Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have a loan set up as a balance sheet account in QBO. I will make an electronic payment to this loan periodically. Should I do it as a "transfer" or as a "journal entry"? I don't need to record the interest with the payment so it could be a transfer (interest is billed and paid separately from principal payments). Thanks!

Solved! Go to Solution.

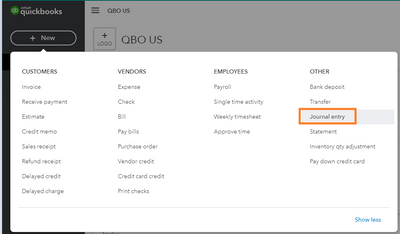

Transfer or JE? Neither and never. Transfers are between same type accounts, mostly bank to bank. You are paying a liability from an asset. JE will just mess you up when all you want to do is record a check.

Use Write Check for payment against principal (the COA account) and post interest as a charge. To properly do this the easiest a loan of this type should be set up as a credit card type and enter the interest as cc charge. Otherwise you will want to post a zero sum Expense that offsets charged interest to principal

Transfer or JE? Neither and never. Transfers are between same type accounts, mostly bank to bank. You are paying a liability from an asset. JE will just mess you up when all you want to do is record a check.

Use Write Check for payment against principal (the COA account) and post interest as a charge. To properly do this the easiest a loan of this type should be set up as a credit card type and enter the interest as cc charge. Otherwise you will want to post a zero sum Expense that offsets charged interest to principal

I have set up an account for a loan. When I write out a check for a payment for this loan - instead of entering it as a minus, it adds my payment to the loan. How can I correct this?

Hello @Mugs,

Let's make sure you have selected your liability and expense account as the line item of your check so it will post a payment into your loan account.

Here's an article you can read to learn more about how you can manage your loan and payment: Make a loan payment in QuickBooks Online.

I've also included this helpful article for more insights about managing your loan: Set up a loan in QuickBooks Online.

Keep me posted in the comment section down below if you have any other questions. I'll be always around ready to lend a helping hand.

I make a loan payment monthly.

My bank transfer the money (send a check) to the Loan's holder (bank account).

However I do not know how to categorize or match it. So how do I record this loan payment? Can you help me?

Hello there, GabrielaIzurieta,

Recording a loan payment only takes a few steps. Here's how:

To enter the payment:

Check this article to learn more: Make a loan payment in QuickBooks Online.

If you have other questions, don't hesitate to post in the Community.

Hi I took out a loan for my business in 2018 but since the business couldn’t, afford to pay it I pay it personally. I still have the loan account in quickbooks. What is the best way to close it out in Quickbooks?

Thanks for joining this thread, @SidiCorp.

I have all the steps you'll need to pay back the business loan using your personal money.

Here's how:

When you reimburse a personal expense, you can record it as a check or an expense. For the detailed steps, refer to this article and proceed to Step 2: Pay for business expenses with personal funds.

You can also check the write-up about mixing business and personal funds for additional reference.

Don't hesitate to visit us again should you require further assistance. The Community is always here to help. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here