Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowStarted my business last fall, so this is my first tax year. As I'm pulling reports, the income listed by QB seemed significantly higher than what it should be. In my Business Overview report for sales for 2022, it lists amounts for both Sales and Services. The amount for Sales is close to the income amount I have from the vendor I run my payments through, and I have all of my income in QB categorized under sales. But then there is another large amount under Services, which almost doubles the income that QB is using for my tax info. I have no idea where that amount comes from. I've been through my transactions with a fine toothed comb and can find nothing categorized as a service and I'm not sure how to corr

Let's get them sorted out @JennZee.

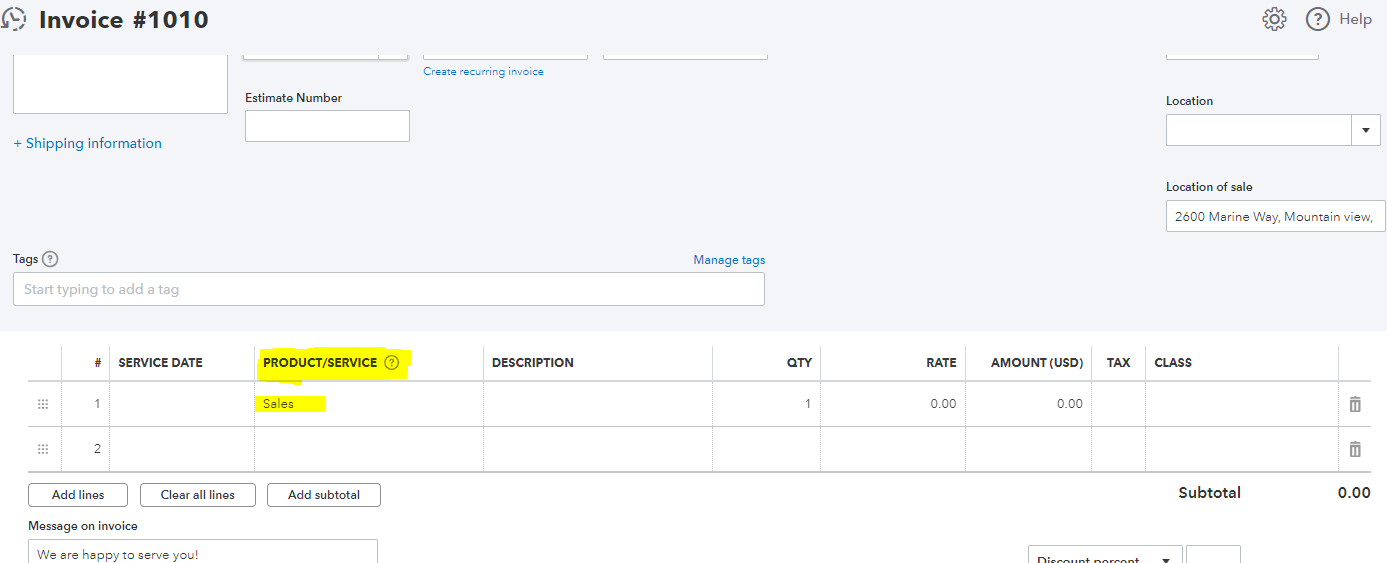

First off, the amount showing under the services comes from PRODUCT/SERVICE that you added when creating invoice and sales receipt. Here's a screenshot below for your reference.

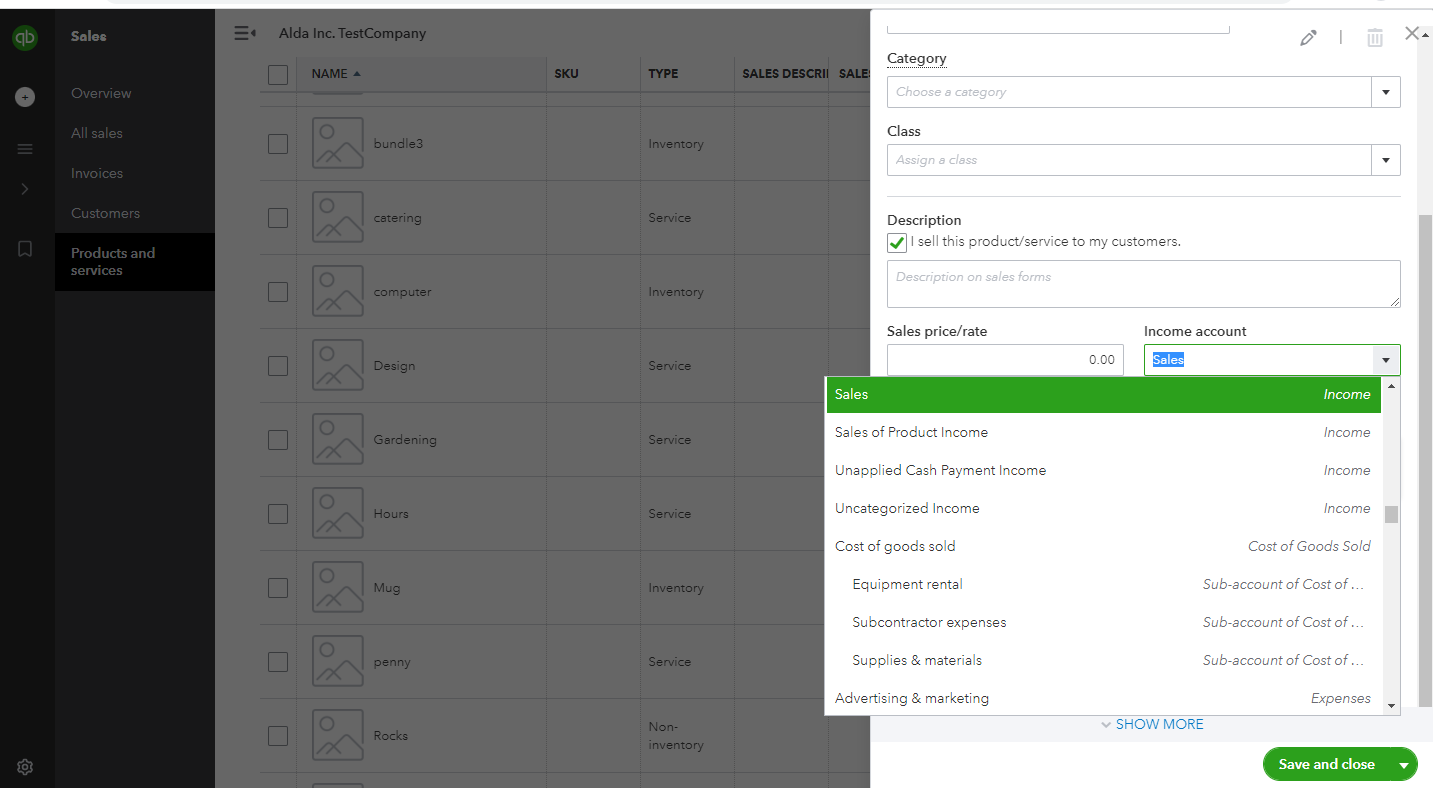

That being said, you'll want to review each of the transaction to verify the added items under services. You'll also want to make sure that the added service item goes the right income account. Let me show you how:

Select Sales on the left pane meu.

Under Sales, choose Product and Services.

Locate the item/product and click Edit under the action column.

Check out this screenshot below:

If everything is good on your end, browse this additional reference about fixing monthly balance differences on the account: Reconcile an account in QuickBooks Online.

You're always welcome to post back in case you need extra help with QuickBooks in general. We'll make sure to respond as soon as we can. Stay safe!

Feeling a bit like a kindergartener with this, so thanks for your patience.

I don't see "sales" an an option in my left pane menu. I did find "products and services" under the "get paid" item in the menu....same thing? If so, it gives me the option to add a product or service, but at this point there is nothing there. All of the deposits are simply coming in through my bank account. I use a different program to send invoices and receive payments, so I haven't don't anything in QB with invoices. Perhaps I need to create a service that I can attach these deposits to as they come in from my bank account? As I look at each of these transactions, I can't seem to see where to add that information though.

I recognize you're having challenges with your transaction, @JennZee. Let me assist you in identifying whether any duplicate transactions have been recorded to your Quickbooks Online account.

But before we start, I'd like to clarify if you connect your bank account to your QuickBooks Online account.

Next, I suggest running a Profit and Loss Detail report. This way, we can determine if all banking files are duplicates.

Follow the steps below:

If you find duplicate files, click the invoice or sales number, click the More option at the bottom, then hit the Delete tab. Moreover, we can also Undo the duplicate transaction in the Banking tab.

Furthermore, you can match your bank statement to your QuickBooks transaction, so you'll be guided on what transactions to add to your QuickBooks account. Check out this article for more information: Undo transactions.

It is also vital to reconcile your accounts in QuickBooks. If you encountered an error the first time your books, refer to this page as your reference: Fix issues the first time you reconcile an account in QuickBooks Online.

Don't hesitate to come if any error happens while navigating your QuickBooks account. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here