Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowDoes the following post apply to my company in how to enter monthly insurance premiums (for Liability Insc) not connected to payroll?

Record and allocate Prepaid Expenses

SOLVED•by QuickBooks•13•Updated January 10, 2023

Follow these steps if you have a customer who wants to spread the expense of an item paid in a single amount (i.e. insurance premiums, Yellow Page bill, etc.) over a period of several months in order to allocate expenses to the appropriate month.

QuickBooks Desktop for Windows

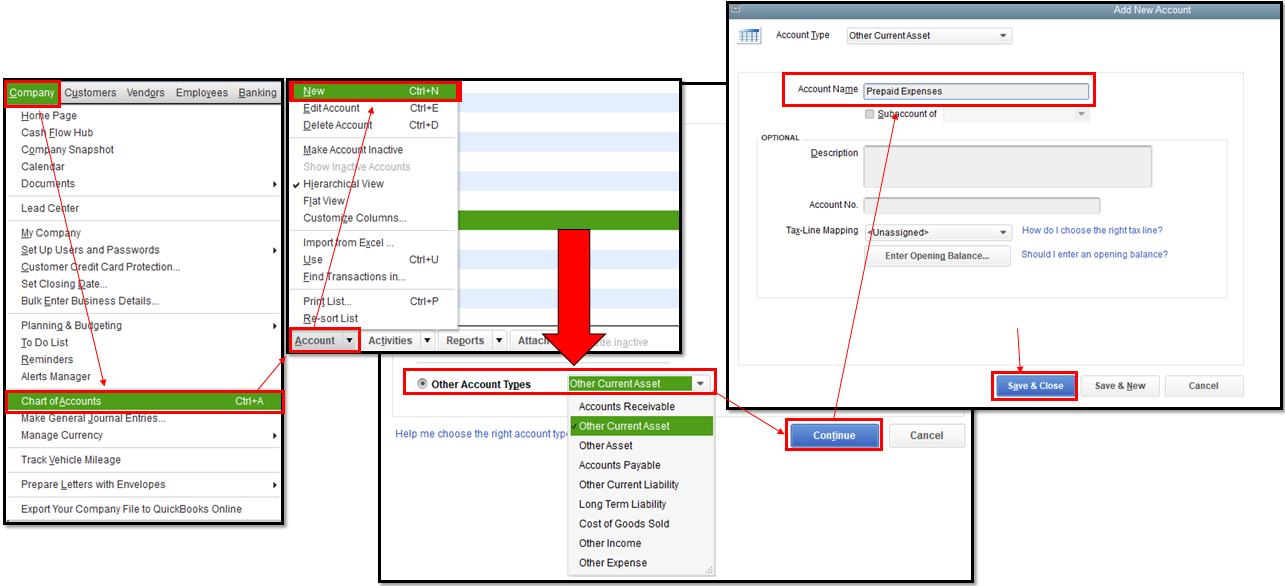

Create an account to track the prepaid expense. Generally, this is an Other Current Asset account.

From the Company menu, select Chart of Accounts.

In the Chart of Accounts window, right-click anywhere, then select New.

In the Choose Account Type window, select the Other Account Types drop-down, then select Other Current Asset.

Select Continue.

Enter the Account Name (Example: Prepaid Expenses) and other details, then select Save & Close.

Enter payment to vendor using the account created in Step 1.

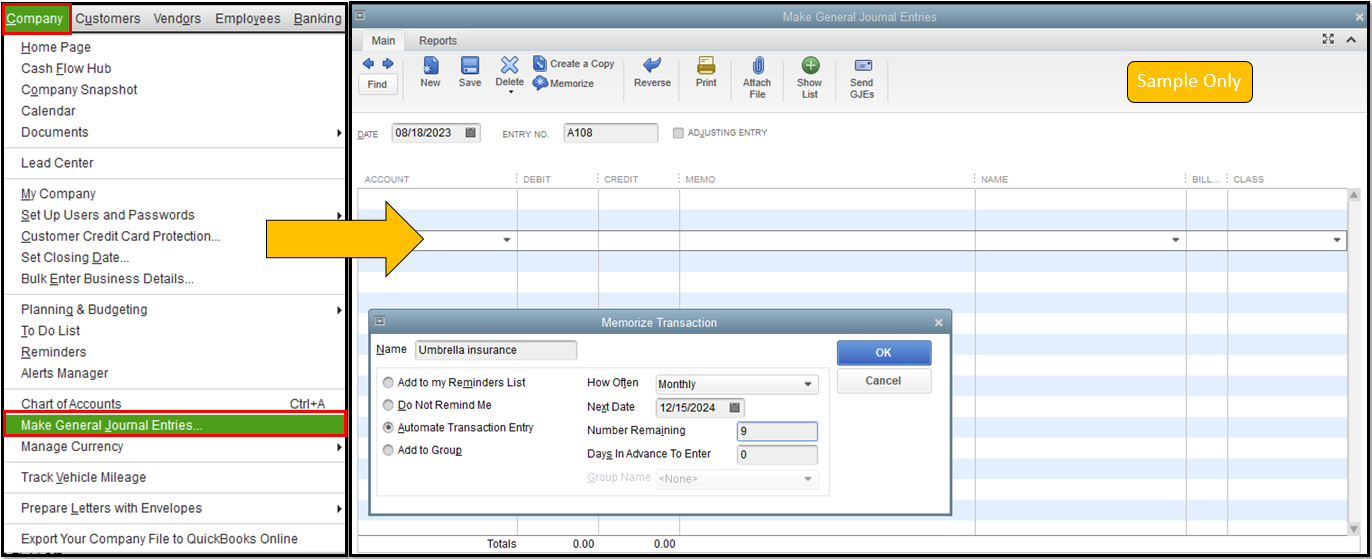

Create a memorized journal entry to allocate one month or quarter of the expense.

From the QuickBooks Company menu, select Make General Journal Entries.

Enter the appropriate date for the first period. You can either use your own entry number or allow QuickBooks to auto-assign one.

Debit the Expense account and credit Prepaid Expenses for the appropriate percentage of the total payment (1/6 if 6 months, ¼ if quarterly for a year). You can include an appropriate memo if you choose.

Press Ctrl-M on your keyboard to memorize the transaction. Assign it a name (Example: Umbrella Insurance), and choose Automatically Enter. Select how often you want the entry recorded and the date of the next transaction. Also indicate the number of remaining entries.

Select OK.

The entries will record according to the frequency you selected, reducing the Prepaid Expenses account each period. The balance in the Prepaid Expenses account should be zero at the end of the coverage period.

If the user has multiple prepaid expenses to track, it is suggested that they create sub-accounts of the Prepaid Expenses account in order to track each separately.

Solved! Go to Solution.

Your screenshot shows a payment made for a monthly insurance premium. Those are not considered prepaid expenses. If you make an annual payment (or quarterly) and want to allocate 1/12 (or 1/3) to each month, then you would use a prepaid expense account.

The proper way to record a monthly premium is to enter the bill and then pay it. You may know this so forgive me if I'm telling you what you already know: if you are on accrual basis, it is important that you enter the bill using the date of the bill and then pay it using pay bills. The reason for that is that you want to incur the expense as of the invoice date, not the date that you pay it. If you're on cash basis, then it makes no difference.

Thanks for reaching out to us, Victoriah. I'm here to provide additional details about entering monthly insurance premiums in QuickBooks Desktop (QBDT).

Yes, you can follow the steps in the record and allocate the prepaid expenses article you've mentioned above, even if you don't have a payroll subscription. For your visual reference, see these screenshots below:

For Step 1:

For Step 3:

You can also consult your accountant for additional guidance on recording insurance premiums in QBDT, ensuring accuracy, and avoiding data errors.

Furthermore, you can access various vendor reports that provide insights into your company's expenses and accounts payable. See this article to learn how to customize it according to your business requirements: Customize vendor reports.

Post a comment below if you have additional questions about recording your monthly insurance premiums in QBDT. We're always here to help you out. Have a good one.

Thanks for the reply KEVIN_C,

Just a follow-up question on this topic - can this also be recorded using the write checks method, as we do all of our other bills? I've attached a screen shot of the Feb 2023 payment. Is this acceptable, or should it only be a GJ entry? Although these are "prepaid" expenses, they aren't recorded in advance... I am a bit behind in entering my data.

Incidentally, I don't "add bills" and then pay them. I only pay them via this method. I'm hoping that is correct?

Thanks very much,

victoriah1956

Thank you for visiting this conversation and providing a screenshot for additional reference, victoriah1956.

Yes, that's correct. In addition to creating a journal entry, you can also utilize the write checks method to record monthly insurance premiums in QuickBooks Desktop.

While the write-checks method is a straightforward way to record monthly insurance premiums, I still recommend consulting with an accountant or financial professional. They can help you make decisions based on accurate information.

If you have additional inquiries about the process of recording transactions, rest assured that we're here and ready to offer you further guidance and support. Bye for now and take care always!

Your screenshot shows a payment made for a monthly insurance premium. Those are not considered prepaid expenses. If you make an annual payment (or quarterly) and want to allocate 1/12 (or 1/3) to each month, then you would use a prepaid expense account.

The proper way to record a monthly premium is to enter the bill and then pay it. You may know this so forgive me if I'm telling you what you already know: if you are on accrual basis, it is important that you enter the bill using the date of the bill and then pay it using pay bills. The reason for that is that you want to incur the expense as of the invoice date, not the date that you pay it. If you're on cash basis, then it makes no difference.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here