Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi guys! I have an issue.

We have some payments over Stripe or simple bank transactions that include diverse positions.

For example:

1) Our customers pay through Stripe, we pay the refunds in same way. But we become the Stripe payouts as a bunch of transaction. One Stripe payment could include 3 customer payments, 1 customer refund and separate Stripe fees. When I want to match this transaction with the documents entered in QBO, I could only select invoices, but not refund receipts or bills.

2) Same with other payments. We have vendors that are also customers. They could pay our invoice deducting the open bill. How could I match invoices and bills in one bank transaction in QBO?

Other question: How should we enter Refund for Vendor. For example for Amazon, when we physically paid for a bill and then get money back? Vendor credit? But how do I match it with the bank transaction, I don't have this in the match list?

Thanks in advance!

I'm here to help record your transactions in QuickBooks Online (QBO), Kateryna_G.

You're unable to match bills, invoices, and refunds with one bank transaction.

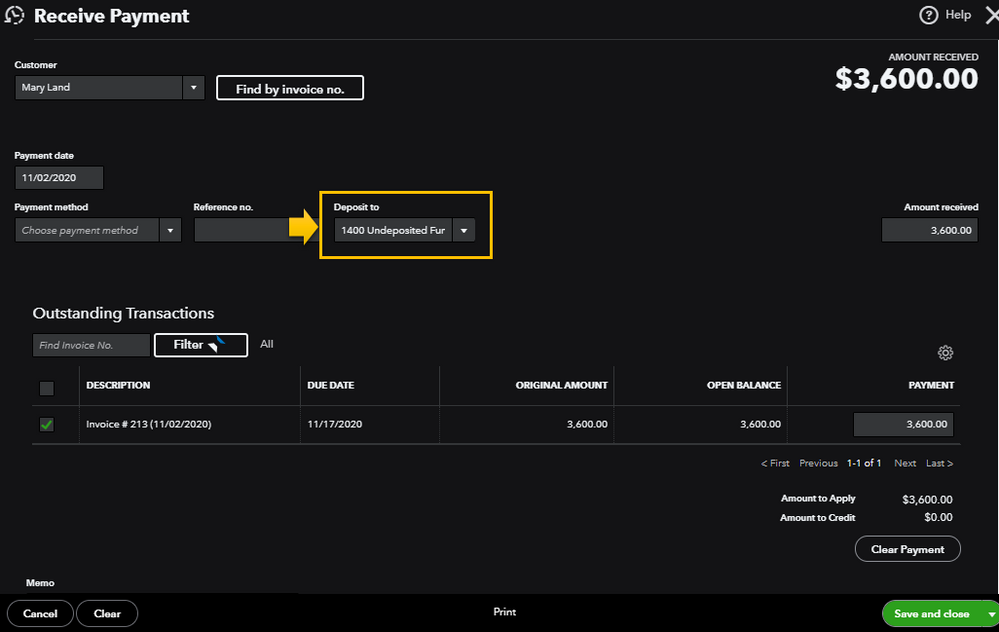

You can exclude Stripe transactions on your Banking page. Then, if the Stripe fee is the deduction for the payment, you can record the full payment to your Undeposited funds. Then, make a bank deposit so you can deduct the fee.

Let me show you how:

Here's how to link the payment to the wire transfer fee:

For vendors who are also your customers, you can enter a Credit Card Credit. This way, you can apply the outstanding customer credits to your vendors. Here's

Entering the credit depends on how you record your purchases. I'm adding this article to help you manage this transaction in QuickBooks: Enter a credit from a vendor.

Stay in touch with me if you need additional information by commenting below. I'm always right here to help you.

Thank you, Mary!

I'll try this and let you know if it doesn't work.

But still, what should I do if I have in the same Stripe transaction - customer payment and customer refund? How should I match it?

Thanks for getting back to us, Kateryna_G.

In behalf of my colleague MaryLandT, you are welcome.

Right now, able to match customer payment and refund into one bank transaction is unavailable.

As what Mary provided, you can manually record the customer payment by following the steps above provided by her. And for the refund, here's what you'll need to do:

For more details, see this article: Record a customer refund in QuickBooks Online.

Post again in the Community if there's anything else you need. I'm here to keep helping. Have a fantastic day!

Hi, I have a similar problem,

I received bulk deposits from stripe to my bank account and stripe deduct the refunds from the bulk bank deposit.

as an example stripe has deposited 3500 to my bank as a bulk deposit. This deposit includes the (sale A 1500, Sale B 1000, Sale C 1500 and deduction for a partial refund of 500. (4000 - 500 = 3500)

I have 4000 worth of sales receipts and 500 refund receipt. How can I match these with my bank account which has a 3500 bank deposit from Stripe? Because I can create a bank deposit by adding all 3 sales receipts and match with bank statement if there are no refund receipts and the bank deposit and sales deposits have the same amount. I'm using QuickBooks online. Thank you.

I can show you how to match your transactions, 9130 3496 0391 8576.

It looks like you entered your sales receipts and refund receipt in QuickBooks. To combine them so they'll match in your Stripe transaction, just make sure that you selected Undeposited Funds under the Deposit to drop-down of each sales receipt and Refund from field of the refund receipt.

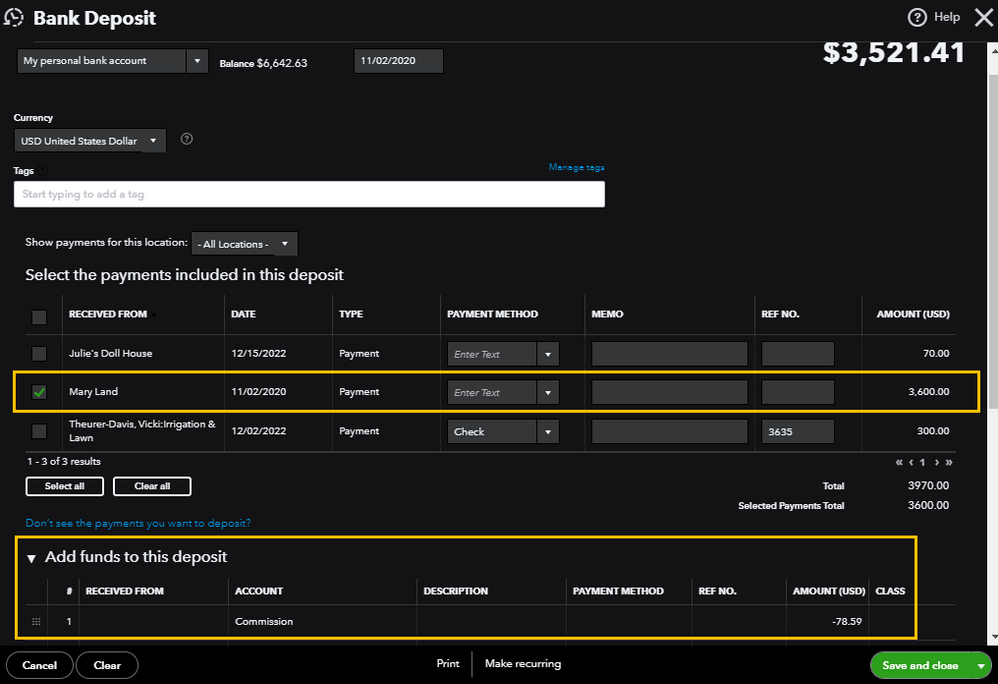

When you create the deposit, you'll see all three sales receipts and a negative amount for the refund. Just select all four transactions and you'll get the same amount posted in your bank feeds. From there, you can match them.

You'll want to look into these articles on how to manage your accounts:

I'll be around the corner if you have further questions. Take care!

I think I understand what you're saying - just assign all the affected transactions to Undeposited Funds, and then do a deposit to match them.

However, if I assign those transactions to Undeposited Funds, they will NOT, then, appear in the Stripe clearing account, right? How do I reconcile the Stripe clearing account then?

It seems that QBO should be able to handle this kind of thing in a way that's consistent with how we get the data. So much of what's done in QBO is nice and intuitive - this kind of exception seems unnecessary. This kind of thing is somewhat unusual, and it's not easy to remember, "oh yeah, I have to do it differently for this case".

Hello, oceanbeachesglass.

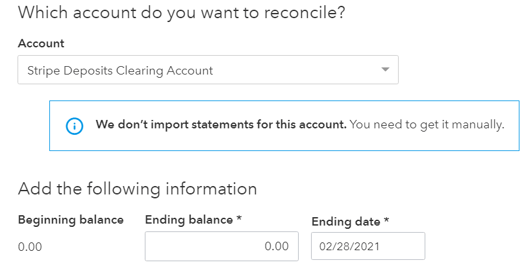

The Stripe Clearing account effectively functions in the same way as the Undeposited Funds account used to record and reconcile payments and deposits.

Like any bank account, it's best practice to reconcile the Stripe Clearing Account on a regular basis (at least monthly). Imbalances in the clearing account could be indicative of adjustments that need to be made to owner income.

Once you're familiar with the how to use QBO's account reconciliation tool, follow these steps to reconcile your Stripe Deposits Clearing Account:

Check out my guide on how to reconcile an account in QuickBooks Online to complete the rest of this process.

I'm always around if you need further assistance reconciling your Stripe clearing account. Feel free to leave a reply below. Have a good one. Stay safe!

I know how to reconcile the clearing accounts. What I'm wondering is how I reconcile them if I'm applying some transactions to the Undeposited Funds account rather than the Stripe clearing account. My impression is that if I'm using a clearing account, I need to consistently apply transactions to that account and not some other account like Undeposited Funds.

I think what you're collectively saying (though nobody seems to want to explain the big picture) is that anything to do with the SALE should appear in the clearing account, and anything to do with a REFUND should appear in Undeposited Funds. Is that correct?

I would like to know if this is some kind of standard accounting practice, or just a workaround for some limitation in QBO's capabilities. If the latter, I for one would encourage the development of the capability to use refunds within the clearing accounts. I really expected to be able to look at my Stripe clearing account, for instance, and see everything that's gone on in Stripe - just as I can look at my primary Bank account and see everything that's gone on there.

Thanks for getting back here, oceanbeachesglass.

Let me share some insights about the process.

When you accept payments using Stripe, there are bank service fees that will be deducted from the payment. As a result, the payment amount that shows on the bank register will not match the deposit amount in QuickBooks Online. This will make it hard to reconcile your bank statement.

To handle the bank service charge, you can deposit the payments to the Undeposited Funds account. Then, record a bank deposit and include the service fee as a negative amount.

Here's how:

You can read this article for reference: Enter a bank service fee while using a third-party merchant service.

Once done, you can match this deposit to the downloaded transaction in your bank. When you're ready to reconcile the account, you can check out the steps here.

On the other hand, the Stripe Clearing Account is set up in your QuickBooks to represent the amount that Stripe owes you. When you process a payment using Stripe, the balance of the Clearing Account will increase. Then, the balance will decrease when Stripe pays the money into your Bank Account.

Please let me know if you have any additional questions or other concerns with QuickBooks Online. I'll be around to provide a solution. Take care and stay safe.

What I had gotten used to with Stripe - and now with Shopify - is that the gross Sale amount would go into the clearing account as a Sales Receipt, as a Deposit. Then, for the payout to me, a journal entry would go into the clearing account with the Gross sale amount as a Credit, and the fee and amount going to the bank as Debits. This works fine until I run into Refunds.

One major issue with Refunds is that both Stripe and Shopify handle them in a couple different ways - either being deducted from other current Sales (if any), OR directly from my Bank account (if not). With the former, the refund is lumped right in with the sales, so there's nothing that concerns the Bank account, and no resulting problem. It's with the latter that I've had the issues - that's where I can't match any Refunds with any Bank transactions.

I think I have it figured out now, though. If the refund comes straight out of my Bank account, I can apparently just add a journal entry that shifts the Refund amount from the Stripe/Shopify account to the Bank account (with the refund being debited from the clearing account and credited to the Bank account). The refund appears in the clearing account for tracking purposes, and reconciles in both the clearing and Bank accounts.

One reason I'd rather avoid using Undeposited Funds is that my cash & checks from daily sales go in there. They comprise a pretty small part of my receipts, so it might be a month before I have enough that I feel compelled to make a physical deposit. I can tell you that things get a little confusing when you start mixing money from various sources in Undeposited Funds. And I have tried to create a second Undeposited Funds so that I could keep them separate, but QBO doesn't allow that.

Anyway, the issues with handling Stripe and Shopify have easily dominated the vast majority of my time trying to keep my books. I think most other very small business owners would agree that their methods are a real curse - if my daily in-store credit card sales were handled that way, there's no way I could handle it. But I suppose that's another conversation.

Thanks for your help, though - it adds to the number of choices I have in approaching things.

I am having the same issue, with a stripe payment containing customer payments and a refund issued. However in this case the net was negative and Stripe debited the difference from our account. I tried to enter the transaction as a negative bank deposit following the instructions above but it would only accept a positive value for the deposit. When I enter an expenditure it does not let me match to the transactions (receipts and refunds) that I created. How should this be recorded? And when can I expect a better Quickbooks solution for what is clearly a VERY common issue among those of us who use Stripe?

Hello,

I am having a similar issue matching the refund.

The sales refund receipt has been recorded. Now I am having the bank transaction come through my feed (the one with the refund and other batched incoming payments).

Example.

Payment 1 - $50

Payment 2 - $100

Payment 3 - $30

Refund - -$25

Total batch transaction appearing in bank feed - +$155

When matching payments to the transaction feed I am not seeing the ability to match the - $25 refund so that the batched transaction accurately matches my records.

What are my options? I want the transaction to be categorized so that I can reconcile my account.

Thank you.

Thanks for joining the thread, usertires2gomobile.

Since the refund has been recorded, there isn't a way to match the payment and refund into a single bank transaction. What you can do instead is to make a bank deposit for those payments and then exclude the bank transaction. I'll show you how.

These are the steps to record bank deposits:

Here's how to exclude bank transactions:

I've added the following articles for your reference:

If the refund isn't recorded, you can match the bank transaction using the Find match and Resolve the difference feature.

Here's how:

I'm also added this resource to help you with the reconciliation process: Reconcile an account in QuickBooks Online.

Do you have more questions about bank feeds? Let me know the details, and I'll get back to help you. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here