Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We made a sizable midcycle transfer/payment our small business credit card that satisfied the statement balance (and more to open up available credit), but our credit card provider also drafted the statement balance on the scheduled due date a week later. The credit card provider then refunded this unnecessary statement balance draft to our checking account.

This situation caused a deduction to our checking account, the application of that transfer/payment to our credit card balance (which QBO recognized as paired), then the addition of this amount back on our credit card and a deposit back into our checking account.

How would I correctly enter these transitions? Should I pair the original credit/debit? How about the subsequent refund and deposit?

Hello there, @AJMCS.

You can create a credit card credit transaction to record the credit or refund given by your bank. I'll gladly guide you on how to do this in QuickBooks Online (QBO) to keep your financial data accurate.

Before doing so, I encourage you to consult your accountant. They may have specific instructions for the debits and credits to use and provide expert advice tailored to your business needs.

Then, make sure you record all the payments you make to your credit cards. You can to this in multiple ways to maintain accurate financial reports in QBO. Please see this article article for the complete guide: Record your payments to credit cards in QuickBooks Online.

Whenever you're ready to create a credit card credit transaction, follow these steps:

Once your transactions are downloaded, you'll have to review and categorize them to keep your financial data accurate.

Also, I encourage you to reconcile your accounts in QBO regularly (every month). This helps monitor your income and expense transactions and detect possible errors accordingly. You may want to check out this article as your reference to guide you in doing and fixing reconciliations in QBO: Learn the reconcile workflow in QuickBooks.

Please feel free to leave a comment below if you have other concerns about managing checks and other expense transactions in QBDT. I'm always ready to help. Take care, @AJMCS.

I'm following back up on this, as I'm trying to close out the period and am not 100% confident the instruction in the reply are applicable to what happened in our case.

It was probably a mistake to refer to the transaction and a refund, it was a reversed payment. Both of transactions have been downloaded into our bank feed waiting to be categorized, the credit card showing 'spent' and checking account, 'received', as the money moved/was reversed from the credit card to the checking account.

What would the next steps be?

Hi there, AJMCS.

I'll ensure you can manage downloaded bank transactions in QuickBooks Online (QBO).

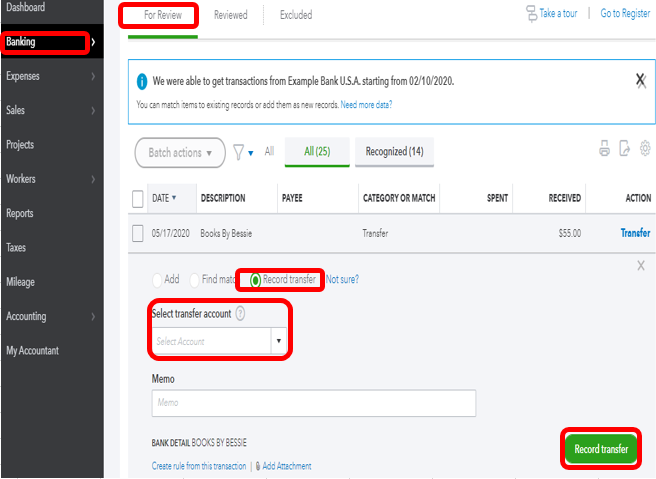

If you have imported transactions in your banking feed for both accounts that aren't entered as a Transfer in QuickBooks, you can record it as a transfer from one account. Then you can match the transaction from the other account.

Here's how:

I’ve included this reference that will guide you with keeping your financial records accurate effectively: Reconcile an account in QuickBooks Online. This will help you review and ensure that QuickBooks entries match with your bank account statement.

Let me know if you have further questions about your banking transactions. I'd be delighted to work with you again. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here