Thanks for bringing this matter to my attention, @BSO2171.

I’m here to share some information about Customer refunds in QuickBooks Desktop.

When you issue a refund through QuickBooks Point of Sale, there shouldn't be a check created in QuickBooks Desktop as it will create a double deposit. What we can do is pull up the Transaction List by Customer report and check the transaction that's been synced from POS.

Here's how:

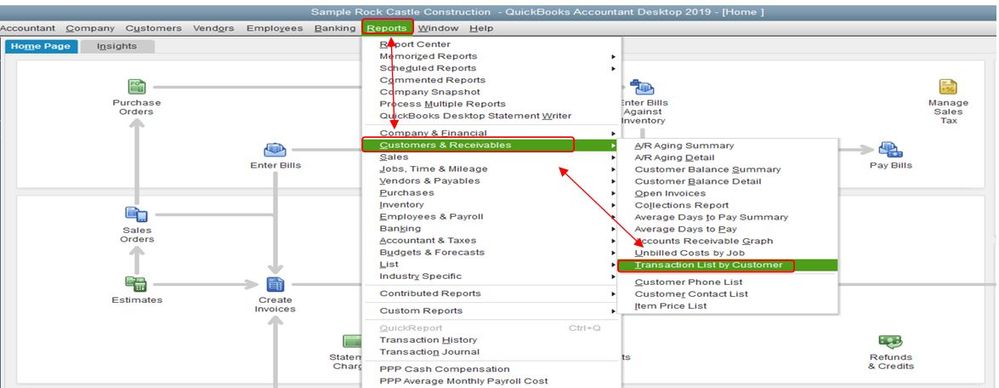

- Go to the Reports tab at the top menu bar.

- Under Customers and Receivables choose Transaction List by Customer.

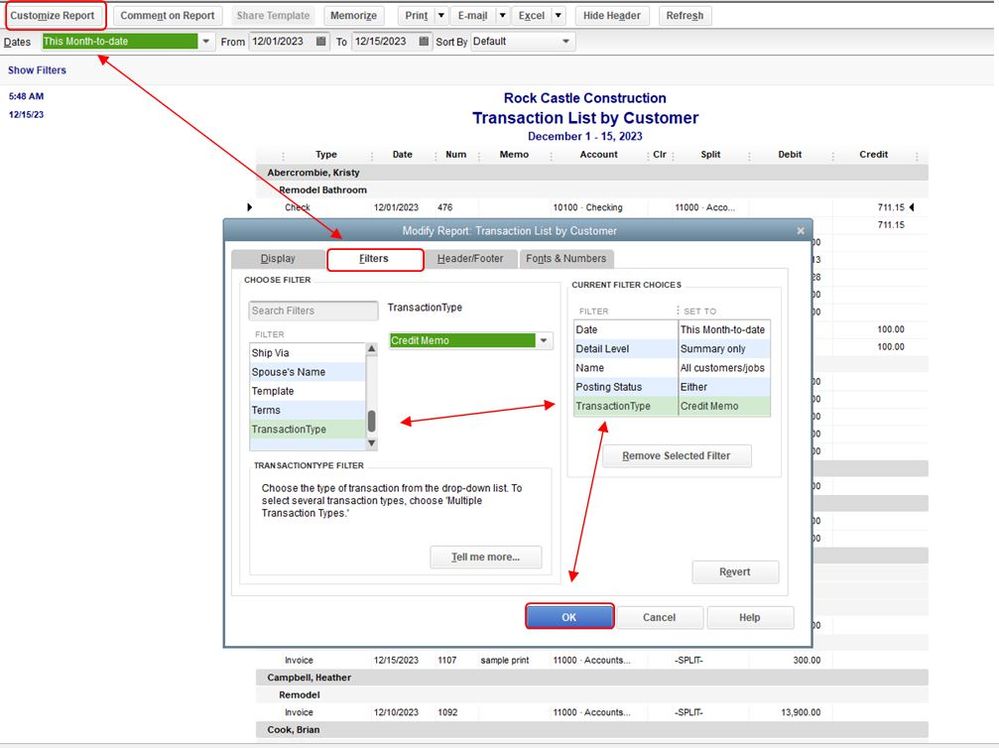

- Choose a date range.

- Click the Customize Report option and filter the Transaction Type into Credit Memo.

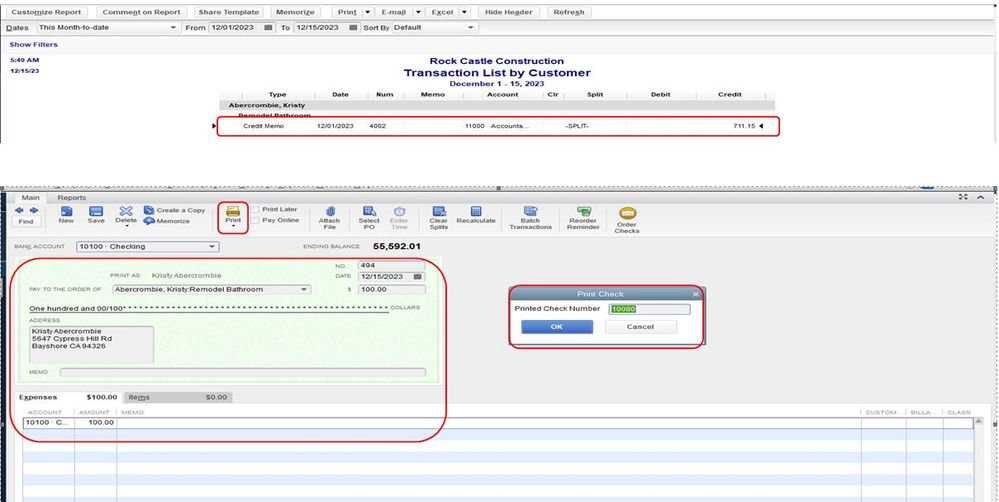

- Open the transaction then click Use credit to give a refund.

- Enter the necessary details then click Print.

- Assign a check number then hit OK

For more information about refund payments, click this article: Void or refund customer payments in QuickBooks Point of Sale

Also, you can visit these articles for further guidance on how to run reports and customize them in QuickBooks Desktop:

Drop a comment below if you have any other questions about processing a refund or any other concern in QuickBooks. I'll be happy to help you out.