Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe receive payments from a vendor which includes credit card commissions, bonuses and maintenance payments for our customers. The customers maintenance fees are withdrawn by the credit card vendor for us.

I need to pay sales tax on the maintenance and the commissions and bonuses are other income. I want to track the all the activity by customer so we can see the profit we make from each customer. Currently we do not invoice the maintenance contracts as I have not been able to figure out how to apply the payment from this vendor to a customer's invoice. The vendor pays us monthly. Can someone offer a fairly simple approach on how to do this. I have thought of a couple of workarounds but it would be a chore to post this each month. Any ideas are welcome.

Thank you in advance for your response.

Solved! Go to Solution.

Not to worry, @KeithOakley. I'm determined to ensure you can apply vendor credit to customer's invoices.

The best way to handle this in QuickBooks Desktop is to use a clearing account to help transfer or apply a vendor credit to customer's invoices. I'll guide you how.

Then, apply the credit to an invoice

However, I'd still recommend seeking professional advice from your accountant about this. They can help you properly handle this type of scenario. If you don't have one, not to worry! I can help run a search to find an accountant.

Here's how:

Feel free to visit the Community again if you need help with QuickBooks. We're always here to help. Have a great day ahead.

Thanks for posting here, @KeithOakley,

This scenario is a special case in QuickBooks. Currently, we're unable to apply vendor credits into sales transactions.

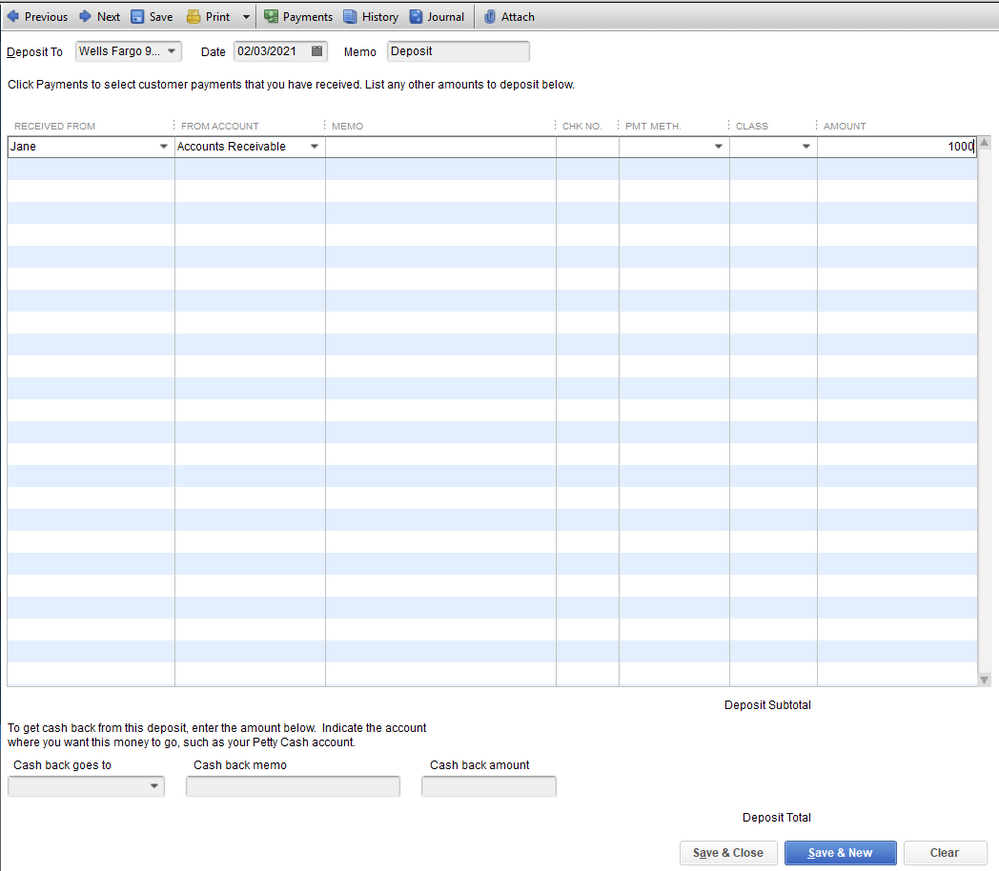

If in case you receive a bulk deposit from a vendor comprising the credit amount for bills and customer invoices, you can record it as a deposit. Using the bank deposit will let you split or apply the whole amount to expense or sales transactions.

Here's how:

To apply the credit to the customer invoice, use the Apply Credits option. See this:

If you need anything else, please comment down below so I can help you further. Have a nice day!

I am using Desktop Pro 2019. This looks like you may done this from the online version.

Also, thank you for the reply. It would be easier if I could see this in the desktop version.

Not to worry, @KeithOakley. I'm determined to ensure you can apply vendor credit to customer's invoices.

The best way to handle this in QuickBooks Desktop is to use a clearing account to help transfer or apply a vendor credit to customer's invoices. I'll guide you how.

Then, apply the credit to an invoice

However, I'd still recommend seeking professional advice from your accountant about this. They can help you properly handle this type of scenario. If you don't have one, not to worry! I can help run a search to find an accountant.

Here's how:

Feel free to visit the Community again if you need help with QuickBooks. We're always here to help. Have a great day ahead.

Thank you so much. That is what I needed.

Hi KeithOakley.

I'm glad to see that my colleague was able to help you out! If there's anything else we can do to help, feel free to post here anytime. Thanks and I hope you have a wonderful afternoon.

How would I handle a 2-party check from a customer that a vendor used to pay a large invoice to us for a job and then sent the difference (check was more that the vendor invoice) to us.

At the end of what I do, I need the full amount applied as payment from the customer. I used a credit memo to

"pay the vendor" and the vendor sent us a check.

I did the above on the check the vendor sent us, and the customer's invoice was reduced accordingly, but now I have credit balance for this vendor in the "Vendor Open Balance" report.

I also need to use the other part of the customer's check that went to the vendor to cover the large invoice as payment by this customer.

I can delete and do this correctly if any guidance as I'm sure there's a better way.

FYI: New to QB and no guidance in current position

Thanks for joining this conversation, @Drew61. I can share some information about handling checks in QuickBooks Desktop.

First, you’ll need to create a bank deposit affecting your customer’s Account Receivable (AR). From there, you can state that this is from your vendor. As mentioned above, this will allow you to split the amounts and apply it to an expense or other sales transactions. I’ll show you how:

After that, let’s pay the invoice you created for that specific customer. Just go to the Customers menu and select Create invoices.

For the remaining amount, you’ll want to follow the clearing account process outlined by my colleague above. However, you’ll need to debit the AR and then credit AP.

Once done, you can now pay the bill. See this article for detailed steps: Pay bills in QuickBooks Desktop.

Despite the troubleshooting steps mentioned, we highly recommend you consult your accountant for further guidance. This way, we can ensure that the correct accounts are affected in order for your books to be accurate.

Feel free to get back to us with additional questions while working with checks and applying it to invoices in QuickBooks. I'll be here to ensure your success.

This is very helpful, though additionally, I needed to apply the vendors credit to his outstanding invoice, so that additional step would be helpful to add to the above.

Thanks for joining the thread, @Tessa1234.

I'd be glad to help you apply the vendor credits to your customer's outstanding invoices.

If you already performed the steps above to create vendor credits, simply follow these steps to apply them to your open invoices. Here's how:

Moreover, you can filter the Transactions tab to Payments and Credits to show the payments and deposits (vendor credits) you've made.

In addition, QuickBooks offers a wide variety of reports that tell where the company stands. These reports offer critical information about the company. To know more, check the Available reports in QuickBooks Desktop section of this article: Understand Reports in QBDT.

Feel free to visit the Community again if you need help with QuickBooks. We're always here to help. Have a great day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here