Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI've got you covered, @janiece.

Generating a second paycheck for the same person on the same day is a cinch, I'll guide you through doing so below:

Creating additional paychecks

Using this method, you can create as many paychecks for an employee as you need, regardless of period. We also offer a detailed guide on creating paychecks in QBO for your benefit. Please keep in touch with me here for all of your QuickBooks needs, I'm always available to lend a hand. Thanks for dropping in, wishing you a happy holiday season.

"Net pay must be greater than 0. To pay [employee], increase the pay or decrease the deductions. To exclude John from this payroll run, clear the checkbox."

It gives me this notice when i adjust the extra hours that i need to pay

Let me share this overview I have about this message, @luisa1.

This prompt message in QuickBooks implies that the net payment amount of your employee is less than 0, which is not allowed when processing payroll. You must enter an amount at least greater than zero to proceed.

QuickBooks will not allow you to enter a negative net pay to record a deduction to an employee. If you have mistakenly entered a paycheck, you may need to delete and recreate it if it's just processed through a paper check.

If it's Direct Deposit, you have to Void if it did not pass 5PM PST within the day. If it's beyond 5PM, you'll need to make an internal agreement with the employee to catch up on taxes on the next paycheck.

However, if you intend is to create a zero net paycheck for the following reasons below:

You can review this article for the detailed steps on how to create a zero check depending on the reasons above: Create a zero net paycheck.

Please leave a message through this post if there's anything else I can help you with.

I have an additional question in regards to this.

If you are running your payroll, and you want to make two checks for the same employee, do you need to first finish the current payroll, print checks and then go back and make the second check or can you do both checks at the same time?

Please let me know.

Thank you

Hey, @EdithC.

It's great to see you back in the Community. I appreciate you joining in on this conversation about generating two paychecks for the same person on the same day.

You'll need to finish the current payroll and then go back and create the second check. Review the steps from my colleague at the beginning of this discussion and use those to perform this action.

Use this guide to learn more about creating paychecks in your QBO account.

Feel free to come back if you have any trouble creating these paychecks. Have a splendid day!

Thank you Candice! I really appreciate the clarification!

I know Quickbooks has a lot of awesome features and it is constantly improving, I hope that soon it adds the option to add a second check at the same time without having to finish the first set of checks.

Thank you again!

Your ideas matter to us, EdithC.

I can see how the functionality to add a second check without having to finish the first one would be beneficial to your business. With this, I'd recommend sending a feature request directly to our Product Development team. This helps us improves your experience with the program.

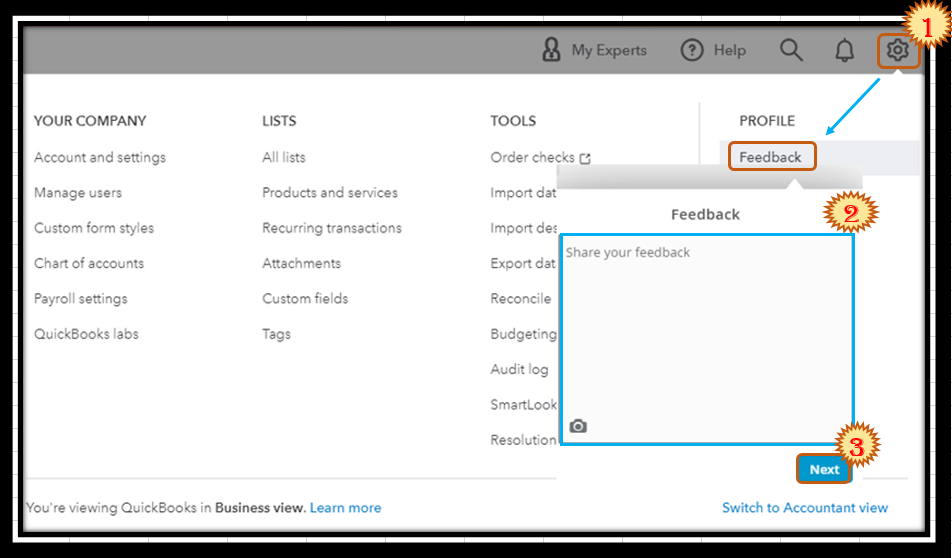

Here's how:

You can track your feature requests through the Customer Feedback for QuickBooks Online website.

I've also included this article that'll help you get a closer look at your business' finances and employee information: Run payroll reports in QuickBooks Online.

I'm only a few clicks away if you need assistance creating and managing checks in QuickBooks. It's always my pleasure to assist you.

Thank you Charlene, I will!

I'm excited to see this new function become available in the future, EdithC.

If you have any additional questions or concerns, don't hesitate to post again. We're always here to help you whenever you need it. Have a great day.

It will be great!

Thank you!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here