Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello there, @ctlbill.

Yes, you can make it as non-taxable by modifying the item details.Let me show you the steps below.

Here's how you can edit and set your items as non-taxable:

This way, your products and services will now be non-taxable items.

Here's a screenshot for your visual reference.

Also, for future reference, you can check this hyperlinked phrase about how to enter late fees or finance and service charges on invoices.

I'll be always around here in the Community to help you if you have any other questions. Have a great week!

My late fee's are set to Non-Taxable, however the automated late fees is still marking them as taxable.

My screen does not look like yours, it has a tax category. I have screen shots if needed but this form would not let me post them.

Hi ctlbill,

You can turn off the automatic late fees from the settings. Let me walk you through the step-by-step process.

Please read this handy article for more information about setting up and applying automatic late fees.

If you have other questions and concerns about fees, please let me know. I'd be more than happy to assist you further. Have a great one.

My late fees are also set to be nontaxable and continue to automatically post with tax applied. I have to manually uncheck the tax for all invoices. Screenshot shows correct settings. Any way this can be addressed?

Welcome to the thread, @jmd1.

Thanks for providing a screenshot and detailed information about your concern. It was super helpful, and I feel like we are on the same page.

I have replicated this on the Test Drive company and was able to see that late fees are no longer applying tax automatically when setting to Nontaxable.

To isolate the issue, I recommend changing the Sales tax category for late fees using a private browser and check the invoice right after. Some function modules may be affected by outdated cache files, which can slow down and affect QuickBooks functionalities.

Here's how to open it:

If it works, then your main browser may have too much historical data from previously visited websites which causes this kind of behavior.

To ensure this doesn't happen again, it's a good idea to clear the cache of the browser you're using. The following article contains additional insight, as well as steps for the supported browsers: Clear cache and cookies to fix issues when using QuickBooks Online.

To learn more about the items, you add to lists and use on sales forms, read this article: Adding Products and Services, Customers, and Vendors to Lists.

Please let me know how it goes. I'll be looking forward to hearing back from you. Have a great day!

**Say "Thanks" by clicking the thumb icon in a post.

**Mark the post that answers your question by clicking on "Accept as solution".

I just want to point out that it's the system applying the late fees with the wrong taxable status. If I manually enter a line item it works correctly. The settings remain consistent, and correct, regardless of what browser or system I use (Chrome, Safari, Mac app).

Today when a late fee was automatically applied by the system it posted as taxable again, even though all settings are set to non-taxable. This essentially means I need to monitor every invoice that is approaching a late fee date. It seems like this is outside the scope of my browser and more of a system issue that I have no control over.

Thanks for your continued help!

Hello again, jmd1.

Thanks for reaching out to the Community about the late fees being marked as Taxable. I’m here to share some information about this unexpected behavior you’re experiencing.

We’ve received reports that some users are being taxed for the late fees, even if the item is non-taxable. This issue is being worked on by our engineers with utmost urgency.

While there isn’t any workaround available, we’ll have to add your company to the list of affected users. This is to ensure you’ll receive email updates about the investigation.

I have to collate sensitive data to verify the account. The security and safety of your personal information are our top priorities, so I suggest contacting our QBO Care Team.

One of our specialists can add your name to a secure environment. The most up to date contact information can be found below:

For additional information about the Automatic Late fees feature, check out the Set up and apply automatic late fees to invoices article. It provides an overview of the steps on how to edit the late fees on invoices, set a custom fee, and answers to frequently asked questions.

I appreciate your patience while we’re working for the permanent solution. Reach out to me if you need some help while working in QBO. I’m always ready to lend a helping hand. Have a good one.

Can I be added to the affected users list? I have the exact same issue. It is nontaxable in products & services, but when it is automatically applied it appears as taxable. Thank you!

I can share some information that can resolve the error you're having about your products and services that appears as taxable, @ambrosee.

The INV-46845 about late fees that are added as taxable is already closed and resolved. Since you're still having trouble with this, I recommend contacting our Customer Support staff. They can access your account in a secure environment, identify the problem, and resolve it.

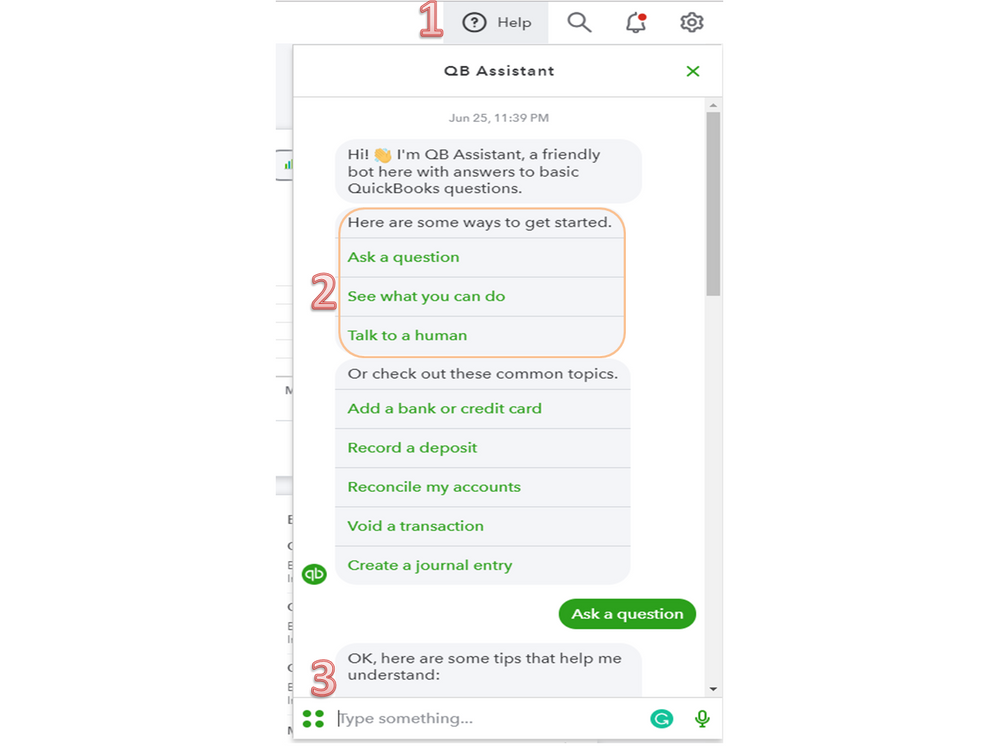

You can contact our QuickBooks Online (QBO) Customer Support by clicking the Help symbol in the top right corner of the account. Take the following steps:

Check this article for more information about the different types of support we offer and their availability: QuickBooks Online Support.

More information on how to set up and add late fees to outstanding invoices can be found here:

Once you receive the payment, here's how to record them in your account: Record invoice payments in QuickBooks Online.

You can always get back to me if you have questions or other concerns about your products and services by leaving a reply below. I'm always here to assist. Have a great rest of the day!

I am having this same issue. I noticed these messages are from 2 years ago so clearly this is not something that has been resolved. If anyone has heard or knows of a fix please let me know.

I am having the same issue.

I know it isn't easy to encounter issues while doing a task, dawnh@traviselec.

If you haven't already, modify the item details to non-taxable. Here are the steps:

If the issue persists, I suggest contacting our Customer Care Support. This way, one of our agents can take a look at your account and have this better check.

The Community is open to help 24/7 if you have other questions.

Our company is also on the affected list. Our late fees automatically applied are showing taxable even when the box is unchecked on the invoice.

Please refer to previous thread. This is happening when late fees are auto posted to the invoices not when manually posting them. This is a real issue that I wish QB would address. Removing the late fee sales tax from the invoice after system generated doesn't work very well when recurring invoices are sent and already to the customer with sales tax applied. Please escalate this issue and get some resolution!

Same issue here. I wish I could say it was unbelievable that this is still an issue after being reported at least over three years ago, but I am really not surprised.

Please, if anyone at Intuit is reading this and has any influence to escalate this issue, do so.

It is incorrect (and illegal) to collect sales tax on taxable items in California and probably/possibly the rest of the United States too. Maybe the IRS and state tax boards need to be made aware Intuit has been knowingly doing this for over three years?

Hello @teamone,

I agree it's important to take action about how the late fees work in QuickBooks Online. I would feel the same with the need to perform a workaround to correct the details of a transaction.

It negatively impacts the productivity and compliance of the users with rules and regulations related to late fees. Please know that we value your feedback about the inconvenience of using this ability.

Our product engineers provide regular updates to improve the features and options in QuickBooks. For now, I encourage affected users to send feedback to get this feature sorted out as quickly as possible.

We also make changes and adjustments based on user feedback. Here's how:

Also, customizing the appearance and layout of sales forms is a simple yet effective way to enhance your business communications. I've included a link for more information about personalizing the forms in QuickBooks: Customize invoices, estimates, and sales receipts in QuickBooks Online.

Don't hesitate to reach us here if you have questions or concerns about the QuickBooks features or managing sales taxes. The Community and I will be happy to help you some more.

This reply is infuriating and frustrating. Why even bother? Three years and dozens of posts just in these forums and who knows how many feedback reports and no action?

The "workaround" is ineffectual and unhelpful. Are you really suggesting to somehow keep track of every late fee as it is automatically applied to an invoice without way for me to know and then edit each one, contact each customer individually to explain not only did they get a late fee, but it is for the incorrect amount? Let's try to be serious here, at least.

How do I stop QBO from including late fees as taxable items on invoices? The late fee item in Products and Services has Non-taxable selected but when QBO adds late fees, they are marked as taxable and included in the taxable subtotal for sales tax purposes. Thanks in advance for your help.

Is there an update on this issue? Late fees that are automatically applied on invoices are still showing as taxable for us - confirmed these are on non-taxable items.

We are also experiencing the same issue, this is unacceptable that QB cannot make this simple change.

Please advise on the status of this issue.

October 2024 and this is STILL an issue for so many of us!

Intuit needs to come up with a solution and not just automatically make late fees taxable when QB automatically applies the late fee.

Our services are not taxable and some of our customers are tax-exempt, yet QB still adds the late fees as taxable! This needs to get resolved!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here