Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have searched here for how to set up QB for an Estates and Trusts General Ledger (not Law firm Trust Accounts). The only relevant postings were under 'Quickbooks for fiduciary accounting'.

But they don't solve the problem, and the solutions proposed are for QB online only.

To restate the problem, how do I set up an 'Estate or Trust' Chart of accounts in QB, including Principal Accounts and Income Accounts? Both Principal and Income Accounts need sub accounts for assets, liabiltiies, income, and expense. Both Principal and Income Accounts are in the same set of books.

Reference: Google 'Bloomberg.com, accounting for trusts and estates'.

Solved! Go to Solution.

Dear JamesPaul, Thank you very much. It worked. I set up the trust principal and income accounts under Other Assets and Other Liabilities, and was able to get it to work.

Now the only problem is that I selected 'accrual basis' when I set up the trust, and I need to change that to 'cash basis'. I could not find it in 'help'. How do I do that? JC

I’m glad to know you’re able to create the account, coppens1.

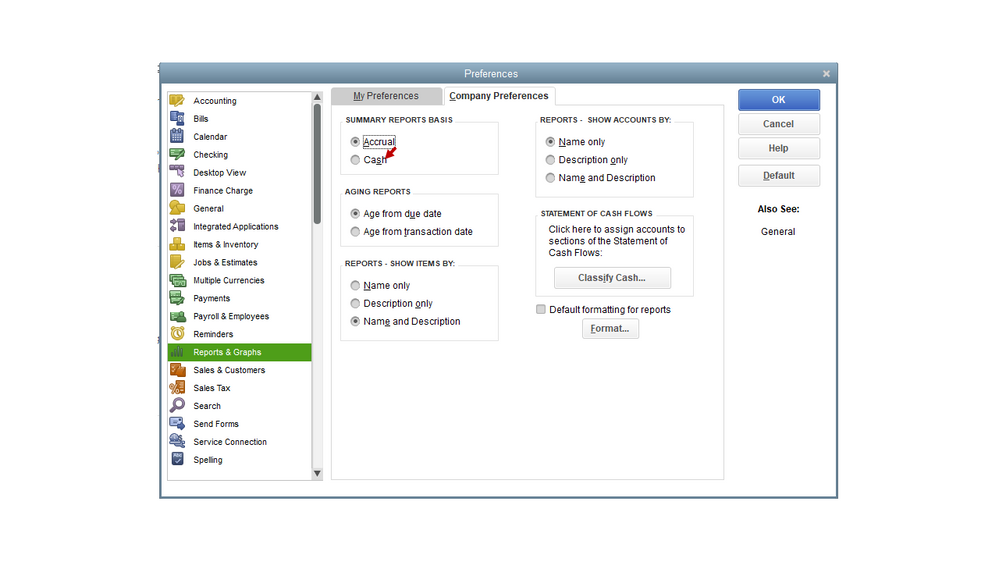

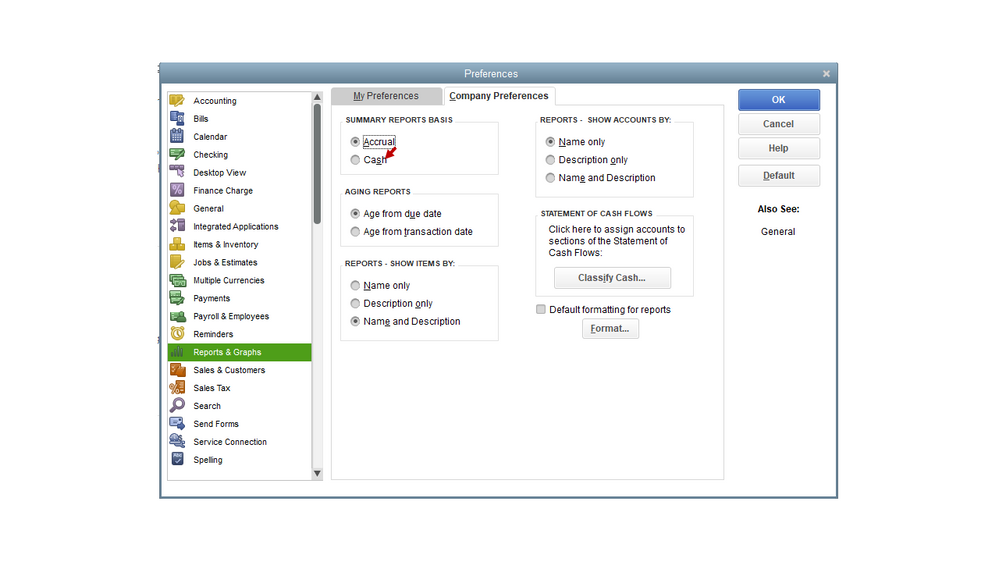

We’ll have to configure the setup in your Preferences to change the accounting method. Let me help show you the steps.

Before proceeding, make sure you’re the administrator in the company file. This is the user type that has permission to update the reporting preferences.

To set the reporting method:

This reference provides more in-depth information into this process: Differentiate Cash and Accrual basis.

Additionally, this resource covers basic information about reports in QuickBooks Desktop: Understand reports. From there, you’ll learn about customizing your statements, memorizing one, setting up a schedule, etc.

Keep in touch if you have other questions on how to set your accounting method. I’ll be around to assist further. Have a great rest of the day.

Hello, Coppens.

I'd like to share a general idea on how you can set up your estate or trust Chart of Accounts in QuickBooks Desktop.

Generally, you can select a specific account type as you manually create an account in QuickBooks Desktop. You can use Other Asset, Other Current Liability and whatnot for your estate or trust Chart of Accounts accounting setup.

To create an account:

This is just a general way of creating your accounts in QuickBooks Desktop. I would still recommend reaching out to an accountant well-versed in the Desktop version.

They'll guide you on how to properly set up the transactions forms to record your entries and help you track your balances.

Since you've already tried Google, you can look for a ProAdvisor near your area: https://quickbooks.intuit.com/find-an-accountant/.

If you need to see those entries and how they are tracked through reports, you can check this article for a guide: Understand reports,

Do you need help recording your transactions or do you have any other concerns regarding your Chart of Accounts? Please let me know and I'll share some details and guides with you.

Dear JamesPaul, That sounds like a good idea. I will give it a try and get back to you. JC

Dear JamesPaul, Thank you very much. It worked. I set up the trust principal and income accounts under Other Assets and Other Liabilities, and was able to get it to work.

Now the only problem is that I selected 'accrual basis' when I set up the trust, and I need to change that to 'cash basis'. I could not find it in 'help'. How do I do that? JC

I’m glad to know you’re able to create the account, coppens1.

We’ll have to configure the setup in your Preferences to change the accounting method. Let me help show you the steps.

Before proceeding, make sure you’re the administrator in the company file. This is the user type that has permission to update the reporting preferences.

To set the reporting method:

This reference provides more in-depth information into this process: Differentiate Cash and Accrual basis.

Additionally, this resource covers basic information about reports in QuickBooks Desktop: Understand reports. From there, you’ll learn about customizing your statements, memorizing one, setting up a schedule, etc.

Keep in touch if you have other questions on how to set your accounting method. I’ll be around to assist further. Have a great rest of the day.

Rasa-LilaM QBTeam 270322 Chg to CashBasis worked

Thanks, it worked. JC

Hello coppens1,

I am so happy our Community was able to help! If you have any questions in the future, don't hesitate to let us know. We will be here to assist!

Dear James Paul, We communicated earlier this year about Trust accounting, and you helped me set up my Chart of Accounts.

I have been successfully recording the transactions for a trust for about 18 months of transactions. But I am not clear as to how to close the income and expense accounts at year end each year. They are included in Other Current Liability accounts, and do not automatically close to retained earnings. What do you suggest?

Bear in mind I am using the regular Quickbooks program, which is normally intended for a 'for profit' enterprise.

No reply from James Paul. How about someone else knowledgeable about Estates and Trusts. Hello, I know you are out there. JC

I've come to help, coppens.

Let me assist you further in closing your income and expense accounts in QuickBooks Desktop (QBDT) to ensure the accuracy of your books.

If you have to close your accounts, don't worry. QBDT performs certain year-end adjustments based on the start month of your fiscal year. Please refer to the following:

I'd suggest reading this article for the full details: Close your books in QuickBooks Desktop.

For further assistance in closing your books, I recommend seeking advice from your accountant. If you're not associated with one, you can visit our Find a ProAdvisor page to find one in your area.

In addition, it's also advisable to reconcile your accounts each month to ensure they line up with your actual bank statements.

Feel free to reach out back to us if you have any clarifications about the income and expense accounts in QBDT. We're always available in the Community to lend you a helping hand. Stay safe, and wishing you continued success!

I am also having an issue with Quickbooks Essentials online. I only need to use this product for tracking the expenses, etc. in the probated estates I handle. As you say, it is not an attorney trust account, but the Executor's bookkeeping that I track for reports to the Probate court. I had a Desktop Account that is no longer supported and am a solo practice in my waning years. Unfortunately, I still would like to use Quickbooks for this type of account tracking. Your comments are the first that appeared to be directed at the same problem I'm experiencing. Surely, there is a solution.

I thought I would check out the desktop app for online products, not to be confused with the online desktop product which is much more than I would need. This app that would mimic the Desktop account map that I was used to and keep me connected so that I don't have to sign in at every instance. The directions say to go to my Settings and select "Get the desktop app". When I open settings there is no such selection before me.

Allow me to address your two concerns, Berry4Holiday.

First, you mentioned that the "Get the desktop app" selection is unavailable on your end. The main reason is that this feature is only available for QuickBooks Online (QBO)Advanced and QuickBooks Online Accountant (QBOA) version. If you want to utilize this feature, you can upgrade your plan.

When you plan to upgrade, here's how:

Second, may I know what you meant by the account tracking you wanted to do in QBO? This way, I'll be able to provide appropriate steps on how you can do this.

I'll also share an article to help prevent unwanted changes before filing your taxes: Close your books in QuickBooks Online (intuit.com).

If you need further assistance, drop a reply below. I'll be here to assist you. Take care!

I am just starting to set up an estate in QB. I have been researching the recommended chart of accounts and related entries for typical opening of estate and transactions. I am very curious what account set up you finally used. One of my concerns is the auto period closing entries and how to force that into the proper equity accounts (e.g. equity principal vs equity income). Would you be willing to share via email? As you know, accurate and streamlined tax reporting/K1s are my goal. Wanting to make is simple by setting up the proper chart of accounts etc.

I am also in the same boat. Did you ever get an answer to this problem?

Hi C, I just ran across your comment; I'm just starting to provide accounting and 1041 to the trustees of an irrevocable trust. I use QB desktop, not QBO. If you are willing, I would much appreciate a copy of your QB chart of accounts and any other tools you are using (Excel spreadsheets, etc.). Thanks... [email address removed]

Hi JP, I just ran across your comment; I'm just starting to provide accounting and 1041 to the trustees of an irrevocable trust. I use QB desktop, not QBO. If you are willing, I would much appreciate a copy of your QB chart of accounts and any other tools you are using (Excel spreadsheets, etc.). Thanks... [email address removed]

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here