Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI just want to see my actual cost vs actual revenue. Example: Item Profitability Report -- list the service/item, then next column is Act. Cost---Act Revenue---($) Diff----(%) Diff.

It shows up with 0.00 under all Act Cost items but Act Revenue and Diff show up (Diff is not correct of course). I have entered all my cost of items and what we sale it for in the Item List, which is where you enter so you can bill out the items. In the item list I have the Name, Description, type, Account, U/M, Price, COST, COGS Acct....that is all the information on the items. What am I missing here?????? It's listed on the reports but amounts show 0.00's.

Welcome to the Community, @Stoney2015. Thanks for sharing the details on what you want to achieve in your report.

The Item Profitability report is designed to show profit and loss by Item over a particular period. It includes the Item, Type, and Current Quantity for the Item.

Let's make the item billable to the customer so the cost amount will be included in the report. Here's how:

I'm also adding an article that's worth reading for an in-depth understanding of the reports in QuickBooks Desktop: Understand reports. It has a list of different reports that provide according to your business needs.

Let me know if you have additional questions. We're always delighted to assist you some more.

Please understand, the item is on the invoice, it is billed out, the invoice is complete, in most cases the invoice is paid.....still no actual cost listed on any report... it shows all zeros. In the item list I have put all the information in such as the cost and what we sell it for. It should show up in the reports. .... why is it not?

Please understand...all that has been done. Everything is where it should be but ALL reports show zeros in the actual cost or cost of goods. Why is it not showing cost on these reports?????

Thanks for getting back to us, @Stoney2015,

There are a few reasons why the Act. Cost column in the Item Profitability Report will show a zero amount. Check this:

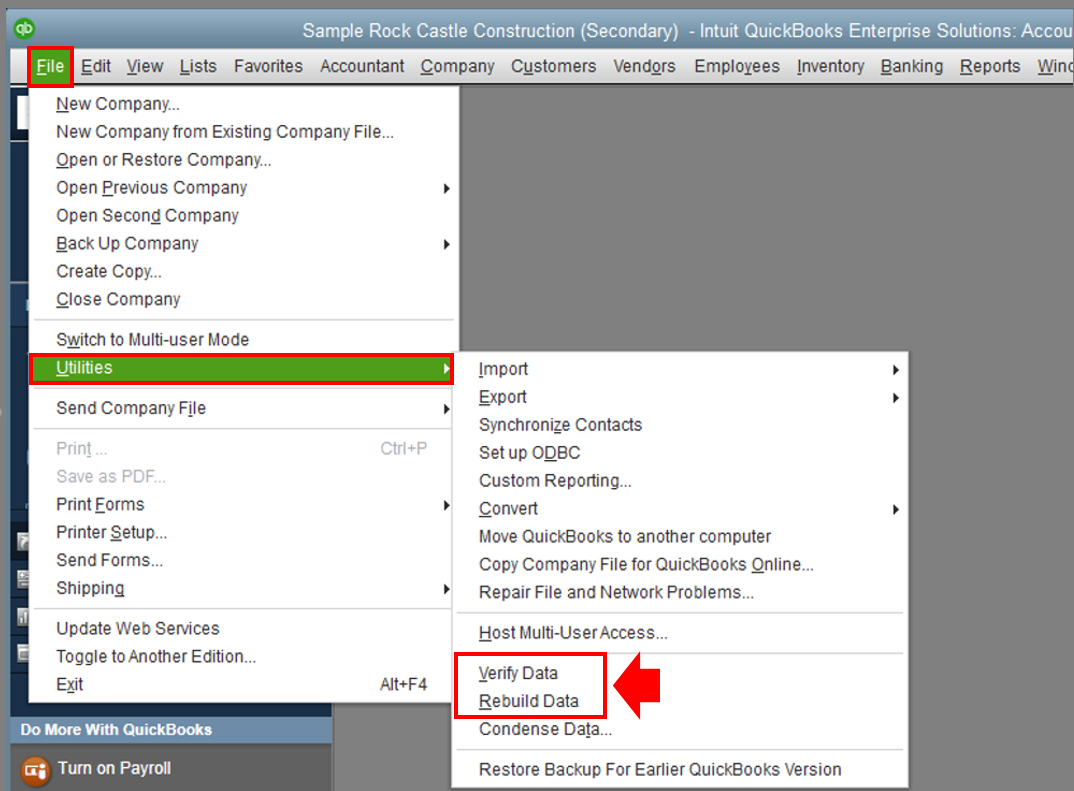

If you set up the item correctly and still not showing the Act. Cost amount, run the Verify/Rebuild Utility to diagnose and fix unexpected issues in QuickBooks Desktop. Here's how:

Once done, launch the report again and see if the same thing occurs. If it doesn't work, please reach out to our Technical Team directly. They can check your company file and provide additional troubleshooting to complete your work.

Contact us through these steps:

Let me know how things go. I'll be right here if you need additional help and I want to ensure you're able to track your margin accurately. Have a good one!

how do iI delete under Customize i want to take out act Difference & act revenue can tell me how please

Hi there, @Lisa4567.

Thanks for joining this conversation. Allow me to hop in and help customize reports in your QuickBooks Desktop (QBDT).

If you're referring to the Item Profitability report that was shared by my colleague above, here's how to take out the Act. Revenue and Diff columns:

To know more about managing and customizing reports in QBDT, consider checking out these articles:

I also recommend visiting our website for more tips and other resources you can use in the future: Self-help articles.

Let me know if you have additional questions about reports or anything else QuickBooks. I'll be happy to answer them. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here