Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHow do I "Match" these sales receipts and payments to deposits to get them out of my way? The list is getting quite long and making deposits is getting cumbersome. The deposits have been made and reconcilled. Why don't they go away when I add them to a deposit?

Solved! Go to Solution.

Hi BPRamsey,

Matching these transactions should be a quick ordeal, so I'd like to take a deeper look at what's going on.

The following article explains what transactions the program looks for when matching deposits and credits: https://community.intuit.com/articles/1164872. The steps to match them are as simple as going to the Banking page, clicking on the transaction, choosing Find Match, checking off the applicable transaction, and clicking Save.

Can you please let me know the steps you've been taking, and provide a screenshot of the issue? Thanks so much.

Hi BPRamsey,

Matching these transactions should be a quick ordeal, so I'd like to take a deeper look at what's going on.

The following article explains what transactions the program looks for when matching deposits and credits: https://community.intuit.com/articles/1164872. The steps to match them are as simple as going to the Banking page, clicking on the transaction, choosing Find Match, checking off the applicable transaction, and clicking Save.

Can you please let me know the steps you've been taking, and provide a screenshot of the issue? Thanks so much.

Hi, I'm having similar problem. Shopkeep is integrated with Quickbook. In QB I go to review my bank statements and select a deposit (from Shopkeep to Bank); select "match"; there are no matches. I go under Sales and pull up a receipt and its showing as a transaction in the QB. I think its not matching because the amounts are different. My deposits don't include the total sale, only sale by card reader, while my sales receipts contain all sales made, including cash. The dates off to account two day delay and one day to post to my account

Hi Zaffron,

You're absolutely correct about the amount and date. These are key factors the program uses to find matching transactions. If the amount is off as well as the date, it looks like two separate transactions. You could always exclude the deposit from the banking page, since you already have the sales receipt recorded. I recommend checking out Intuit Meg's answer in the following article for additional details: https://community.intuit.com/questions/831895-can-t-match-downloaded-transaction-to-register.

Please let me know if this helped clarify things, or if you have any further questions for me.

I am having a similar issue with Kindful. We have integration set up and the transactions are synced over as sales reciepts for each individual transaction (including the donors name), but the money is direct deposited as a lump sum every week or 2. Because the dates and amounts are different they don't match-up. On the profit and loss, both the sales receipts and the deposit shows up in 2 different income accounts.

Hello there, @IGF0828.

Thanks for joining this thread. I'm here to help direct you in correcting your integration setup.

The data you have in QuickBooks is dependent on the integration process of Kindful. I recommend reaching out to their Customer Service to update your settings and syncing method. They have the necessary tool to help you with your request.

After correcting the data, you should be able to match your transactions with no hassle.

Keep me posted on how the call went, @IGF0828. If you have any follow-up question, just add a comment below. I'll be here if you need further assistance about QuickBooks.

Hi. Am I matching both the sales receipt and the payment to the bank statement ?

I am having the same problem with Kindful. They have told me to work with QuickBooks to troubleshoot further. Can you provide more specifics about the "tool" they have to fix the integration?

Hi @HoneyLynn_G - I am having the same problem with Kindful that @IGF0828 mentions. Both the sales receipts and the direct deposit are showing up, but the amounts and dates are different. When I speak with the Kindful reps, I am told that I need to work it out with QuickBooks. Can you provide any additional specifics or step-by-steps for how to resolve this? Thank you!

Thank for posting a response in this thread, lbattis4.

Let me share some information about using Kindful app with QuickBooks Online.

Kindful has a two-way sync between QuickBooks and it gives you real-time updates for your transactions. However, the data comes in individually from Kindful as a sales receipt.

If you're also using the online banking feature, I'd suggest checking out this articles to help you manage the deposits:

I've added this resource as your future reference: Reconcile an account in QuickBooks Online.

Feel free to drop by for any follow-up questions about banking. I'll be here to help. Enjoy your weekend.

I have sales receipts, yet I deleted the deposits to move sales receipts to the Paypal Sales Income and not he undeposited funds, where everything was going for assets and sales.. I now see that on my reconciliations I am off by those deposit amounts. Can I just exclude in the banking area. Or do I have to deposit all sales receipts to deposits. Some are matched to deposits most are not. My reconciliation is over -12,000.00 off for the year. Client gave me his entire year at once. Client sales something he makes (cost of goods sold) through the internet using paypal, and never removes money from the pay pal account, until the end of the year, or this time the 1st week of the new year. And he removed around 13,000. Can you please help me

Hey there, @Micki V.

It's possible that the sales receipts were deposited first to the Undeposited Funds before they were moved to the bank account. Thus, deleting these deposits would decrease the amount on your reconciled bank.

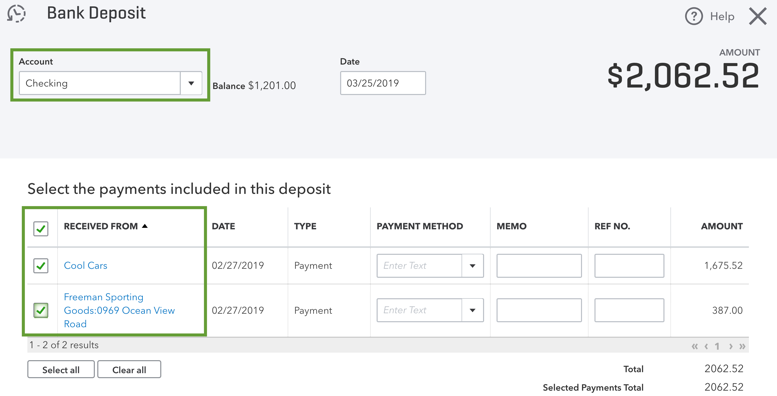

To correct your records, you'll have to deposit them back to the correct bank account. That way, you can fix the discrepancies in your reconciliation. Here's how:

Please take note that all transactions in your Undeposited Funds account appear in the bank deposit window.

You can also exclude your transactions that don't match to your sales receipts.

Feel free to reach out to us if you have a follow-up question about banking. We're always here in the Community to help.

I did delete all those deposits once I went in to see the reconciliation, and I was double the income over. I realized (i know better now) that there were two entries for every transaction of sales receipt, so instead of doing the right thing and deposit everything to the PayPal account through the undeposited funds, i deleted all those deposited from the register. So, they are gone, and now my dilemma as you imagine is that I have a negative amount of my income amount. I cannot match anything, or undo anything else. I need to go in and delete all transactions and just start over. Nothing is reconciled at this time.

Can this be done. It would just be easier for me to start over and get the info back in the correct way.

Or can I delete a sales receipt re-enter, then put to deposit in undeposited funds (maybe 52 sales receipts), a few expenses outside of the transaction that should be tied to the transaction, as in we bill the customer 239.99, (which is 199.99 for product and 40.00 for the shipping (the actual shipping as an expense is anywhere from 40.00 - 60.00) and there is a paypal fee due on each transaction, 8.87 for PayPal fees expense) and start redoing things that way. Which i also deleted those deposits as well for the 239.99 - the neg 8.87 from the deposits as well. I need to get the 1099's out by Friday and he really did not have a huge number of transactions, total income was around 14000.00 for the year.

Would it be easier to just start over. I think it would be way easier to track these transactions. better than they are now.

Thank you so much. I do not want to start a new company i just want to remove all transactions and start fresh. Is this possible? I always want to try to fix things and learn that way when I made a mistake, at this point i understand what I did, but fixing all of this seems completely out of scope to recover.

I think I have officially confused myself on the fixing of this. I am very embarrassed and i should have known better, and when I did not understand the full extent of the undeposited funds, i should have looked that up verses winging it. What comes in must go out. Accounting 101.

Can anyone help me here. I thank you for your time.

I appreciate you for doing the recommended steps by my colleague. Let me chime in and provide additional troubleshooting to fix the negative amount of your income account, Micki V.

We can run the Transaction List by Customer report to evaluate the amount to determine and trace the negative transaction. Let me show you how.

If the data didn't show any entries related to the sales receipt, I'd suggest consulting your accountant on the best option on how to handle this one. From there, you can ask them if there's a need for you to delete a sales receipt, re-enter them, and put to deposit in undeposited funds or create a journal entry. Creating a journal entry is the last resort for entering transactions. They let you move money between accounts and force your books to balance in specific ways. Here's an article you can refer to for more details about creating a journal entry in QuickBooks Online.

If you need help with entering the deleted transactions to deposit them back to the correct bank account to fix the discrepancies in your reconciliation, I'd suggest contacting our support agent. They'll pull up your account in a secure environment and assist you with this one. Here's how to reach them:

I'm adding this article with the steps that'll help make sure your QuickBooks accounts always match your bank and credit card statement: The Reconcile Workflow in QuickBooks.

If you've got questions other than QuickBooks banking, please let me know in the comments. Use the Reply button below so that I can continue assisting you. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here