Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello everyone, thank you for reading this. I am using Quickbooks Premier Nonprofit Edition 2019.

We received payment on an outstanding invoice that was posted to Accounts Receivable. After receiving a check payment and depositing it to the bank, I accidentally posted this deposit under the "Make a Deposit" feature on Quickbooks instead of "Receive Payments" so still shows the balance as not received. Is there a way to correct this? Or a way to link the deposit to the accounts receivable and eliminate the balance? Thank you all!

Yes, there is an option to link the deposit to close the invoice, @izzyfa.

Since you've already created the deposit, it will automatically create a credit/deposit for your customer. If you want to link it to your customer's invoice, you can simply follow these steps:

In addition, you can run the Transaction List by Customer report in QuickBooks. This will show you the list of your transactions (income and expenses), grouped by customer. Just go to Reports and select Customers & Receivables. Then, click Transaction List by Customer.

The Community always has your back, so please let me know if you have more questions about receiving your customer payments.

Thank you so much for taking the write out a very detailed response. This transaction has already been reconciled. Will the reconciliation be affected if I apply credits afterwards?

Thank you @ReymondO !!

You’re most welcome, @izzyfa.

I’m glad that my colleague was able to resolve your concern. Allow me to address your follow up question by providing some details about it.

Bank reconciliations are like a fail-safe for making sure your accounts receivable never get out of control.

The resolution mentioned above won’t affect your reconciliation as long the amount and the date period of the transactions are the same. The process will make sure to clear the outstanding balance on your account receivable in order to have an accurate record in the system.

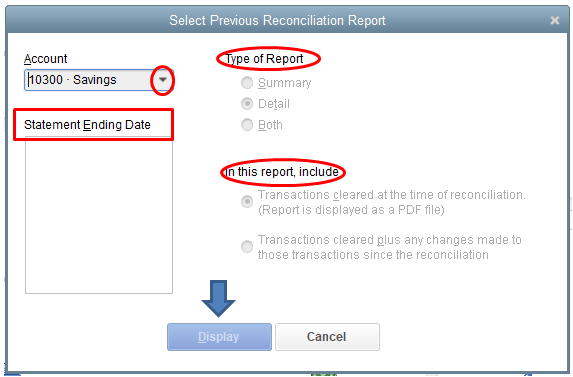

You can run a previous reconciliation report before and after applying the credits. This way, you can review and compare the details. Here’s how:

In case you want to generate customized reports in the future to easily track your transactions, you can visit this reference. I’m sure this can help monitor customer payments, invoices, and deposits.

We’re always here to assist you whenever you have concerns with QuickBooks. Just visit our page and leave us a message. Thanks.

Hello @MadelynC, thank you for the explanation. Just to reiterate, the accounts receivable transaction that I am referring to was posted on June 30th, 2020, but the deposit (invoice payment) was posted on 8/26/2020. The deposit contains multiple items including the invoice payment. If I apply these credits the reconciliation will be affected, correct?

Thank you for your help and I apologize if my question does not make sense. I will gladly clarify anything that doesn't make sense.

Thank you for the clarification, @izzyfa.

Yes, it might affect the reconciliation if that’s the case since it contains multiple items. However, as long as the amount and the date period are the same, the reconciliation remains intact.

You can also modify them. You can edit the deposit and add the account receivable as an additional line item then allocate the invoice payment to it. You can split the deposit this way so you can still include and categorize them as part of the events. Here’s how:

You can visit our QuickBooks help articles to get some ideas on how other users manage their records. You can select each topic to view them. I’m sure you’ll it helpful.

You're welcome to post on this page if you have other concerns. I’ll be happy to work with you again. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.