Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowLet me please set the table. Lets assume that I have to pay $1,000 rent at the beginning of each month. Let say I can defer my rent for a few month. Each month I'll book the following transactions:

Jan 1, credit payable $1,000 debit rent $1,000

Feb 1, credit payable $1,000 debit rent $1,000

On March 1 I have cash and I can pay three months rent, so I write a check for $3,000 and book the following transaction in the checking account

Rent 1000

payable 2000

When I run my P&L on a cash basis, it only shows the rent for March $1,000. What am I doing wrong?

Solved! Go to Solution.

Yes, and Write Checks works great for current expenses or paying down liabilities. But the scenario you posed calls for Vendors>Enter Bills, Pay Bills. A Bill posted 1/1 and paid 3/1 is accrual expense on 1/1 and cash expense on 3/1.

Do you have a mismatch of names between the A/P credit znd debit? In a journal dntry as you would have been cautioned with a popup. A name is required for A/P entr^^^

But what I wonder is why you went through the hassle of debit/credit when a Bill for rent each month would just sit until paid? Then when you paid in March you would have cash badis expense in March of $3000. In cash basis you cannot book expenses in Jan and Feb that were not paid then. That is accrual accounting and nothing special has to happen other than a Bill for the expense to post then even if unpaid

Thanks John. The above situation is an example. This also happens with receivables. My taxes are done on a cash basis, my P&L and BS has to be on accrual basis.

QB is by default accrual basis accounting with the option of viewing reports as either accrual or cash with no fancy data entry required. Pere your example, your rent expense for cash basis only happens when you stroke a check but if you run P&L on accrual your rent bill shows expensed when billed (same with customers and invoices, income to you )

@qtl wrote:

Let me please set the table. Lets assume that I have to pay $1,000 rent at the beginning of each month. Let say I can defer my rent for a few month. Each month I'll book the following transactions:

Jan 1, credit payable $1,000 debit rent $1,000

Feb 1, credit payable $1,000 debit rent $1,000

On March 1 I have cash and I can pay three months rent, so I write a check for $3,000 and book the following transaction in the checking account

Rent 1000

payable 2000

When I run my P&L on a cash basis, it only shows the rent for March $1,000. What am I doing wrong?

@qtl How are you recording each month? You mentioned credit payable as if it seems you're writing a Journal type. If you're entering Vendor Bill type each month (Jan, Feb & March) and payment on March for $3,000, P&L on a Cash basis should show a $3,000 expense in March. This is on QuickBooks Desktop.

If you click on "Write Checks" on the home page, you'll see an image of a check on the top and on the bottom you can select the accounts that are impacted by this check.

Yes, and Write Checks works great for current expenses or paying down liabilities. But the scenario you posed calls for Vendors>Enter Bills, Pay Bills. A Bill posted 1/1 and paid 3/1 is accrual expense on 1/1 and cash expense on 3/1.

Thanks @john-pero

Now I am having an issues with prepaid expenses. Lets say that I pay 12K for one year worth of insurance on July first 2019. On a cash basis my P&L should reflect 12K in insurance expense. On accrual basis my P&L should show 6K in insurance expense and other assets prepaid expenses 6K. However both cash & accrual P&L show 6K. I followed the procedure on the following link:

Any advice? TIA

Good day, qtl.

The insurance payments are made via journal entries, as stated in the article. This means the payments are directly reflected in the P&L no matter what reporting method you'll use. The Accrual and Cash basis reporting methods will matter if you use bills.

You'll want to seek more guidance from your accountant, especially when dealing with journal entries.

Please post again if you need anything else. Wishing you all the best!

Thanks Alex, I read your response several times and I don't think you understood my question. My issue is not accounting (as I am one). My issue reaching my objective thru QB. Again I need to have accurate cash & accrual financials. Can you detail If I can reach my objective for prepaid expenses (in this case insurance expense) using QB?

Allow me to jump in on this thread, @qtl.

As my colleague mentioned, using journal entries when receiving the payments will not affect the report basis of the P&L report. You'll want to create bills and then pay them to view the different amounts on the report.

Her's how:

Once you're done, you can now create payments via the Pay Bills window. I'll guide you how:

I've also included an article that'll help you check the complete list of workflows and other vendor-related transactions: Accounts Payable workflows in QuickBooks Desktop.

Don't hesitate to click the Reply button if you have other QuickBooks concerns. We're always here to help. Take care always.

As @CharleneMaeF Detailed the actions I will not repeat them but to emphasize that in quickbooks, journal entries BYPASS the differences between cash and accrual. In addition, an expense or income entered in a hournal entry will not be displayed in a transaction by vendor or customer.

That is why you must use bills and bill pay to properly record the expenses you wish to show as accrual on the date of each bill and cash paid on date of payment

Thank you @CharleneMaeF . Let me make sure that I have communicated what I want to achieve.

1. I want my P&L and Balance to be accurate on "Cash Basis" and "Accrual Basis"

2. I am paying my insurance company 12K on 7/1/19. This is insurance for one year.

3. on 12/31/19 my "Cash Basis" P&L should show 12K in Insurance Expense.

4. on 12/31/19 my "Accrual Basis" P&L should show 6K in Insurance Expense and my balance sheet should show 6K in prepaid.

I followed your instruction to the best of my understanding, it achieved item 3 but not item 4. Would you kindly create a QB file with necessary transactions that would achieve item 3 & 4 and upload it. If QB files don't contain registration info, I can upload the test file that I have created for your review.

Thanks again for your kind reply.

@john-pero, Thanks for taking time to reply to my question. I think I am following the use bill and bill pay properly as outline on this board by you and others. Yet I am not achieving my objective. So let me ask a direct question:

Is it possible in one QB file achieve what I outlined in my response to @CharleneMaeF ?

Allow me to join the thread, @qtl.

For now, make sure that the payments are dated correctly so when running your Profit and Loss report, it'll display the correct amounts from both the accrual and cash basis. Some payments may be dated incorrectly reason why this happens.

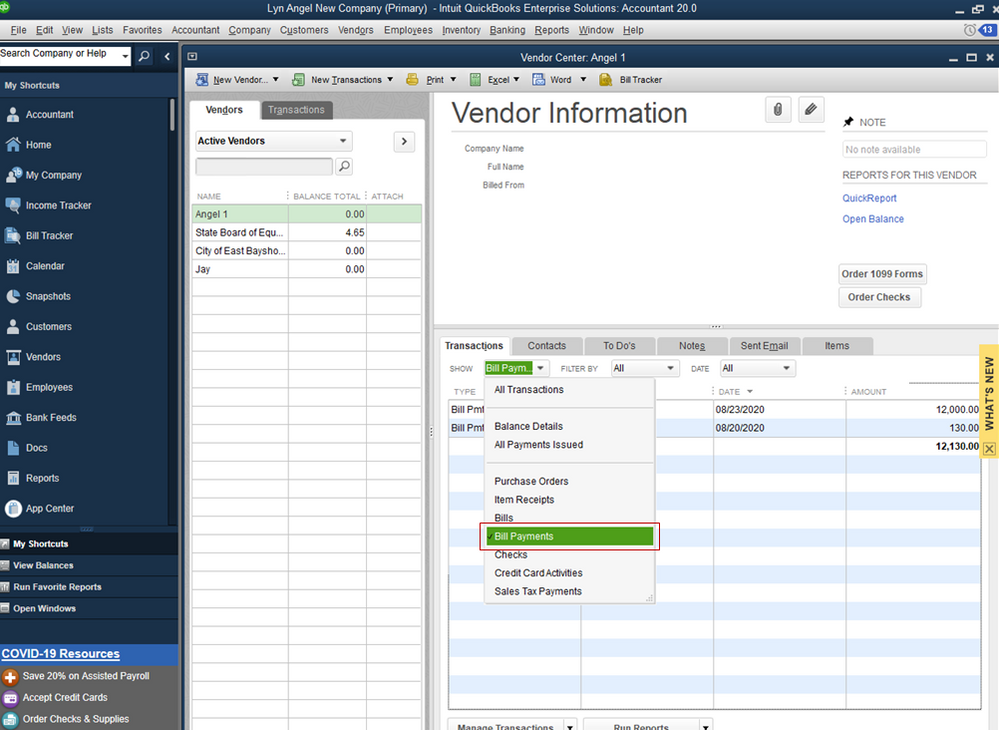

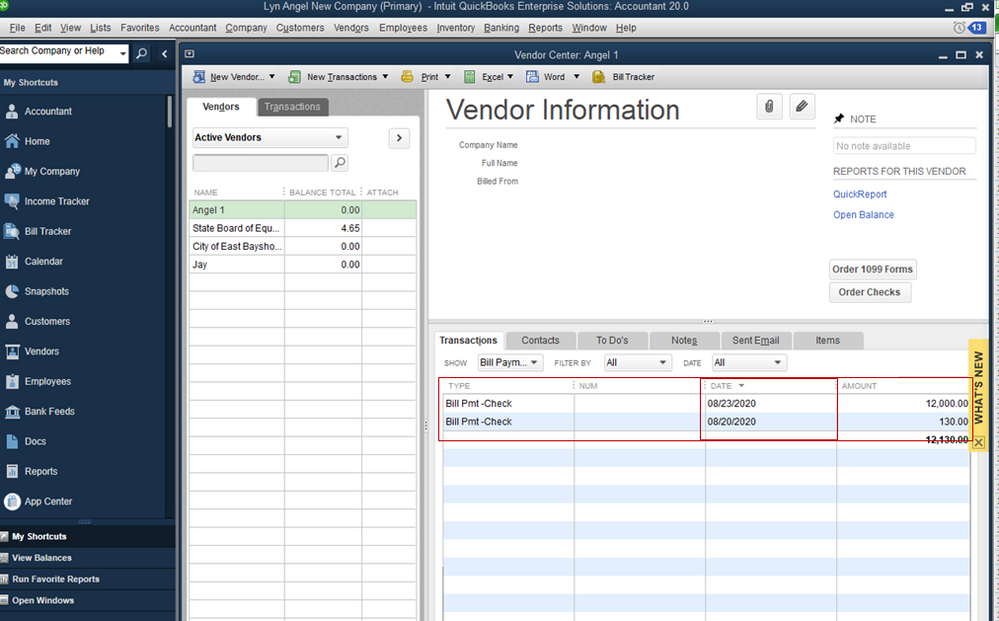

To locate the payment transactions:

If there are incorrect records, update it from there.

On the other hand, check out the topics from this article to learn more about the cash and accrual accounting methods in your reports.

Also, feel free to read the topics from this article for additional guides about running and customizing reports in QuickBooks Desktop.

Post again if you have any other questions. I'm a few clicks away to help. Have a good day!

@Angelyn_TI use desktop version. What did your response add to this conversation? Did you read my response to @CharleneMaeF ?

Hi there, @qtl.

To make sure that the payments are dated correctly in QuickBooks Desktop, you can do it by running Expenses by Vendor detail report.

Here's how:

Here's an article for additional information about cash and accrual: Differentiate Cash and Accrual basis.

Let me know if there's anything I can help you further. Have a good day.

1. how is you answer helping me? I don't have problem with transaction date.

2. I am an accountant, I know the difference between cash basis accounting and accrual basis accounting?

3. Would you please state what is the problem that I am trying to solve.

@qtl wrote:

@john-pero, Thanks for taking time to reply to my question. I think I am following the use bill and bill pay properly as outline on this board by you and others. Yet I am not achieving my objective. So let me ask a direct question:

Is it possible in one QB file achieve what I outlined in my response to @CharleneMaeF ?

The issue, as i see it, is despite spreading the bills out monthly, and accrual expense being correct at 6k, you only have 6k paid bills in cash basis at year end. Because of this, you have 6k as prepaid unapplied payments and without corresponding paid bills you will only have 6k expense both cash and accrual, exactly what you see.

If the target is to split between years and have 12k cash expense one year and 6k accrual each year it may take more work to accomplish. And time to figure this out.

I'm trying to do the same thing now. Did you end up figuring a way to do this? I'm trying to pay the rest of our liability insurance this year (to hit cash basis) but still have the expense show in our accural reporting each month going into the next year so our reports aren't skewed.

I still have not seen a solution to record prepaid expenses such that the expense can be viewed properly on a cash and accrual basis.

For a 1 year liability insurance payment made in advance, I recorded 12 bills (all after payment date) to recognize the monthly expense, and then applied the insurance payment to these 12 bills. I thought this would work, but under the cash basis reporting, QBO shows the bill payment not as insurance expense (what all 12 bills were coded to), but as a line called "Unapplied Cash Bill Payment Expense."

Does anybody have thoughts here / has anybody figured out how to record prepaid expenses so they can be properly viewed under cash and accrual basis?

Greetings, @dsberrycpa.

Welcome to the Community. Let me help you record prepaid expenses.

Here's how you can record prepaid expenses in QuickBooks Desktop.

Please feel free to review this article for more details: Record and allocate Prepaid Expenses.

Just hit the Reply button if you have further questions. Take care and have a good one!

@dsberrycpa @What you are seeing is correct. Until the current date reaches the bill date your payment ahead has nothing to be applied to. For true Cash reporting there is no such thing as a Bill or Invoice

Here is what I have done to spread out prepaid expenses.

Record the 12x payment as a Current Asset, Prepaid Expenses. Then create a journal entry [or a zero balance check] for each monthly exchange of Prepaid Expense (CR) to Actual Expense (DR) and for setvand forget you can make this a memorized transaction. Your 12 monthly expenses will be the same for cash and accrual.

@Mich_S @Step 1. Create a current asset account called Prepaid Expense

(You left out part of the description)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here