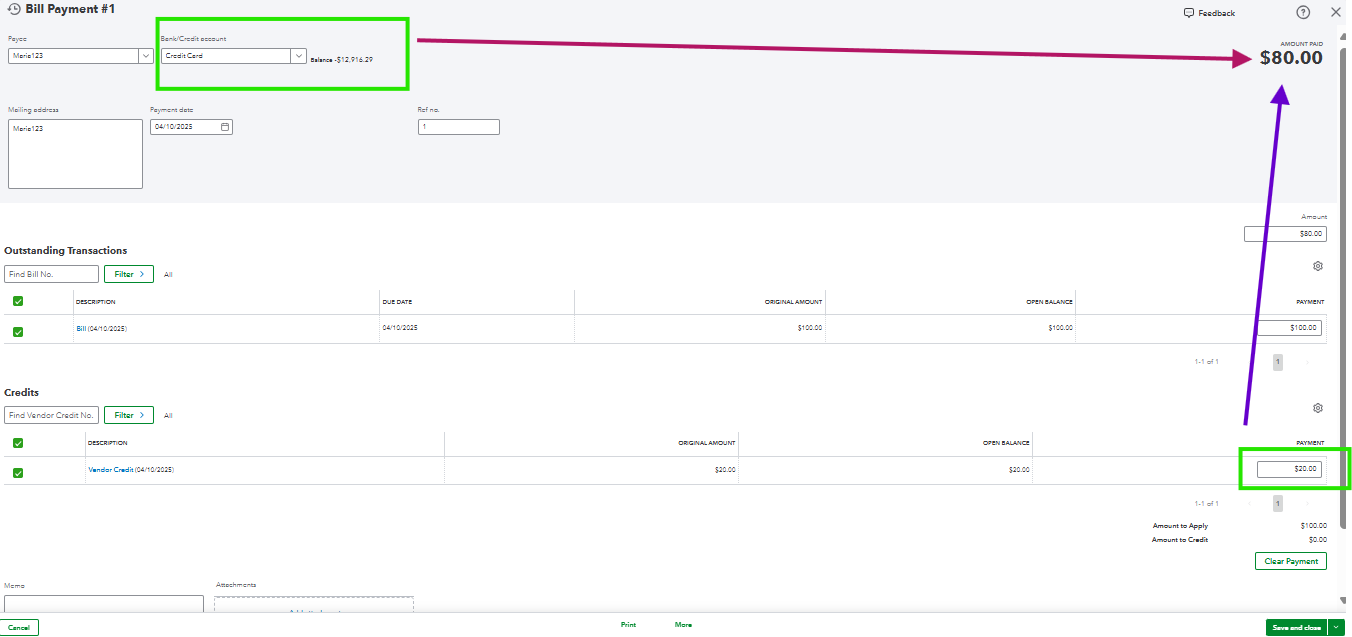

You'll see at the bottom part the Vendor credit (store) you created, make sure to check on it. At the same time, In the Bank/Credit account field, choose the credit card you want to pay for the remaining amount that will appear on the Amount Paid balance.

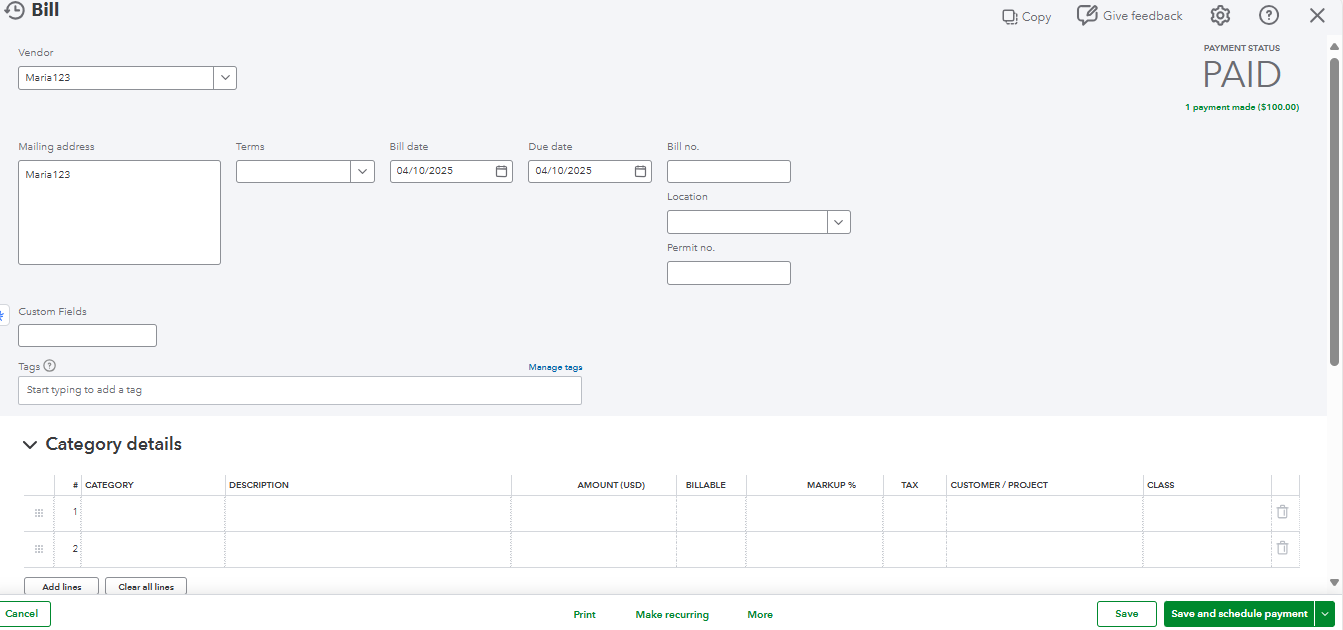

Once done, click Save and close. It will now show your bill being paid.

To give you different ways how you can enter a credit, check out this article: Enter Vendor Credits and Refunds in QuickBooks Online.

Additionally, QuickBooks provides different reports that will cater to your business needs. You can run the Transaction List by Vendor report and filter it to ensure you're getting the right data. To learn more, you might want to read this article: Customize Reports in QuickBooks Online.

If you need assistance in managing your customers or vendor transactions, check out QuickBooks Live Expert Assisted. These are our team of experts specialized in helping businesses and can help you assist with your bank transactions.

Please get back to us if you have any other concerns or questions when recording multiple payments. I'm always here making sure to help you anytime.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here