Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi All,

We recently shifted from Quickbooks Enterprise to Quickbooks Online, and did not migrate the entire data but rather started fresh in QBO by updating opening balances as of Jan 1, 2020.

Now there was a credit note issued by a vendor in 2019, and this was applied in Feb 2020. Also, the service provided by the vendor is annual. Hence all bills received are for future period, and we first debit the prepaid account and create a monthly journal to expense off. I created JE by crediting Prepaid and debiting vendor account, but the JE does not appear in "Pay Bills" window when I select the vendor name.

I need help on:

1. How to create the JE for this credit note from Vendor. Which account do I need to debit and credit.

2.

Solved! Go to Solution.

Hi there, @SB8.

You have to create a Bill transaction so that you can see a transaction in the Pay bills page. Then create a Journal Entry (JE) for the vendor credit that will be applied to the Bill transaction that you've created. I'll guide you through the steps on how to do that, I added screenshots too after every process as a reference.

Please take note that the accounts used in this example is only for clarification purposes. We aren't able to advise as to which specific account you should apply the transactions. I suggest doing this with your accountant to avoid messing up your books in the future.

Here's how:

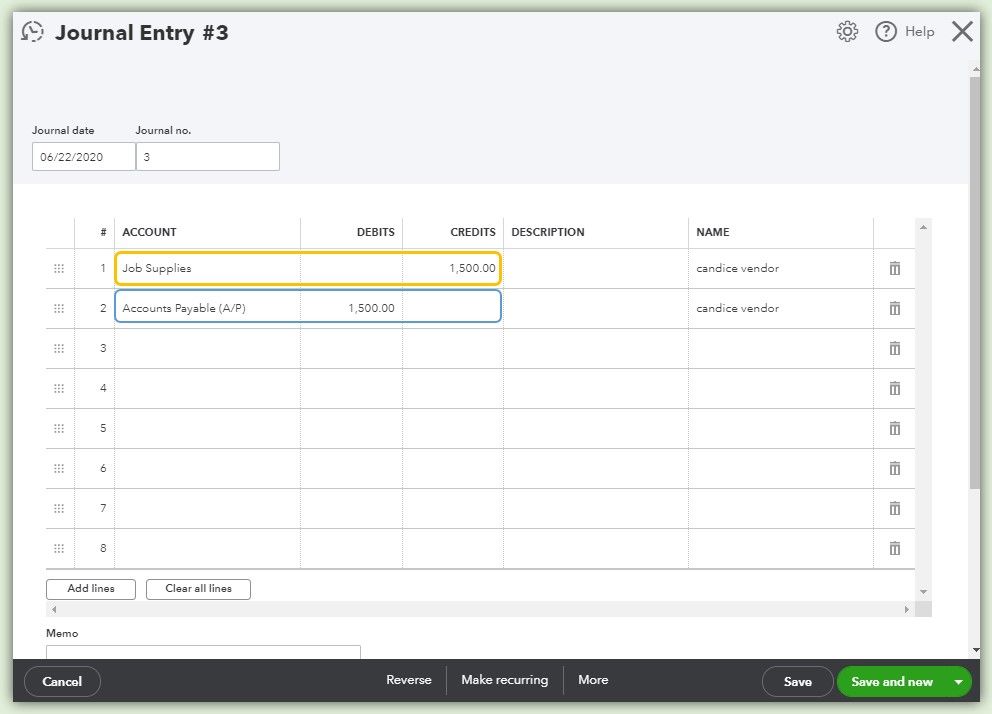

Step 1: Create a Journal Entry transaction

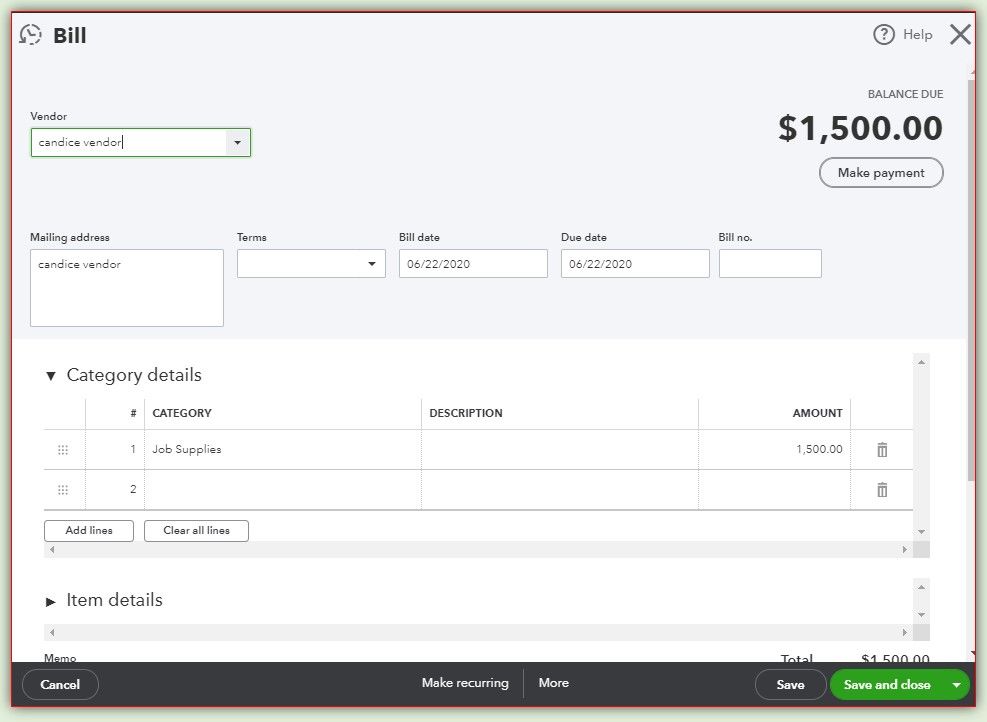

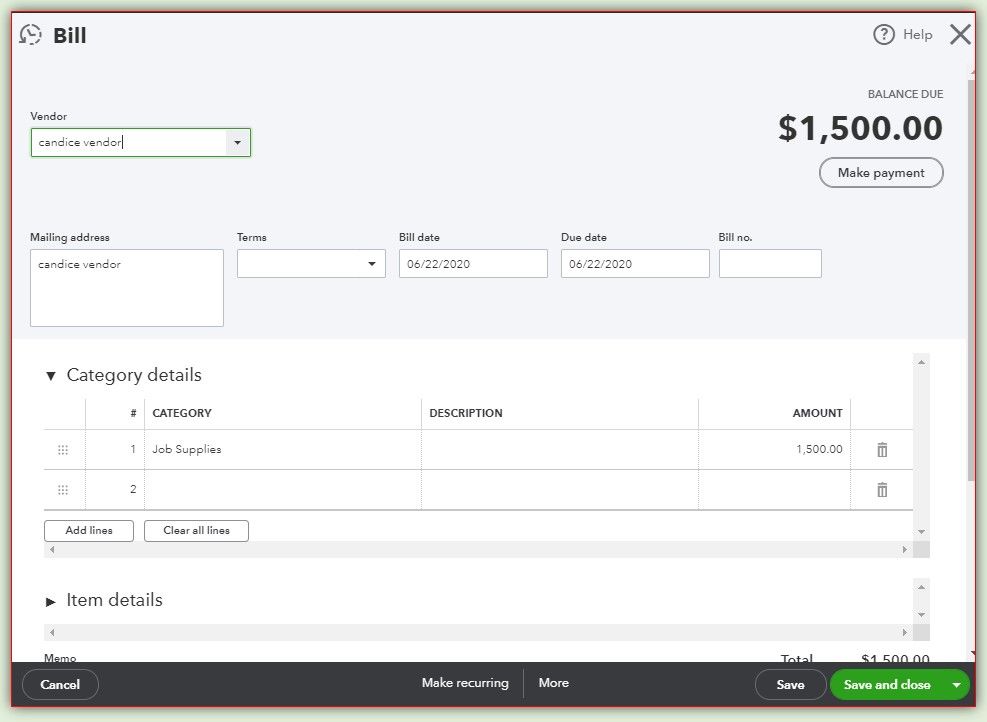

Step 2: Create a Bill transaction

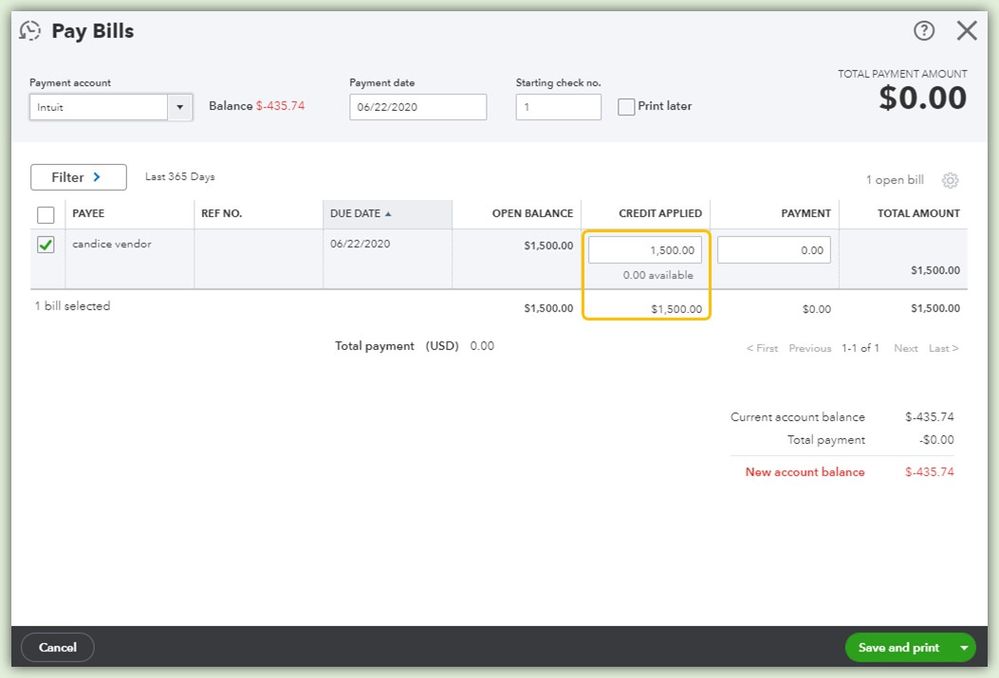

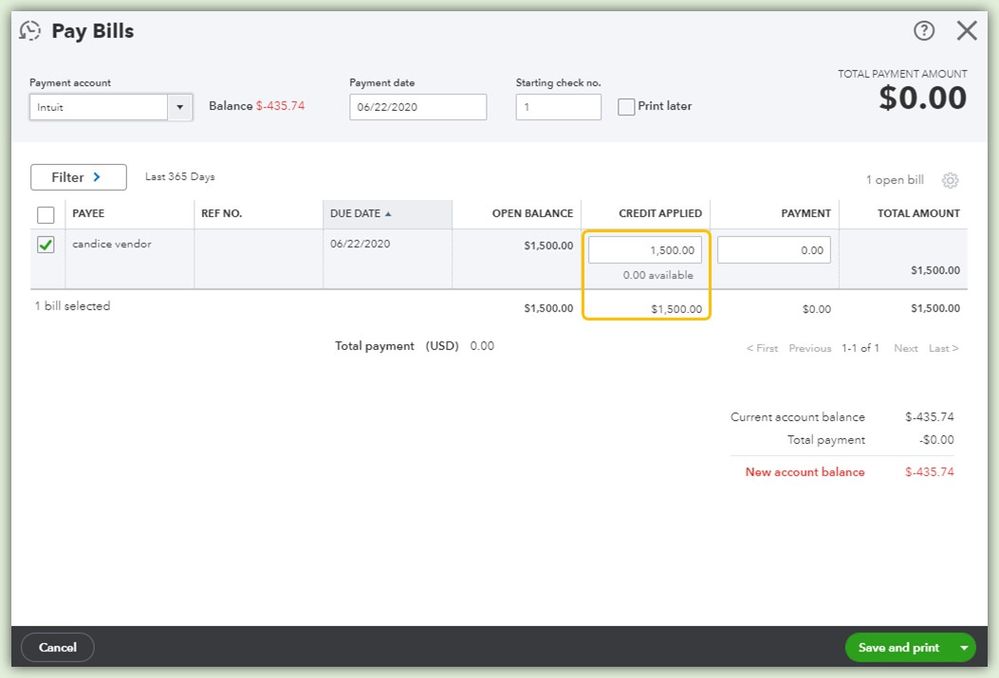

Step 3: Create a Pay Bill transaction (This is done to link the Vendor credit via JE and Bill transaction)

To see the transactions you've made with your vendor, you can run a Transaction List by Vendor report then customize it to see the essential variables of your report.

You can also memorize the customized report so that you'll no longer do the same process in customizing your report. Here's an article that shows the steps on how to do that: Memorize reports in QuickBooks Online.

Please don't hesitate to comment below if you need anything else. I'll be here to help you. Stay safe out there and have a good one!

Utilize the trial period of TP Importer to import the data as Vendor Credit.

https:// transactionpro.grsm.io/qbo

Hi there, @SB8.

You have to create a Bill transaction so that you can see a transaction in the Pay bills page. Then create a Journal Entry (JE) for the vendor credit that will be applied to the Bill transaction that you've created. I'll guide you through the steps on how to do that, I added screenshots too after every process as a reference.

Please take note that the accounts used in this example is only for clarification purposes. We aren't able to advise as to which specific account you should apply the transactions. I suggest doing this with your accountant to avoid messing up your books in the future.

Here's how:

Step 1: Create a Journal Entry transaction

Step 2: Create a Bill transaction

Step 3: Create a Pay Bill transaction (This is done to link the Vendor credit via JE and Bill transaction)

To see the transactions you've made with your vendor, you can run a Transaction List by Vendor report then customize it to see the essential variables of your report.

You can also memorize the customized report so that you'll no longer do the same process in customizing your report. Here's an article that shows the steps on how to do that: Memorize reports in QuickBooks Online.

Please don't hesitate to comment below if you need anything else. I'll be here to help you. Stay safe out there and have a good one!

When I pay a vendor bill using a vendor credit this way, my account entries on the bill get divided.

Example: One bill has several charges that go into several different accounts. I put the single amount charges in the correct accounts. I enter the vendor credit ( that is given on the bill) under vendor credit on the left in the vendor account. I go to Pay Bills and the vendor credit applies. I then pay the bill with a check. I go to the accounts to view the single charges and they are divided in two amounts but equal the single charge entered. What am I doing wrong?

Hi there, @rhea3.

Let me share with you more info on how to use vendor credits in QuickBooks Online (QBO).

Once you create this transaction in QBO, you can use it to either record returns to your vendors or refunds from vendors. If a vendor issues you a credit, you can apply that credit manually in the Credit Applied column in Online Bill Pay.

What you've done is correct. However, since you've entered different accounts to a single bill, this will automatically be recorded as a split transaction. This is the reason why your account entries on the bill are divided.

In addition, you don't have to create a check to clear the bill if a vendor credit was already applied to it. Doing this will record another expense transaction in QuickBooks.

In case you want to unrecord this check, you can simply delete it.

To know more about when to use bills, bill payments, expenses, or checks in QBO, you can check out this article: What is the difference between bills, checks, and expenses?

Please let me know if there's anything else I can do to be of assistance. Just place your concern by clicking Reply and I'll get back to you. Wishing you and your business continued success in all that you do.

Thank you for the information. But when I am trying to Pay the Bill, it is not deducting the credit. Even the credit is there and the total amount is with the credit, the total amount to pay does not consider the credits. How can I do it.

I'm glad you reached out to us, @12345678905. I can help pay the bill and apply the credit to it.

We can do that by reviewing the Journal Entry (JE) you created if the Accounts Payable (AP) is increased on the Debit column while the expense account is on the credit one. Please see the screenshot below for visual preferences.

Once done, go on pay bills and ensure that there is an amount shown on the Credit Applied column. Normally, if you create a JE, the amount will show as credits.

I've added an article here that can help you learn more about recording a credit from a vendor.

I’ve added this link that tackles expenses and vendors in QuickBooks. This will give you more details about your business and your cash flow through proper bookkeeping practices.

The Community team is always here to find a solution. Just leave us a message below, and I’m sure it will be taken care of.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here