Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe are in the construction industry. Our builders (customers) send us payment for lesser the amount of the invoice due. This is because of workers comp insurance that they provide while we are on the job. These are "Wrap Jobs". They deduct a percentage of the invoice to account for them paying the insurance on behalf of us. How can I record this in the payment? My last software allowed me to allocate the deduction to my expense account "Work Comp Ins" in the payment section. In QBO I tried to do the same thing, under Receive Payment, but the Deposit To field does not include my Work Comp Ins expense account. How do I bring that expense account into that field? If not possible, how do I record this adjustment without having to create a credit memo every time?

Solved! Go to Solution.

I'd be happy to assist you in recording customer payments with a percentage deduction in QuickBooks Online, PinkyK.

We can record the percentage deduction when depositing the invoice payment without having to create a credit memo in QuickBooks Online. This allows us to add the expenses account, where we can allocate the deduction.

As an initial step, let's record the invoice payment in full amount. See the sample steps below:

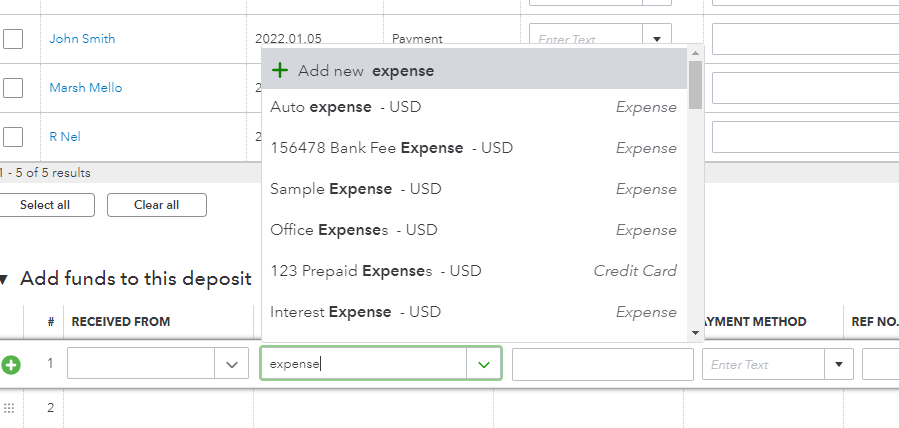

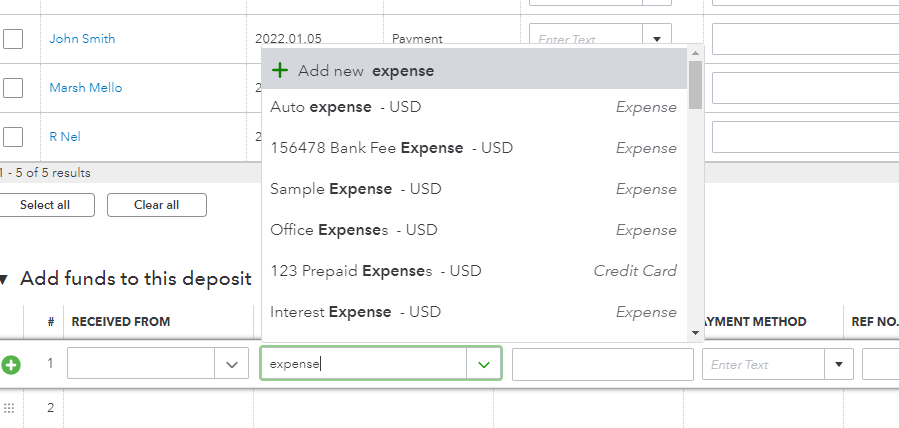

Once done, we can manually record the deduction when creating a bank deposit and enter the value in a negative amount. Here's how:

If you want to reconcile the account, refer to this article: Reconcile an account in QuickBooks Online. This will walk us through the steps of manually reconciling an account that is not linked to online banking.

Loop me in if you still need help with recording invoice payments or have follow-up questions about QuickBooks. I'll be around to help, PinkyK.

I'd be happy to assist you in recording customer payments with a percentage deduction in QuickBooks Online, PinkyK.

We can record the percentage deduction when depositing the invoice payment without having to create a credit memo in QuickBooks Online. This allows us to add the expenses account, where we can allocate the deduction.

As an initial step, let's record the invoice payment in full amount. See the sample steps below:

Once done, we can manually record the deduction when creating a bank deposit and enter the value in a negative amount. Here's how:

If you want to reconcile the account, refer to this article: Reconcile an account in QuickBooks Online. This will walk us through the steps of manually reconciling an account that is not linked to online banking.

Loop me in if you still need help with recording invoice payments or have follow-up questions about QuickBooks. I'll be around to help, PinkyK.

Thank you! How will this effect the invoice?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here