Hi there, Highly.

Since you've run payroll 15 days back, you'll need to adjust PTO balances at the end of the calendar year or before running the first payroll of the new year. This ensures that your employees have access to their updated PTO balances at the start of the new year when their carry-forward limit takes effect.

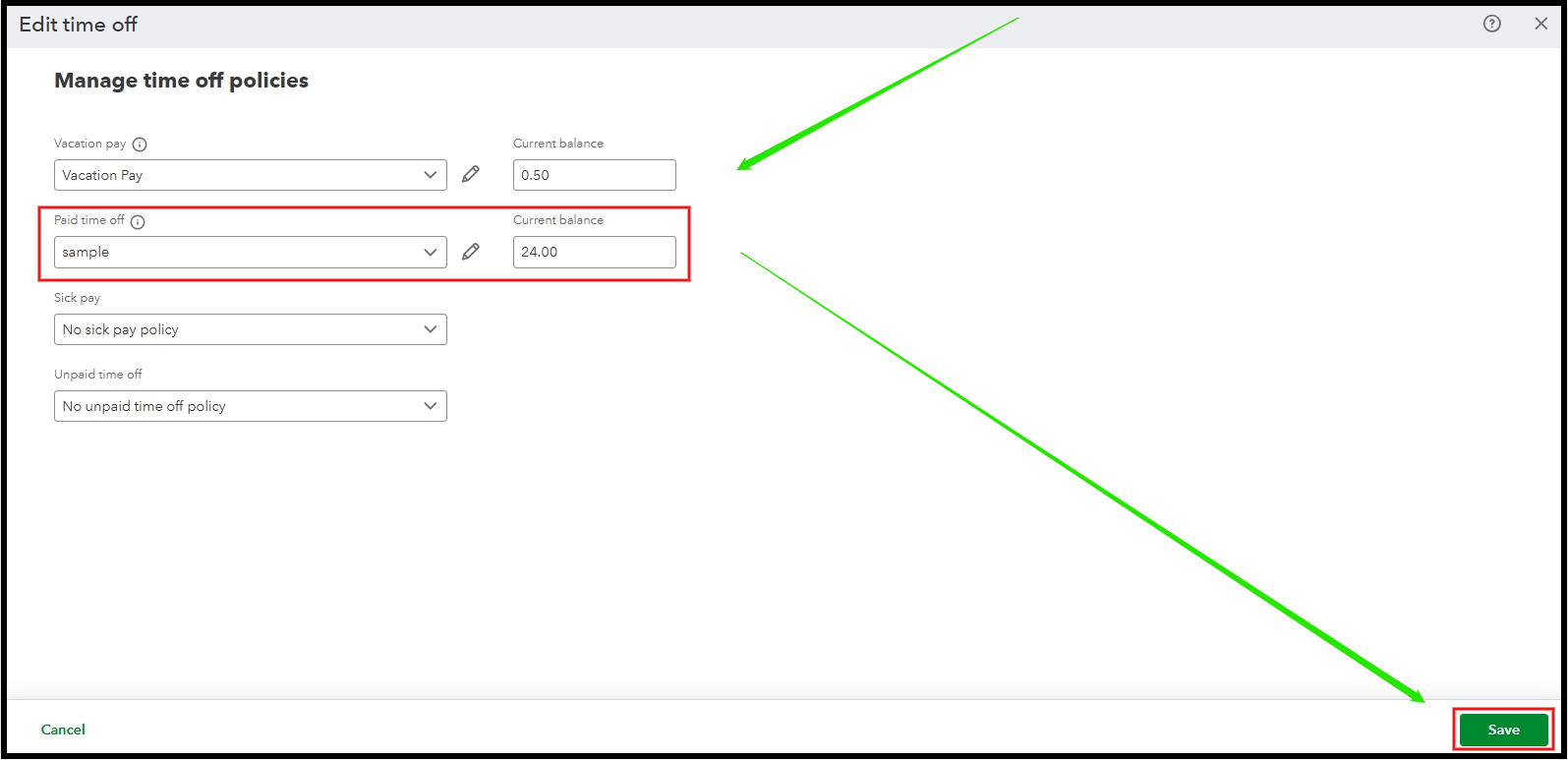

To adjust PTO in QuickBooks Online:

- Go to the All apps menu and click on Payroll.

- Select Employees, choose the employee, and edit their Time off policy.

- Add up to 24 hours to their PTO balance, following your company’s policy.

- Click Save to apply the changes.

If you have additional questions or concerns, feel free to leave a comment below.