Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

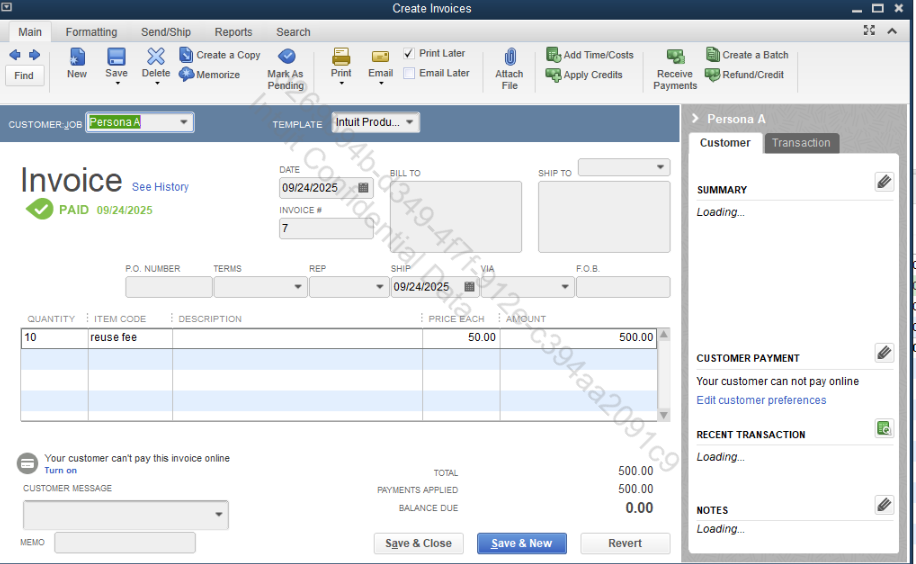

Buy nowI received a check in June that was returned as NSF. I double-clicked the payment and recorded it as a bounced check. For unknown reasons, the new invoice created never showed up in the balance of that job. I received the check for the following month and applied it to the July invoice. I just noticed that the June invoice generated by the NSF seems to have been ignored by QB. Why don’t I have an outstanding balance for June?

Hello there, Crescere.

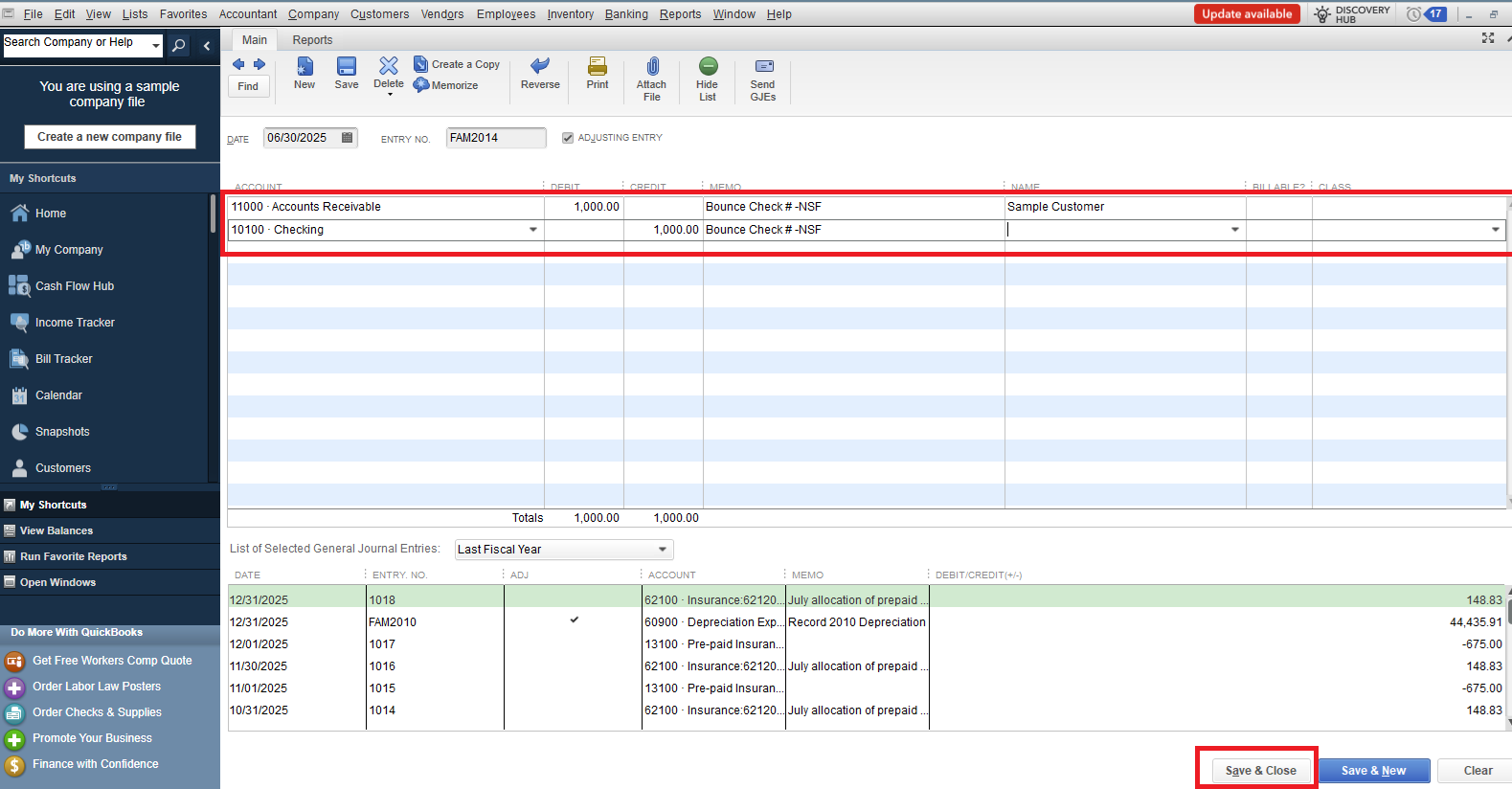

You'll need to manually record the bounced check, as it was not successfully processed. This is the reason why the invoice for the month of June isn't appearing in the job balance. To do that, we need to create a journal entry to reverse the original payment. Here's how:

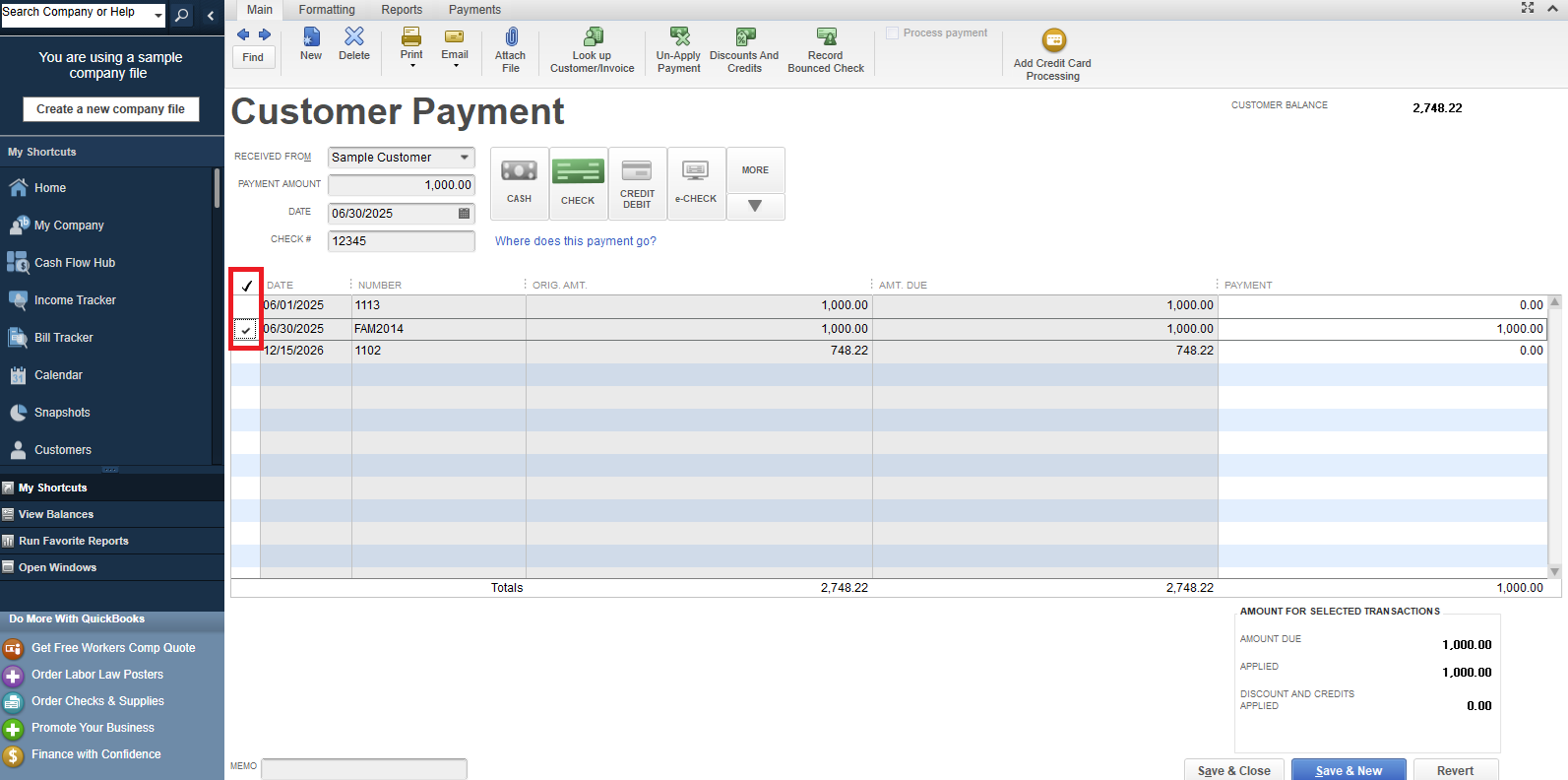

After creating the journal entry, you'll need to move the NSF payment to this new reversing entry. Here's how:

Once these steps are complete, the invoice associated with the bounced check will reappear as unpaid. Then your bank account balance will accurately reflect the deduction for the NSF check.

Please be aware that these steps may be complex and require careful attention. For a better understanding and specific advice, I strongly suggest consulting your accountant. They can offer helpful insights on this matter.

For more details in recording in bounce check, refer to this article: Handle Non-Sufficient Funds (NSF) or bounced check from the customer.

Feel free to visit the Community if you have any questions. The entire QuickBooks Team is always here to help.

Thank you for this comment. However, in my bank account, I already have a deduction, i.e., a credit for that amount. So wont I be double crediting cash?

You no longer need to record a bounce check again, as it will cause a double deduction, crescere.

Since the deduction has already been reflected in your bank account, this confirms that the bounced check you recorded has already been processed.

For now, let's find out why the invoice never showed up in the balance of that job. Could you let me know which specific report you reviewed when you noticed this issue?

In the meantime, using the Verify and Rebuild tools in QuickBooks is a reliable way to detect and fix potential data inconsistencies that might be preventing the invoice from showing on your end. Here's how:

Next, let's proceed to rebuild your company file data by following these steps:

Feel free to reply to this post if you need further assistance.

I used verify and rebuild a few years ago for a different problem at the suggestion of tech support. That ruined all my files and made it all unworkable. Fortunately, I had backed it up. I will never use these commands again.

My data is not corrupted. The fault lies with QB. I followed the procedure for marking that receipt as a bounced check. I have a credit in my bank account, but the AR does not have an outstanding balance. How is this possible, and how do I fix it???

Thank you for providing that additional clarification. The fact that you have a credit in your bank account is a key piece of information, Crecere.

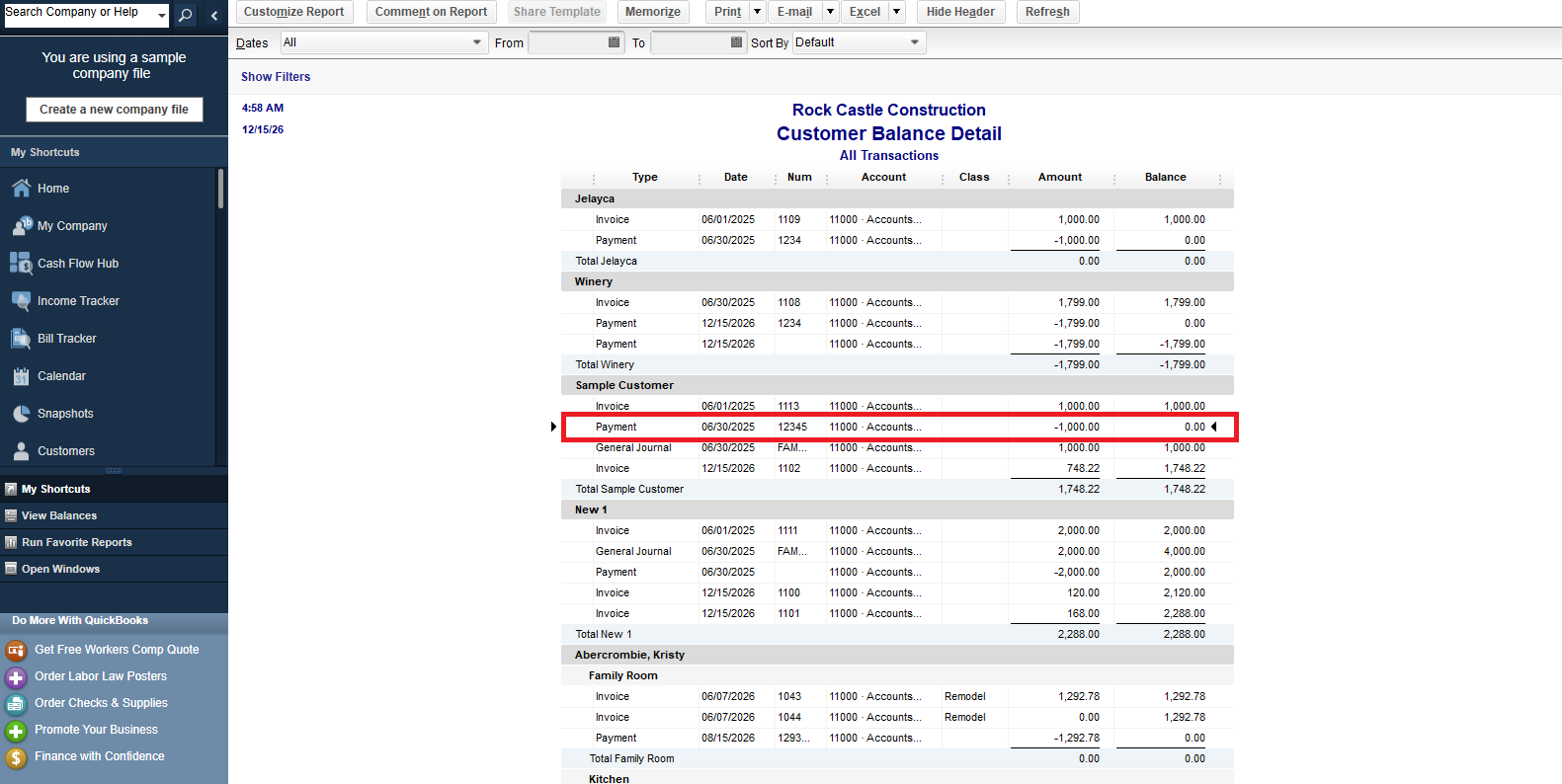

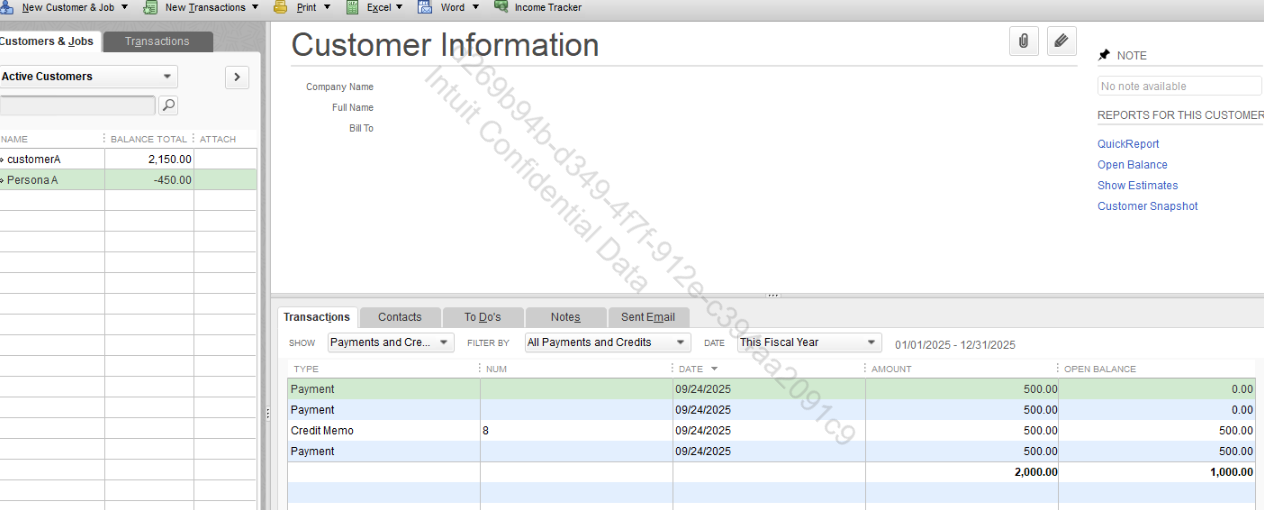

The possible reason for this is that the Accounts Receivable (AR) balance doesn't show as outstanding for June; there are payments or credits linked to the invoices or other unapplied transactions affecting the customer's balance.

To verify this, check the invoice from June to see if a payment applies:

If there are no payments linked directly to that invoice, you should then check for other unapplied credits.

Make a necessary changes after checking.

The Community is always here if you need anything else.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here