Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello,

A customer handed us a check and on the same day, his accountant paid the open invoice online through the quickbooks invoice. We have already recorded the check as being deposited, but it has now bounced. Now we have a bounced check and an online payment for this invoice. How can I fix this?

Thanks for posting to the Community, @copperstatess.

There are a couple of ways to enter a bounced check. For paid online invoices, here's the right article to help you out: Record a returned or bounced check using an expense.

Another way to do this is to use a journal entry. Though, I'd recommend checking with an accountant first to help you with the accounts and ensure your books are balanced.

After recording the bounced check, do you need to categorize your bank transactions for your books? This article can help you with the process: Categorize and match online bank transactions in QuickBooks Online.

Do you need to record other transactions in QuickBooks? Please let me know, and I'll share other helpful guides and details. Always here to help.

Now I have the payment to Quickbooks Checking for the amount of the invoice, however it has been "applied" and I am still showing monies owed from the customer.

I'll share the steps to fix this, copperstatess.

Let's ensure that the bank deposit you receive from your customer is linked properly to an invoice. Before doing so, please unlink the payment first if it has already been applied to the invoice. Find the invoice, then click the 1 payment made link, and then delete the payment.

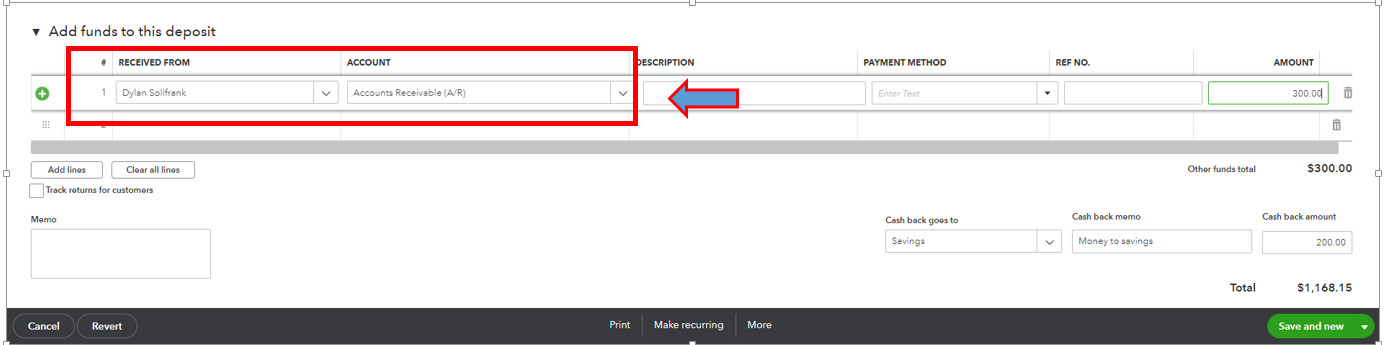

Then, proceed with the steps below to link the deposit to the invoice:

The deposit entry should then be used as an invoice payment.

Here's how:

For your reference, you can review this article for more details: How to link a bank deposit to an invoice.

I also recommend reconciling your account once a month to ensure that your QuickBooks balance matches your bank or credit card statement balance. Check out this resource to guide you through the process: Reconcile an account in QuickBooks Online.

We're always available to help you anytime, simply add any details below. We'll be right back to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here