Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a contractor that I have hired as a W2 employee. I have changed them in my ADP RUN system and terminated the 1099 profile but the import to tsheets merely archives the employee and does not add the W2 employee. the import log stated that the user was skipped as it is already associated with a different remote user. Can the ADP RUN ID be re-assigned to the new employee profile?

Hi there, JPLynchRN.

Thank you for reaching out to the Community. I suggest reaching out to our TSheets support team, one of the agents can pull up your account and help you set up the ADP RUN ID for your new employee.

You can refer to this article on reaching out to our Tsheet team: Contact TSheets.

Additionally, you may want to check out these articles about TSheets and ADP RUN integration:

Please let me know how it goes, I want to ensure everything has been taking care of. Stay safe!

I have an similar problem I'm changing a W2 employee to contractor 1099. I have an Online Payroll account through Bank of America. I don't know how to make this change for this year.

Thanks for joining us here, @Jwoods687.

You'll want to add your employee as a contractor so you can generate a 1099 form. In QuickBooks, you're not allowed to enter the same employee or contractor's profile; you can just add a period at the end of your contractor's name to make it unique.

To add a contractor's profile:

Please check out this article for more information about: Create and file 1099s using QuickBooks Online.

If you need help with other tasks in QBO, just browse this link to go to our general payroll topics with articles.

Let me know if you still have questions or concerns with employees or contractors. I'll be around to help. Take care and have a good one.

I have a contractor that is transitioning to a W2 employee. Is it possible to convert the same contractor profile to employee? Do I have to create a new profile as an employee? If so, can I use the same email address to invite the employee to Workforce? Presently it is saying user ID already exist.

I'll help you out with this, abhanna.

Yes, you're correct. We need to create a new profile for your employee since converting your contractor's profile to an employee is unavailable. No worries, we can still use the same email address to invite your employee to Workforce.

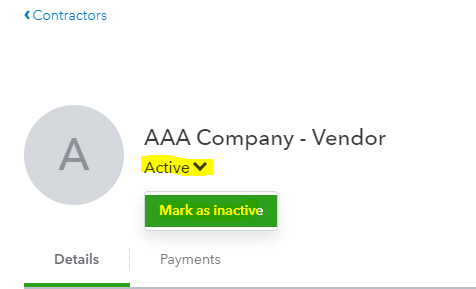

The system will prompt an error saying a User ID already exist because this was used or set up already in your book. To accomplish this process, we need to deactivate or delete the contractor's profile first.

Then, invite your employee to QuickBooks Workforce. This portal lets your employee add or change some personal info, like their name, address, bank account, and tax info. Here's how:

Your employee will receive an email to accept the invite. Afterward, I'd suggest checking these articles to get more details on when to submit your W-2 form and things to do before submitting it: File your W-2 forms.

Here are a few articles for you for additional details.

Feel free to post your QuickBooks payroll concerns in this thread. I'm always around to help you update your employee details and anything related to QuickBooks. Stay safe always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here