Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowOur team noticed that, recently, customer payments conducted through Quickbooks Payments were no longer automatically matching in our bank feed as they have done previously for years. Instead, they appear as a total batch amount and invoices must be manually matched. The only way we've been able to work around is to get an admin user profile to pull the batch deposit information from our QBO merchant portal. I've checked that automatic matching is enabled in our Bank feature and even gone through a live support call to try and diagnose the issue. The support rep instructed me to try and get payments processed before 3pm PST to ensure matching is done correctly. This seems like incorrect advice since banks process payments at their own discretion, we have no control over that. Is this a structural change to the normal process for automatically matching Quickbooks Payments? If this feature no longer works it would be helpful to know why so that we may reassess our usage of Quickbooks payments as this adds work to our typical AR application process.

I see how much effort you've put in, and I know this has been challenging for you, Alonzo.

Let me provide some information about the automatic matching for QuickBooks Payments. Once you've turned on this feature, it will automatically apply to all future transactions.

Meanwhile, please know that this feature is still working. On the other hand, sometimes QuickBooks won't automatically match the transactions if your bank does not give a unique ID for every deposit. I recommend contacting your bank to know if there are changes on their side.

In such cases, QuickBooks won't automatically match and will leave it for you to do it manually.

If no matches were visible, use the Find match feature to categorize them from the bank feeds:

Moreover, after categorizing and ensuring all transactions are matched, you can start reconciling your QuickBooks account. Doing this will ensure that all your financial records are maintained accurately and that differences or inconsistencies will resolved promptly.

Please know I'm still here, ready to provide additional assistance and information regarding the automatic matching feature. Just tap the reply button for your response.

Thank you for the reply and the information. I have researched the transaction detail in my online banking profile. In the line item detail from my bank I can confirm that each deposit is accompanied by a unique identifier in the "Bank Text" field (i.e INTUIT 18572675/DEPOSIT, INTUIT 12306195/DEPOSIT 524771993973513, INTUIT 16211095/DEPOSIT 524771993973513). This is confirmed to be consistent with prior deposits and the accompanying transaction data.

Is there somewhere else that you might recommend looking to verify this fact? From what is visible as a consumer, the only variable at this time seems to be the functionality of the matching feature.

I appreciate you for checking the unique ID, Alonzo M. I'm here to ensure this gets sorted out.

Normally, when the Automatic matching feature is turned on, it will apply to all transactions you create through QuickBooks products like QuickBooks Payments and QuickBooks Bill Pay.

Since the program stops matching your entries automatically, I suggest reviewing and comparing the transactions in your QuickBooks Payments account to your bank feeds. This way, we'll be able to verify if they both match.

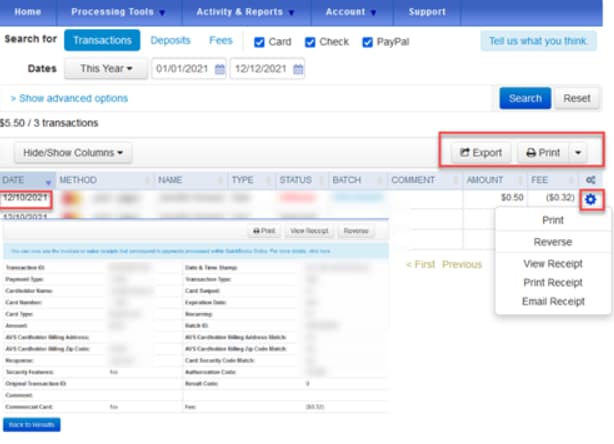

Here's how to view the deposits:

If they all match, I recommend reaching out to your financial institution to determine if they made any changes on their end.

You can also contact our Payments Support Team again. They're equipped with tools to check the cause. It'll also allow them to submit a ticket to our engineering team to alert them about the issue if necessary.

Keep us updated if you have additional concerns or questions about managing your sales transactions. This way, we'll be able to provide the help you need.

I have been dealing with the same issue. Over the past 3 weeks I have spoken to at least 6 QB customer service reps who have had no idea for a solution. They all seemed to think that you always have had to manually match feeds. It's been exhausting to tell them that they are incorrect. I just got off of a 3 hour phone session with them without resolution. This time the excuse was that multiple deposits no longer match because QB is afraid they will be inaccurate. Laughable when I clearly showed them the actual deposit page that showed that all transactions were already batched BY QB and the totals and the deposit ID were identical.

This feature is no longer working for everyone. I have the same issue. I have been on the phone multiple times with QB about this. I can clearly see the batches when you go to Sales > Deposits. The Batch ID's match the bank feed ID's and the Batch contains a statement that says "Nice! Your money is in the bank." I have to manually match them all now. This is not the case with Spent monies...they still automatically match.

I wish someone would fully investigate this issue. I spent time on the phone on 11/12 and the rep told me that there were multiple reports on this issue and that the engineering team was working on it and that they attached the investigation to our account. When I called today I was told that there was no investigation and no complaints and nothing attached to the case # on our account. This is creating a lot of manual labor for companies like mine that have multiple deposits in a Batch. I can not understand why QB is not explaining why this is occurring. I keep getting uninformed excuses.

Your feelings are valid, @gabrielle5.

I can see that you've been contacting our Support Team back and forth countless times for the same issue. Matching deposits to payments is critical for easier and faster tracking of transactions. I'll take note of your experience with our specialist.

We're escalating your case to our Next Level Help Team. They will review these with the Support Team to ensure your concerns are addressed. Rest assured that you'll be contacted by them within 1-2 business days.

We appreciate your patience as we work on this matter. Don't hesitate to come back here if anything else comes up. I'll be here to lend a hand.

I am having the same issue and received the same ridiculous QBO support answers. After 7 years of automatically matching deposits it suddenly stopped working about a month ago. They are telling me that it never matched! And other ridiculous solutions - I've spent many hours trying to get support for this and they say there is no known issue but obviously I see others having the same issues here!

Was there any resolution? I'm having the same issue and can't get any help on this!

I am a QBOA user and have several clients using the QB Payments feature. ALL of them are experiencing this same problem. Please advise!

Out of curiosity - seeing if there are any similarities... We use M&T Bank. Anyone else?

I have a call today at 2 pm EST scheduled with someone from the "Office of the President"...which I assume is an escalation team. I will post back on this chain after that call to advise on a resolution. If I have to spend hours re-explaining and being told the same ridiculously uninformed responses I may cry.

Great! Please let us know!

Trying to find any similarities of the issue that we are having. Is anyone else using M and T for banking?

So the QB engineers are aware of the problem. They are now calling it a 'product limitation' and it occurred during last months multiple updates. They do not know if they will revert back to a system where payments conducted through QB Payments will automatically match again but they will be discussing at their Friday's engineer meeting.

They advised to continually use your gear icon to submit your feedback about this issue and the more often you can do that the more often it will be in front of the engineers to know that it is a big inconvenience and they may revert back to the automated match in a more timely manner.

Not an ideal answer. You would think any reversal of an amenity that allowed for us to work more efficiently would be reconsidered quickly.

Thank you so much for this! I was sure it was on my end.

Thank you for the update. QBO does such a poor job of testing that it shouldn't surprise me they didn't see this error. This is a huge miss by them

Wells Fargo

I'm also having this issue. Unbelievable they wouldn't have this fixed by now. I have clicked on the gear icon to "submit feedback" about this. Hopefully something gets resolved quickly.

Still nothing and it's always our largest deposits that are not matching. This is exhausting when we have 3K transactions at a time. We are looking to move to a new platform because of this.

Ours are still not matching. And especially our large deposits. It's exhausting (especially when some of our deposits have 3,000+ transactions attached.) We are actively looking to move to a different platform simply because of this. It's sad they would prioritize other updates and overlook something that will continue to cause more complications for customers.

Hello there, @d_bird24. Thank you for joining us here in the thread, and we appreciate you for sharing detailed information on what you've done. Please know this isn't the kind of experience we'd like you to have here in QuickBooks. I'm here to provide the steps for contacting our support team in QuickBooks Online.

I can see the urgency of getting this resolved. However, the Community is a public forum, and the ability to review the account is unavailable. I'd recommend contacting our Merchant support team. One of our agents can take over and check why large deposits still can't be automatically matched.

Here'e how:

You can reach them through this link: Contact Payments or Point of Sale Support.

Additionally, I've got you these articles to help you manage payments in QuickBooks:

@d_bird24, If you need more help or have questions about handling your payments in QuickBooks Online, feel free to get in touch. I'm here and eager to assist you in maximizing your accounting experience. Your satisfaction is my main focus, and I'm dedicated to ensuring you succeed. Thank you for choosing QuickBooks Online, and I'm excited about the opportunity to support you further.

I’ve talked to them several times. Same answer over and over. “Sorry about that, you can go download the deposit list and do it manually”.

It doesn’t solve the issue, which is clearly a QBO Payments one. The issue being MOST deposits auto match and then randomly, some won’t. In my case it’s always the largest deposits that don’t match, causing a ton of unnecessary work for my teams.

The best solution is to move to a different payment platform and only use QB for accounting.

Hey @d_bird24, do you mind trying the following the instructions below and see if they help you?

Thank you! This was the problem for me.

Spent hours with tech support and no help.

I don't understand your last sentence - ".....should be the same as the CoA that customers get paid with in the banking page"

What are you talking about customers getting paid??

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here