Hello there, mlcs. I'm here to guide you through the process of recording returned items in QuickBooks Desktop (QBDT).

Before we begin, I recommend consulting with an accountant about this process, especially considering the depreciation of the goods and to determine if this method is suitable for your business structure.

To record the returned goods, we need to create a non-inventory item for the returns and set up a discount account if you haven't done so already. Finally, after selling the returned items, you can create a credit memo to apply the amount and offset the outstanding balance.

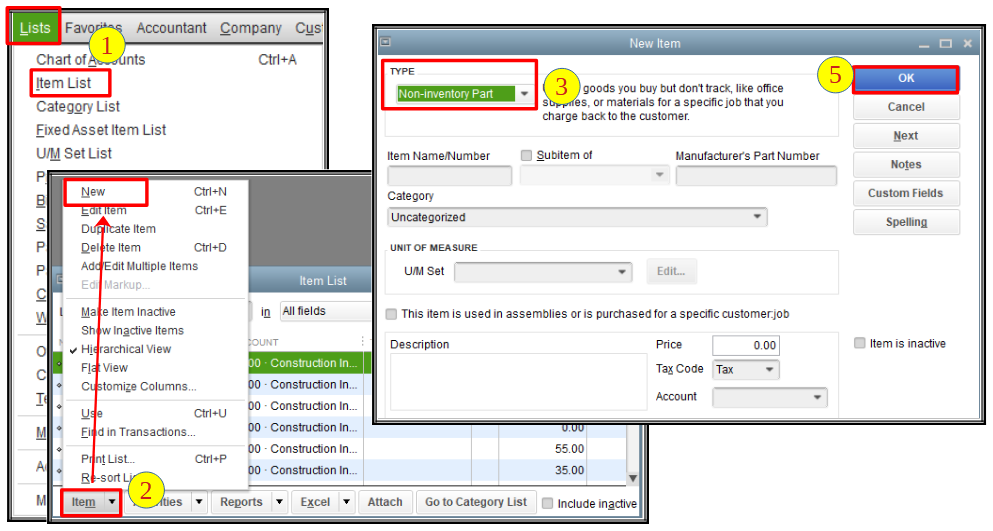

Here's how to create a non-inventory item:

- Go to Lists and select Item List.

- Click the Item dropdown and select New.

- Choose Non-inventory Part in the TYPE dropdown.

- Fill in the necessary details.

- Once done, click the OK button.

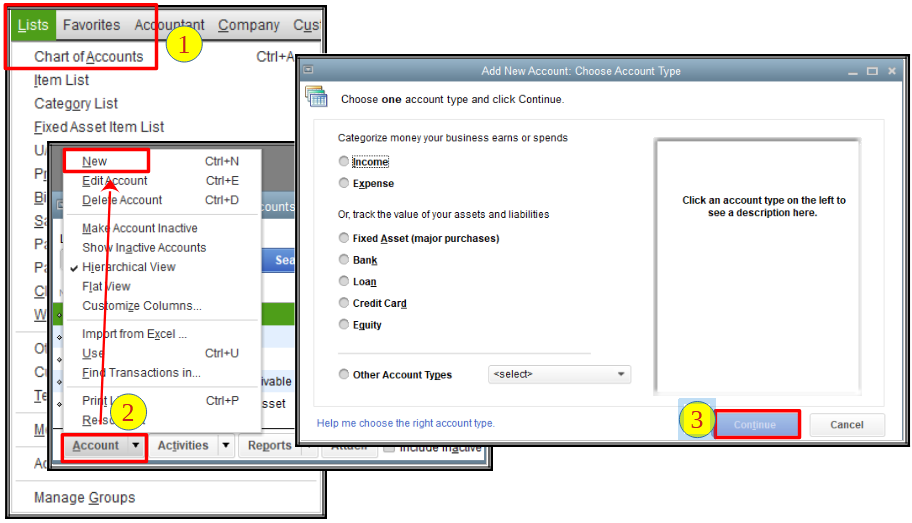

Here's how to create the discount account:

- Go to Lists and select Chart of Accounts.

- Click the Account dropdown and select New.

- Tick the category radio button and click Continue.

- Fill in the necessary details.

- Once done, click Save & Close.

After selling the returned items, you can now create a credit memo to apply the amount to the open invoice. Keep in mind to use the returned goods item. Please refer to this article for the steps: Give your customer a credit or refund in QuickBooks Desktop for Windows.

Additionally, you send statements to your customers to show them summaries of their invoices, payments, credits, and balances.

Please return to this thread if you have other questions about the process, mlcs. We're here to help you in any way we can.