Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGood evening,

Please let me know if I should post this on another board.

As with most people who start up an organization, I put all of the funds into all the expenses. Plus, at times I've made purchases through my my personal bank account. I won't actually be drawing a salary for the foreseeable future but will need to reimburse myself for any expenses that I don't draw directly out of the business bank account.

I assume that I should set myself up as an employee, correct? I have a lot of work to do to set up accounts, banking, etc., and want to make sure I get things setup correctly to start with.

Thanks,

Chris

Good evening, @SusCSRA. You've come to the right place to help reimburse yourself for any expenses you don't draw directly out of the business bank account.

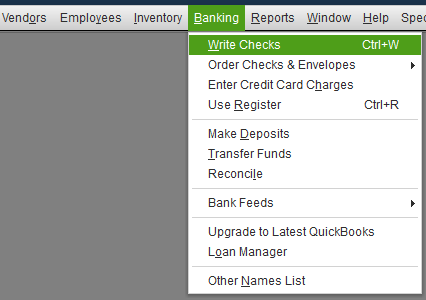

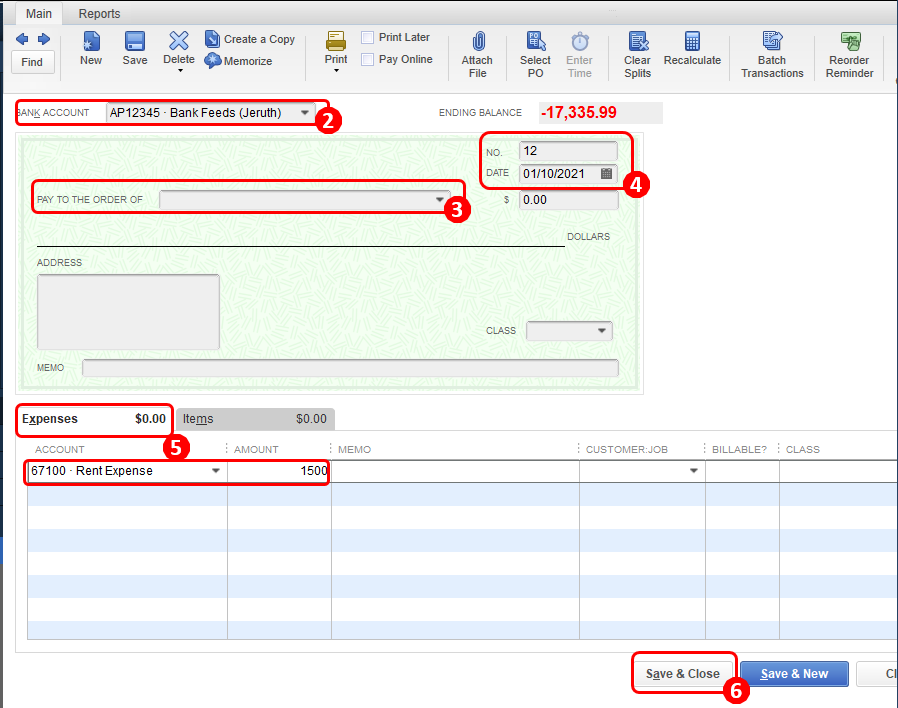

While it is generally advised to keep business and personal funds separate, we understand that there are instances where they may overlap. You don't necessarily need to set yourself up as an employee. If you need to reimburse yourself for a personal expense, you can record it in QuickBooks Desktop as either a check or an expense. Here's a step-by-step guide on how to do it:

Step 1: Record the business expense you paid for with personal funds.

Step 2: Decide how you want to reimburse the money. You have two options:

If you're all good, feel free to explore this extra guide on how to manage checks: Modify, void, delete, or print checks in QuickBooks Desktop.

If you require any additional assistance, please leave a message below. We'll be happy to assist you at any time. Keep safe.

Mich, many thanks for such a quick reply. Now if I and board members are making monthly contributions (can't bring in donations if you don't give too), would you have different thoughts on how each of us would be setup?

Hello again, SusCSRA! We greatly appreciate your continued engagement in the Community space. It's our pleasure to assist you in effectively managing your business contributions in QuickBooks Desktop (QBDT).

Thank you for choosing QuickBooks as your trusted tool for handling your business operations. We prioritize your ability to utilize the program efficiently and effectively. We would be delighted to guide you through the process of recording monthly contributions for you and your board members.

Begin by setting up a vendor for each person and creating an owner or partner equity account. These accounts allow you to track the investments and withdrawals made by individuals in the business. Please follow the steps below:

Please note that before setting up accounts for multiple partners or owners, you need to create a single equity account. Afterward, you can create separate equity accounts for each partner. When filling out the information for the equity account, simply select "Is sub-account" and enter the parent account.

Once you have completed these steps, you can now record monthly contributions. If you have connected your bank account, there is no need to record the investment separately. Simply categorize the transactions associated with your deposits.

However, if you do not automatically import your bank transactions, you can record a deposit into your equity account instead. Here's how:

Moreover, you can keep these resources that you can use in handling bank transactions moving forward:

Please do not hesitate to reach out to us by clicking the Reply button below or posting a new query. We will be eagerly waiting to assist you. We are dedicated to supporting your business venture and wish you a highly productive day, SusCSRA!

Thanks both of you for your help!

Last question (I think) on this topic: contributions in general. As a non-profit taking in gifts from the general public, do these contributors get added as customers? I'll also receive 'gifts' from other non-profits. Do each of these get created as customers too?

Thanks!

Chris

Almost all of the information provided by @SirielJeaB and @Mich_S is incorrect. It is so bad that it is obvious no one with an accounting background at Intuit reviews their answers. Because non-profits are under more scrutiny, you should contact your own CPA/tax accountant on this to avoid putting your exempt status at risk.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here