Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am using QuickBooks Online, Simple Start edition. When I follow the recommendations for recording an overpayment to a vendor, it results in a negative balance on the vendor account and a negative amount under accounts payable on the balance sheet. In reality it should appear as an accounts receivable amount on the balance sheet (it is money the vendor owes me for the overpayment). How do I fix this?

(The recommended process found online for processing the overpayment is to match the payment to the bill but enter the actual overpaid amount on the bill line item. QBO automatically creates the credit on the vendor's account as a negative amount)

Solved! Go to Solution.

"When I follow the recommendations for recording an overpayment to a vendor, it results in a negative balance on the vendor account and a negative amount under accounts payable on the balance sheet. In reality it should appear as an accounts receivable amount on the balance sheet (it is money the vendor owes me for the overpayment). How do I fix this?"

That is how all versions of QB work. Yes, technically it's an asset but QB uses A/P to track vendor balances. If you move it out of A/P, QB cannot automatically apply the vendor credit to a bill. If you want to move it, create a journal entry and move it to an other current asset account. You can't have A/R for a vendor in QB. Obviously, you want to ignore @LeizylM 's advice, it makes no sense.

I understand that you're experiencing an issue with handling the overpayment to the vendor, Madzack. I'm here to guide you through the process for a seamless experience.

When recording an overpayment to a vendor, It won't be categorized under accounts receivable; instead, it should be recorded as a credit representing the overpayment as an asset.

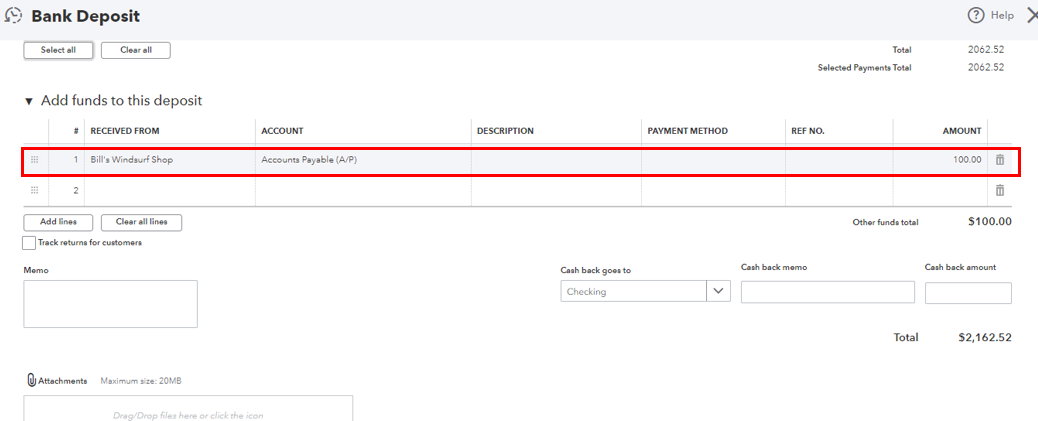

If you have recorded a vendor refund, we can create a bank deposit affecting Accounts Payable (AP) to offset the overpayment.

Then, we can make a Pay Bill to link the bank deposit to the vendor credit. Here's how:

Moreover, you may also want to check out this article to learn specific ways to customize your reports to get awesome insights in QuickBooks: Common custom reports in QuickBooks Online.

Kindly leave a reply if you require further assistance with refunds or have additional QuickBooks-related queries. I'm just around to assist you anytime.

"When I follow the recommendations for recording an overpayment to a vendor, it results in a negative balance on the vendor account and a negative amount under accounts payable on the balance sheet. In reality it should appear as an accounts receivable amount on the balance sheet (it is money the vendor owes me for the overpayment). How do I fix this?"

That is how all versions of QB work. Yes, technically it's an asset but QB uses A/P to track vendor balances. If you move it out of A/P, QB cannot automatically apply the vendor credit to a bill. If you want to move it, create a journal entry and move it to an other current asset account. You can't have A/R for a vendor in QB. Obviously, you want to ignore @LeizylM 's advice, it makes no sense.

Hello Rainflurry,

Thank you for sharing your input to help address the issue. We love to see members supporting one another! Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here