Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I setup a Progress Invoice based on an Estimate and the invoicing system has worked perfectly, including issuing the final invoice to client on the day it was scheduled due.

However, the project has not gone as planned due to customer delays. This means the work is not complete and the final payment cannot be collected based on original terms. How should I handle the Progress Invoice in QBO? Edit and change due date? Void and reissue at a later time? Other options I am not seeing? This is my first time using progress invoices.

**Note: The invoice was already automatically sent to customer by QBO on the original due date which was the original end date for the project.

Thank you!

I'm here to help handle the progress invoice in QuickBooks Online, momoco.

You can either void and re-issue at a later time or change the due date of the invoice. Any of the two processes will do as long as you haven't recorded the payment.

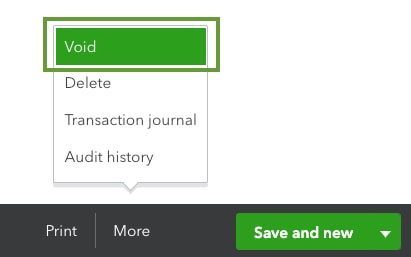

Here's how to void the transaction:

If you're still not sure whether to void or delete a transaction, you can consult with your accountant for specific instructions. If you don't have one, we can help you find a ProAdvisor.

Check out the setup and send progress invoices for additional information about this feature in QuickBooks.

Stay in touch with me by commenting below if there's anything else you need. I've got your back.

Will voiding the progress invoice update the status of the Estimate away from Closed and allow me to create a new Progress Invoice against that Estimate?

Thanks for getting back to us, @momoco. Allow me to chime in and help you with your progress invoicing.

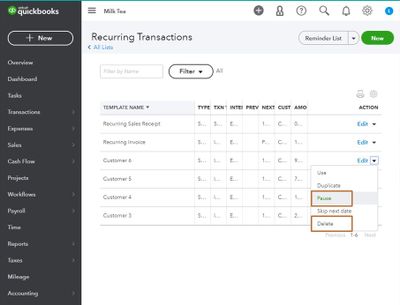

Do you need to stop the invoice from recurring? Voiding the sent invoice will update the status. However, it won't allow you to create a new progress invoice against the estimate unless you delete the recurring invoice template that's linked to it. You can delete the template from the Recurring transaction list.

You also have the option to pause the recurring invoice. This way, you won't need to create a new one. You can resume the scheduled template anytime you need it.

Here's how:

You can read through our guide on creating recurring transactions for more information. It also has additional resources that I'm sure you'll find helpful with regards to editing your templates.

Please fill me in should you have any further questions or concerns. I'd be happy to help. Thank you for reaching out. Have a wonderful day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here