Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThat will do it. If you have more questions, juts leave a comment below. Thanks!

I came on board recently and years before me purchase orders were entered and cleared but no one ever deleted them, so there are years and years of old defunct PO's in Quickbooks. How does one delete large groups of PO's from years ago? Or is it really necessary?

You can delete a purchase order if you don't need it, GeriR.

The option to delete them one time isn't available in QuickBooks. You'll need to do it one at a time. To do it, open the purchase order, and then click More. Then, select Delete. However, you can look for a third-party app that helps you delete years of transactions one time.

While this option isn't available yet, I'll personally send feedback to our Product Development team to review and determine features to be added in our feature updates.

On the other hand, you can browse the list of common questions about purchase order in this article: Create purchase orders in QuickBooks Online.

Drop me a line if you still need my help.

is there any way to find a deleted purchase order?

You've come to the right place for finding your deleted purchase order in QuickBooks Online, @bi3.

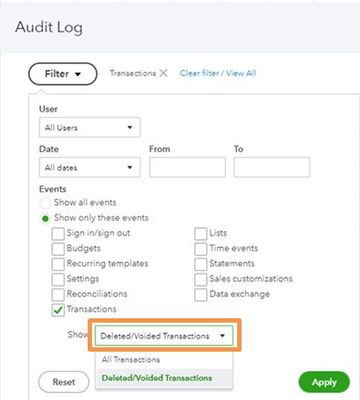

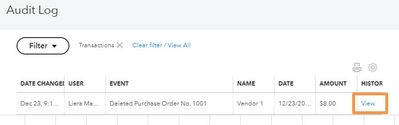

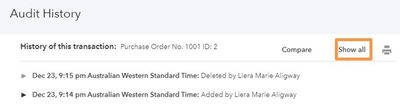

A quick and easy way to locate transactions in QBO is by running the Audit Log report. This report helps you keep track of added, deleted, and modified transactions, as well as user entries. It allows you to see the history of changes made to individual transactions or a range of multiple transactions. It can be customized by using the Filter tool to narrow down the data.

Here's how:

I've got some articles here to help you navigate with the search function and I'm sure you'll get the hang of it in no time:

Should you need further assistance with finding transactions in QBO, don't hesitate to comment down below. I'm always available here to help. Wishing you all the best.

I voided a purchase order that was dated 11/21. I voided it on 1/24/22. This action changed the amount of my A/R for year end. How do I void previous year purchase orders AFTER the tax return has been completed and want to keep my books in balance with the tax return.

Hi, bookieJ.

Thank you for posting here in the Community. I'm here to share some information about voiding old purchase orders (PO) after tax return.

You can easily delete the PO by following the steps by RCV, However, deleting that item may cause imbalance previous year's data. But you can create a Journal Entry to correct the data. Here's how:

I also suggest consulting an accountant, to ensure your previous books are correct.

In addition, you can check this article to learn more about how to adjust account balances and to review the Adjusted Trial Balance report: Make adjusting journal entries in QuickBooks Online Accountant

Feel welcome to get back on this thread if you'll need assistance in dealing with purchase orders. We're always here to help you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here