Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe have implemented Class Tracking. When we invoice, we assign a class to that document, or we might assign various classes to each line, if different classes are appropriate.

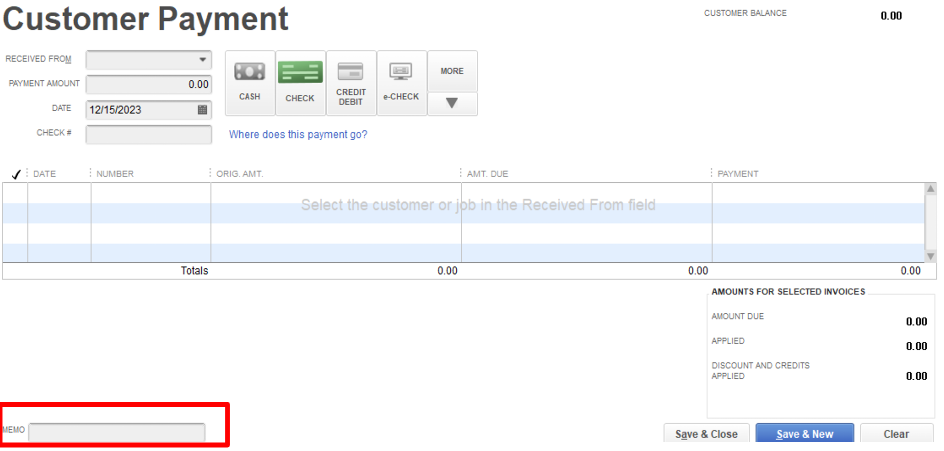

I've noticed that when we "Receive Payments" there is no field present to identify a class. However, when we go to the Deposit screen where we move the payment from undeposited funds into the appropriate bank account, there IS a field for Class.

Why is there a field on the Deposit screen but not on the Receive Payment screen? It would seem to me more appropriate on the Receive Payment, but perhaps I am missing something...??? Or is this just another puzzlement of the crack QuickBooks coding designers ???

Hey there, @Deadwood Al. Currently, the Class field is unavailable in the Receive Payments section in QuickBooks Desktop (QBDT). Moreover, this field is available in the Make Deposit screen to easily track balances by department or any meaningful breakdown of your business. Let me share more information below.

As a workaround, you can enter the class of that invoice payment in the Memo field so you can track it easily.

Also, you can assign the payment in the Undeposited Funds until you deposit them to the bank and link it to a specific class. Check out this article for more information: Deposit payments into the Undeposited Funds account in QuickBooks Desktop.

In the meantime, I recommend submitting direct feedback to our Product Development Team to further analyze this feature suggestion. Once they see that it improves the experience in QBDT when receiving payments, they can add this to our future product updates.

If you want to learn how to sort your bank transactions automatically, you can visit this article: Create rules to categorize transactions in QuickBooks Desktop.

Feel free to return here if you have additional questions about class tracking when receiving payments. We'll be willing to help you. Take care, and have a good day.

In my mind, the reason you can choose a class when making a deposit is because a deposit is a standalone transaction so you need to be able to assign a class to it, whereas receiving a payment is a function designed to link the payment to an invoice where the class is assigned. This would only be an issue if you received payment before issuing the invoice which I assume is what you're doing. Maybe it's a way to prevent users from assigning a class to the entire payment received and then spreading that credit across several invoices and/or line items on an invoice with different classes. I don't know how QB would handle reporting in that case. If you want to apply a class to a payment received, instead of using receive payment, you can create a journal entry that debits A/R and credits your bank account. But, again, not sure how QB would handle reporting in that case.

The question actually came up when I applied a payment to two separate invoices, each recorded to a different class. The payment didn't even offer a chance to associate the payment to a class, and the deposit only allowed associating to one class. I guess the solution would have been to record the payment as two separate transactions, each portion then associated with the proper class. This is just a variation on what happens if we get a check that is paying two (or more) separate accounts.

I am not a fan of using a JE to record things to a control account (AP, AR), and (so far) we haven't received a payment in advance of an invoice. If we did, I'd post it to the account as unapplied cash and then match that with the invoice when the invoice was done.

And in your description of why, if the Receive Payments is a function to link the payment to a specific invoice where a class was recorded ... or even multiple classes ... then why isn't the class assignment on the paid invoice carried forward to the deposit screen? As it is, the class assigned on the deposit screen may well be a different class (accidentally, assumed) than was on the invoice, it seems like a "broken link". It would make more sense to carry the class from the invoice forward to the payment and then deposit ....???? Or am I making some flaw in logic? (That has certainly happened in my lifetime!!!)

"The question actually came up when I applied a payment to two separate invoices, each recorded to a different class. The payment didn't even offer a chance to associate the payment to a class, and the deposit only allowed associating to one class."

If these aren't prepayments then why would you need to assign a class to a payment received or the deposit - you should have already assigned the class to the invoice(s)?

"then why isn't the class assignment on the paid invoice carried forward to the deposit screen?"

Again, because all class assigning was done on the invoice. What if you're making a deposit that includes payment on multiple invoices containing multiple classes and from multiple customers? If you could assign another class to the deposit, that would create conflicting data. As it is, assigning it to each invoice is sufficient. Also, if you could change the class on a payment received, then you would have conflicting classes based on accrual vs. cash reports.

Thanks for the food for thought.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here