Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm trying to better understand how to fully process a transaction using a barter account. My company offers education courses and I contract instructors to teach some of them. Let's say that each customer pays my company $1000 for the training and I have a course with 4 customers ($4000 tuition paid). Rather than pay the instructor a set amount, our arrangement is they receive the tuition less costs paid by my company and a fee paid to my company. For example, let's say that my company rented the facility for $1000, there are $500 worth of materials provided to the students, and my company receives a fee of $100 per customer ($400 total in this case).

I create an invoice for the Instructor (under the Customer) for $1000+$500+$400 for a total of $1900 and receive payment from a barter account.

I create a bill for the Instructor (under the Vendor) for $1000 * 4 for a total of $4000 and pay the bill from the barter account.

My barter account now has a balance of $1900. How do I reconcile that with the payments received from the customers in my actual bank account?

I'm here to help you reconcile the payments received in your actual bank account, @Tim104.

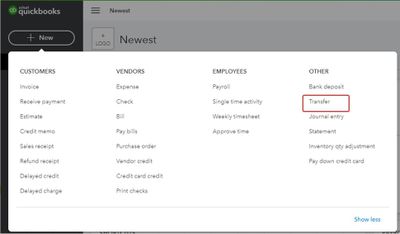

First, you'll have to transfer the barter balance to your actual bank account so that you'll able to include that amount in the reconciliation. I'll guide you how.

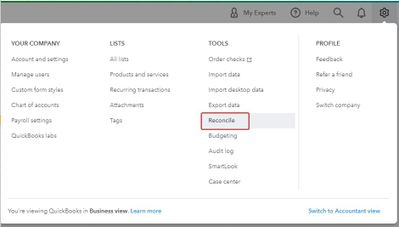

From there, you can start reconciling your actual bank account.

Once done, you can run the Reconciliation Report that summarizes that beginning and ending balances. It also lists which transactions were cleared and which were left uncleared when you reconciled.

Here's how:

Please let me know if you have any other questions or concerns. I'll be around to help. Have a good one.

Thank you!

Before I do that, I want to make sure I am doing it properly. Will this allow me to match it to the payment received from the customer or will this double that amount in the bank account?

Or I am approaching the entire scenario wrong? To recap: customer pays me. I pay upfront costs that the instructor is responsible for, so I create an invoice (that gets handles through a barter transaction) to account for those and the fee the instructor pays me. I create a bill for the FULL amount the customers paid me (to reconcile the barter transaction), and I then ACTUALLY pay the instructor the net amount. I create a transfer to zero the balance in the barter account.

Thanks for adding more details about your concern, @Tim104.

The recommended steps shared by my colleague are how to properly record and match your payment transactions. This process, won't double the amount in your bank account.

For additional reference, let me share this article to guide you in transferring funds between accounts. We also have a page that covers all tasks you can do when handling A/R transactions, please check this link.

If you have other questions or concerns, don't hesitate to comment below. I'm more than happy to answer them for you. Have a lovely weekend.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here