Hi, grozaconsulting.

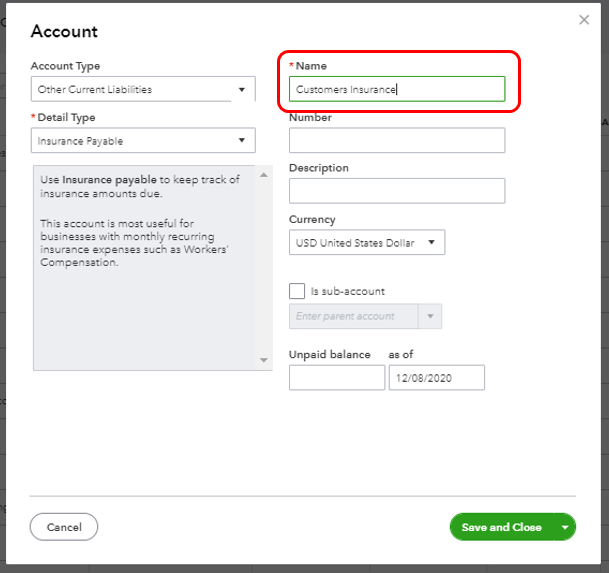

To get this sorted out, you'll need to create a liability account, create a service item, and use that liability as to their posting account.

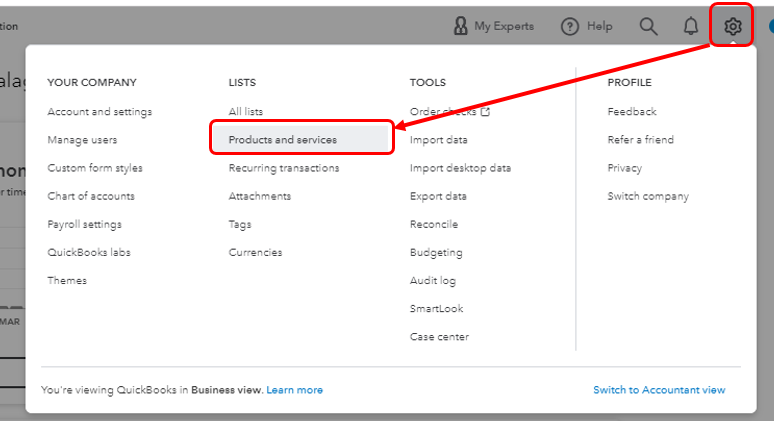

Here's how to create a service item:

- Click the Gear icon at the upper-right corner and choose Products and Services.

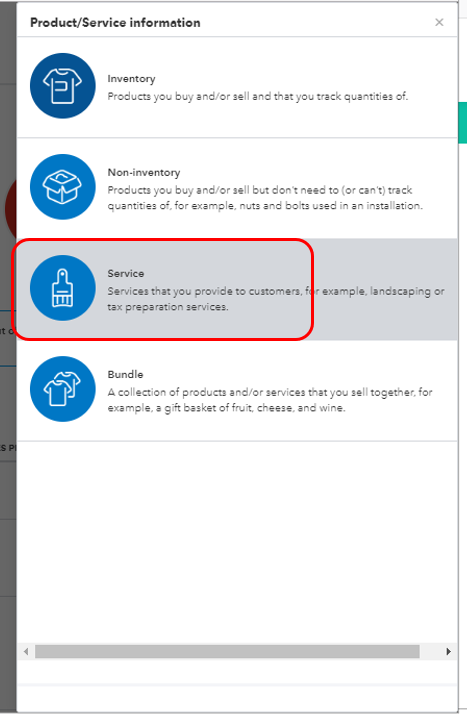

- Select Service.

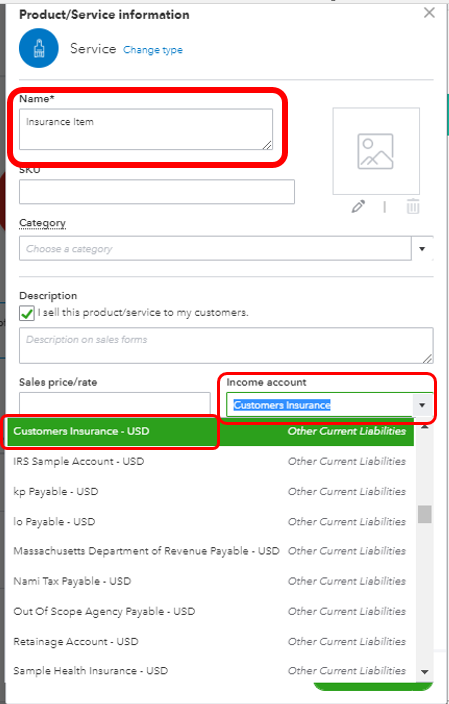

- Enter the Service Name (ex: Insurance Item).

- Under Income Account, choose the Liability Account (ex: Customer Insurance).

- Hit Save and close.

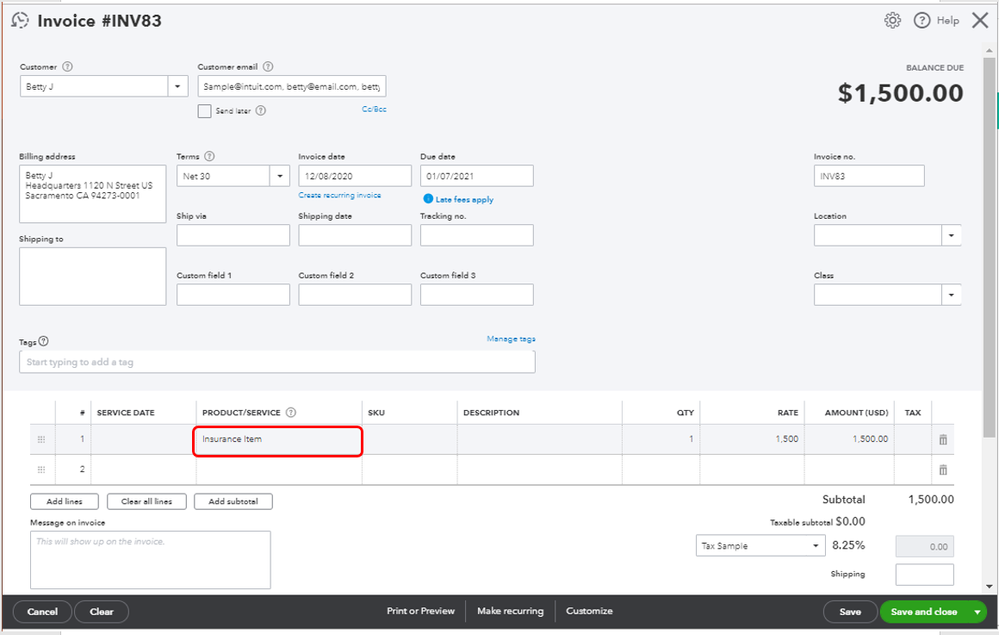

After that, let's create an invoice using the service item, and use the unapplied cash to pay the invoice. This way, all the credits showing on your Profit and Loss will be moved to the Liability Account.

To get more details about the unapplied cash payments, check out this article: Unapplied cash payment income on your profit and loss. This will provide you steps on how to locate those payments as well as steps on how to apply them to an open invoice.

Let me know the results, grozaconsulting. I'm still here to help you more if you have follow-up questions about this. Just click the "Reply" button or mention my name. Wishing you all the best!