Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

Hi, office@impressca.

Thanks for stopping by the Community for help, you absolutely can hold the deposit as a security deposit and I'm happy to show you how. Follow along below:

The funds should be treated as a liability to show that it doesn’t belong to you until it’s used to pay for services.

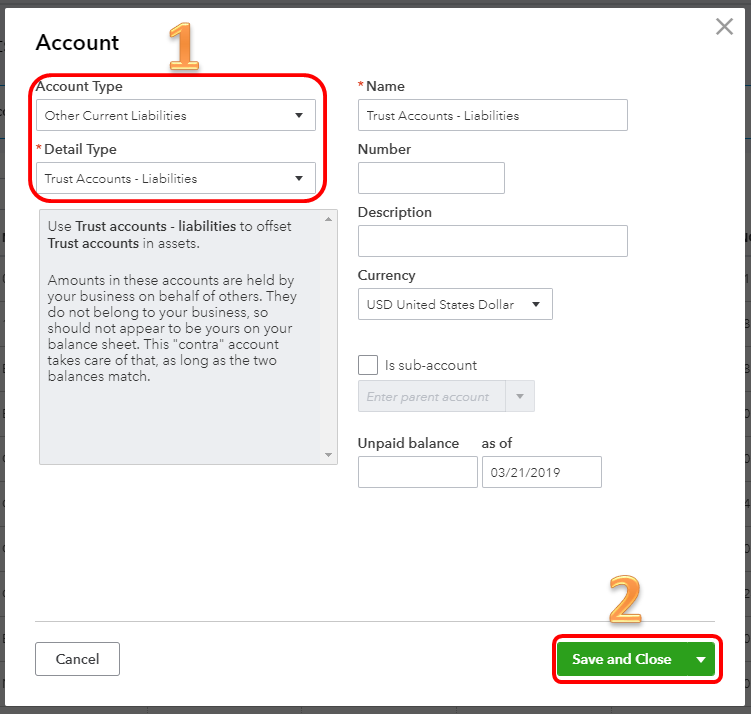

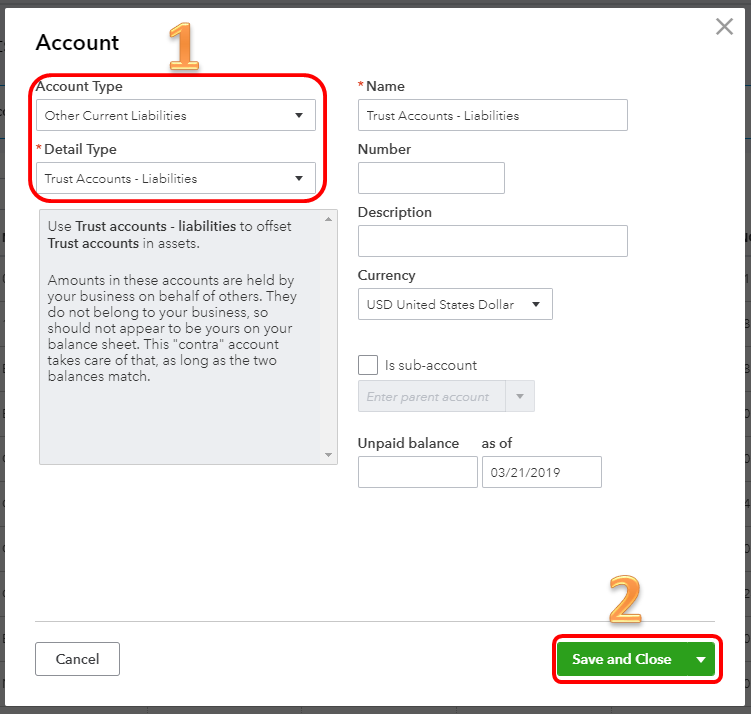

First, let's create a liability account to track the amount of security deposits. Here's how:

Next, create a service item that you can use when recording security deposits. Here's how:

When refunding a security deposit, you must first issue a check for the portion to be refunded.

Here's how:

Here are some articles for the complete details about security deposits:

The information above should help you with the security deposits.

If you have any other questions or concerns, feel free to post them here, night or day. Thank you for your time and have a nice Tuesday afternoon.

Hi, office@impressca.

Thanks for stopping by the Community for help, you absolutely can hold the deposit as a security deposit and I'm happy to show you how. Follow along below:

The funds should be treated as a liability to show that it doesn’t belong to you until it’s used to pay for services.

First, let's create a liability account to track the amount of security deposits. Here's how:

Next, create a service item that you can use when recording security deposits. Here's how:

When refunding a security deposit, you must first issue a check for the portion to be refunded.

Here's how:

Here are some articles for the complete details about security deposits:

The information above should help you with the security deposits.

If you have any other questions or concerns, feel free to post them here, night or day. Thank you for your time and have a nice Tuesday afternoon.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.