We want to make your experience with completing your tax forms as seamless as possible, kwoods06. I’d like to share some helpful insights to ensure your taxes are filed automatically in QuickBooks.

Once you've enabled the automatic filing for your payroll taxes, federal, state, and local taxes will be filed automatically. In your case, we can review the payroll setting and ensure that it's turned on.

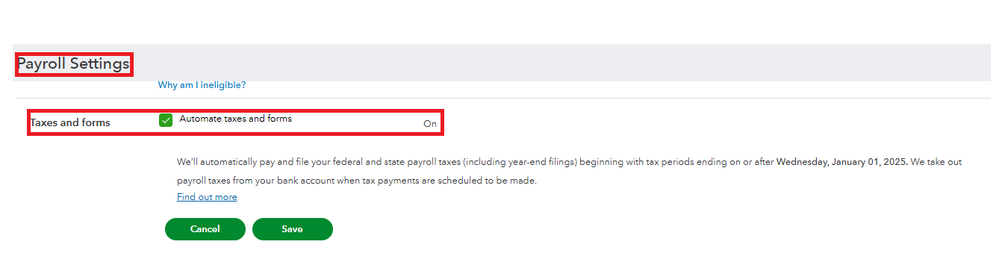

To review your payroll settings and make any necessary adjustments, follow the steps outlined below. If the Automate Taxes and Forms is disabled, this could explain why your Form 941 hasn’t been submitted.

Here's how:

- Go to the Gear menu, then select Payroll Settings.

- In the Taxes and Forms section, click the Edit (pencil) icon.

- Ensure that the Automate Taxes and Forms checkbox is turned on.

- Select how you plan on making your tax payments and filings.

- Click Save.

For more information, see this article: Set up QuickBooks Online Payroll to pay and file your payroll taxes and forms.

If the Automate Taxes and Forms option is enabled, I suggest getting in touch with our Payroll Support Team. They can securely review your account and further investigate the issues regarding the submission of forms. To reach them, click this link: QuickBooks Online Payroll Support.

On the other hand, if you have tax payments made for prior tax periods, see the details from this link to record the entries: Recording prior tax payments.

Feel free to leave a comment below if you have any other questions about payroll taxes or concerns related to QuickBooks. I’m here to assist you.