Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do I record a customer prepayment on QuickBooks Accountants Desktop ver 2024?

You've come to the right place for assistance, PASC. I'm thrilled to assist you in recording customer prepayments in your QuickBooks Accountant Desktop, ensuring accurate financial records and cash flow management.

The prepayments feature in QuickBooks Desktop is only accessible in QuickBooks Enterprise 24.0 or later. If you're using another version, consider upgrading to a newer version of QuickBooks Desktop to have this feature.

If you're a QuickBooks Accountant Enterprise user, you can follow the tailored steps below:

Step1: Enable Prepayments

Step2: Receive prepayments on a sales order or estimate

If you don't have sales orders turned on in your company file, you'll have to turn it on first.

Step3: Apply a prepayment credit to an Invoices

It is important to note that Prepayments are recorded as liabilities until the goods or services are delivered. Once you apply the prepayment to an invoice, you can no longer edit it. If changes are needed, delete the initial prepayment and create a new one.

Additionally, I'll share this article that will help close out your books by reconciling your payments and entries: Reconcile an account in QBDT.

I'm willing to lend a hand again if you have other concerns or questions about handling customer prepayments in QBDT. Drop a reply to this post or create another one. I'm here to assist you and will respond promptly to any inquiries you have.

The prepayment feature works fine ONLY IF you are manually processing a payment in QB from an estimate or sales order. It is not working at all when the customer uses an Intuit payment link (send via QB payments). When the payment makes its way to us we are prompted to apply the payment to the customer's account. HOWEVER there is no option to use the incoming payment as a prepayment. If an invoice is not being paid then the other choice is to keep the payment as a credit on the account. Now how would I apply this credit to a sales order? Or why can't Intuit fix the payment posting screen to allow the option to post as a prepayment against an order or estimate? Waiting for a resolution to avoid serious financial errors caused by some prepayments handled correctly and others not.

Yes, you're right, @Anne16720. I'll tackle the details of applying credit to a sales order in QuickBooks Desktop (QBDT).

At this time, QuickBooks Payments doesn't support recording prepayments. Instead, you'll need to manually record them in QBDT. It's also important to note that you can't apply the credit directly to a sales order. You'll have to convert it first into an invoice. To do that, please refer to Step 3 provided by the previous agent.

Additionally, check out this article to learn when QuickBooks Payments deposits customer payments into your bank account: Find out when QuickBooks Payments deposits customer payments.

Keep me in the loop for any further questions concerning prepayments. The Community is always ready to address any queries you have. Take care.

Accepting prepayments was a new feature in QB24 - but it really doesn't work well at all. I have been waiting for months to have this issue resolved and nothing is being done. QB is accounting software, correct? Well this feature is creating an accounting nightmare on my end. I can send you my step by step cheatsheet to fix our prepayments - it is ridiculous! QB Payments will be increasing our check processing rate in February. How can this be justified when you have your customers doing manual work every day to fix your glitch? I really would like someone in your technical support to contact me and explain why this known and serious issue can not be addressed. I will put in a support ticket (again).

You deserve a better experience than this, Anne. Rest assured, I'm here to get you the best support you need.

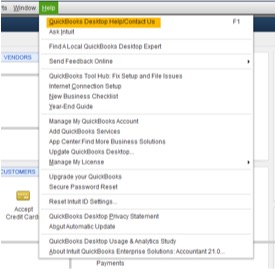

The prepayments feature for QuickBooks Desktop 2024 using QuickBooks Payments is only available for the QBDT Enterprise version. While we don't have a direct way to transfer you to our technical support team, I can guide you through the steps to connect to them. Here's how:

Please know that you can call our support as many times as you like. However, they're only available during their support hours.

After that, consider running a report to see open prepayments on sales orders or estimates.

Let me know if you need further assistance running a report for prepayments in QuickBooks Desktop. I'd be glad to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here