Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI also have the same issue. The supplier issued a proforma invoice for KES 1,345,020, and we made the payments. When they sent the tax invoice, the amount was KES 1,318,120, and the negative balance was KES 26,900. As a result, the supplier refunded the amount directly to the bank account. Now, how should I record this operation in QBO?

Thanks for chiming in on this thread, @Khisrav. I appreciate you for providing in-depth details of your concern about documenting these transactions and the returned amount. I'm glad to share the steps on how you can track this properly in QuickBooks Online (QBO).

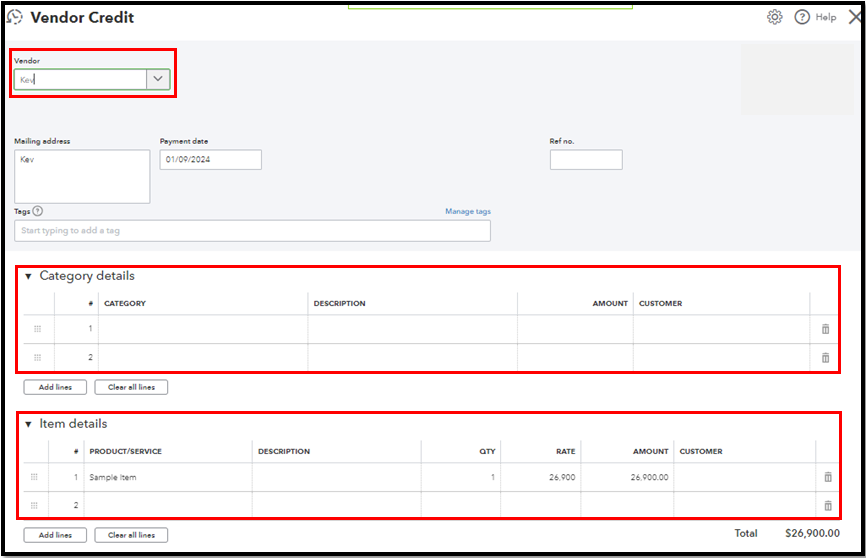

Since you have already paid the bill, we can record a supplier credit for the refunded amount. Then, create a bank deposit for the same amount that went back into your bank account. Here's how to create a supplier credit:

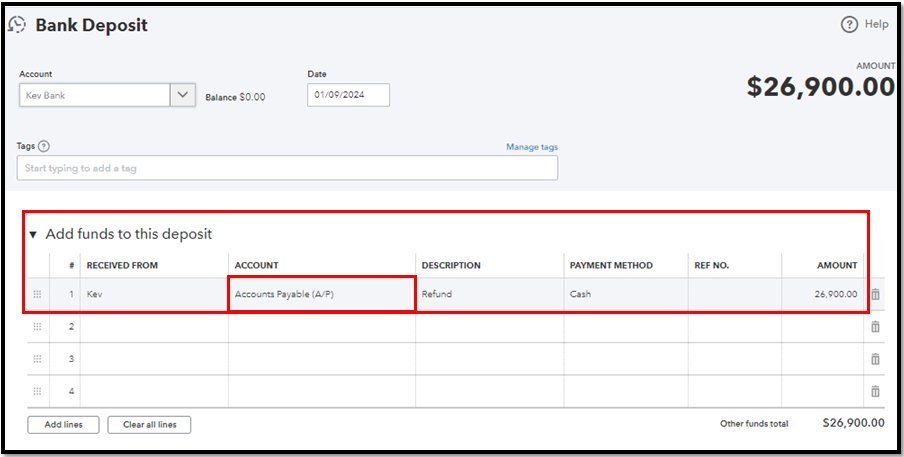

Once done, let's record a bank deposit and use Accounts Payable (A/P) to proceed with linking it to the supplier credit.

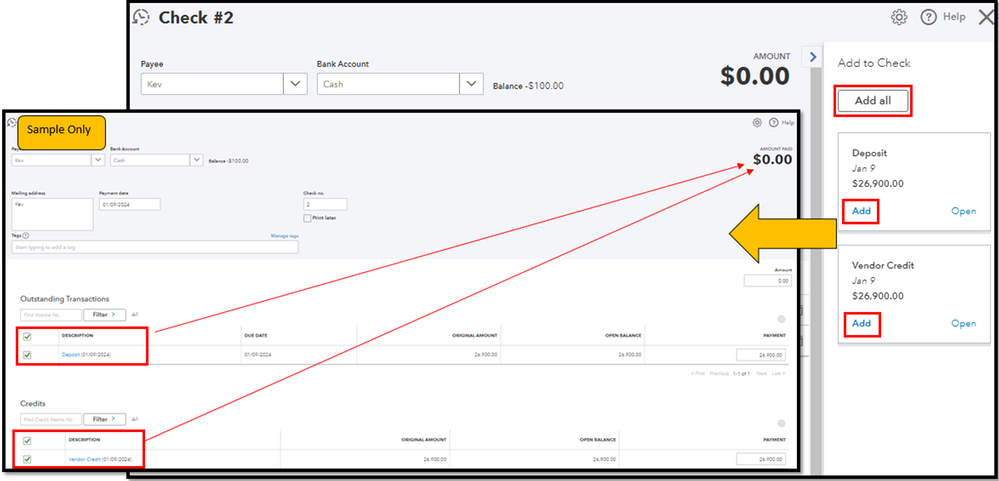

Lastly, use Cheque to connect the bank deposit to the supplier credit. Here's how:

For more details about the process, please refer to this article: Record a customer refund or supplier refund in QuickBooks Online.

Furthermore, if your bank is connected to QBO, make sure to match it to these entries when they show up in the For Review tab so they won't duplicate your transactions. Check out this article to learn more about doing it: Categorise and match online bank transactions in QuickBooks Online.

Our door is open 24/7 if you still need further assistance with recording a supplier refund transaction. Just post here again if you have any additional QuickBooks-related concerns. We'll be more than happy to have you here again, @Khisrav!

Thanks, @Kevin_C it worked perfectly, I appreciate

Thanks for getting back to the thread and adding a confirmation, @Khisrav.

I'm glad that the steps shared by my colleague Kevin_C work perfectly on your end.

If you have any additional concerns, please add your details to this thread and I'll help you out. Have a good one.

Using this senerio, what Payment Account should be used when doing the application of the Vendor Credit, if the vendor issued an credit note for and invoice that has not yet been paid.?

Welcome to the Community forum, Ruby6201. I'll be here to provide you with the necessary information, but first, I'll need to clarify a few things.

To start, may I know the specifics of your concern? Are you referring to selecting a Payment Account when recording a Vendor Credit? You can also provide all necessary screenshots for us to have a visual reference of your concern.

Any additional detailed information is greatly appreciated, as it will help me provide an accurate resolution.

Come back to this post with those details, and I'll be sure to offer support and assistance to you, Ruby6201. In the meantime, have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here