Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowYou can create a referral fee item, jhit.

After creating an invoice, you can create a non-inventory or service item using an expense account. Then, create a credit memo using that item. Once the customer pays the invoice you can link both the invoice and credit memo. I'll show you how:

Create a Credit Memo

Link Invoice and Credit memo

The total amount of the actual received payment is now deducted from the referral fee.

If there's anything else you need help you, just leave me a reply. You take care and stay safe!

I receive referral fees or call it commission s from a vendor on.customer orders. How do I record these payments in Quicknooks?

I've got you covered today, SherBear8512.

I'm here to guide you on how to record commissions from vendors in QuickBooks Online (QBO).

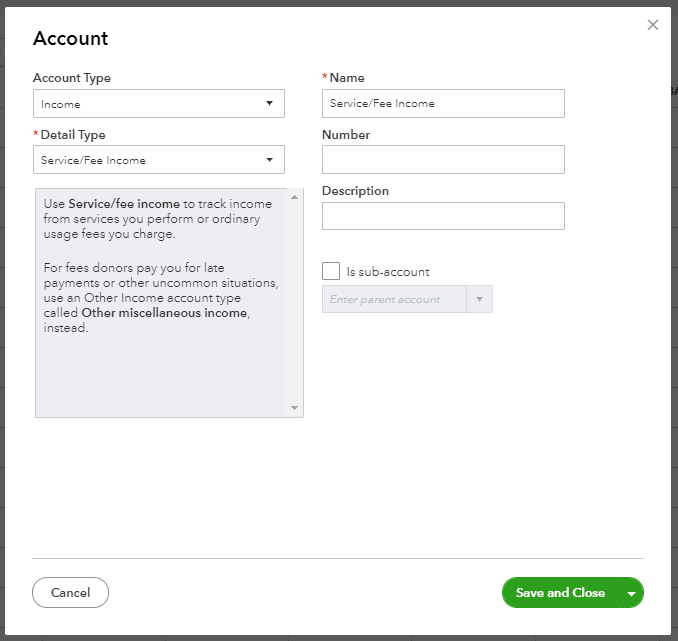

The first step is to create an income account for the commission. Please follow the steps below:

Scan through this article for more information about adding accounts to your Chart of Accounts in QBO: Add an account to your chart of accounts in QuickBooks Online

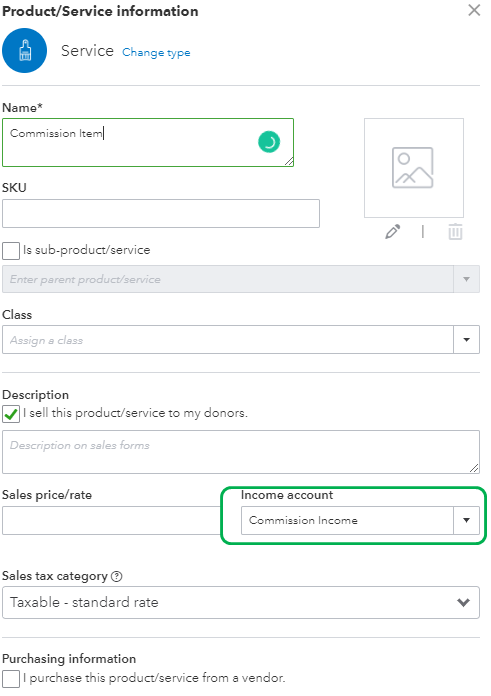

Next is to create a service item and linked it to the income account you've previously created.

Here's how:

Here's an article made handy to be more familiar with managing items in QBO: Add, edit, and delete items.

Once you get the commission check, you can create a Sales Receipt and add the Commission income item.

Here's how:

To help you with future tasks and tips when using QBO, you might want to visit our Help Articles.

Get back to me if you need help with something else. I'd be happy to assist. Enjoy the rest of the day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here